Charles Edwards, founder and CEO of Capriole Investments, has issued his starkest warning yet on quantum computing, arguing that Bitcoin must migrate to post-quantum signatures on an accelerated timeline or face existential risk later this decade. “We need to upgrade Bitcoin to be Quantum proof next year. 2026. Otherwise we are fucked,” Edwards wrote on X early Monday, escalating a series of posts in which he contends “Q-Day is this decade.”

Could Bitcoin Crash To $0?

Edwards’ thesis hinges on the rapid compression of resource estimates required to run Shor’s algorithm against Bitcoin’s elliptic-curve digital signatures (ECDSA/Schnorr on secp256k1). Pushing back at skeptics who “handwave Quantum as being 20+ years away,” he argued that only “~2,000 logical qubits” may be sufficient to break ECC-256 within a practical time window, placing a credible attack in “2–6 years.” In a separate exchange he framed the stakes bluntly: “Do you want $1M Bitcoin in 5 years, or $0?”

Related Reading

Edwards’ timeline closely tracks a fresh line of research and industry messaging from Pierre-Luc Dallaire-Démers, founder of Pauli Group, a startup focused on quantum-resistant money. In an August research preprint and public thread, Dallaire-Démers and co-authors introduced graded ECDLP challenges on Bitcoin’s curve and, after translating logical circuits to physical costs across several error-corrected architectures, placed “cryptanalytically relevant” ECC-256 attacks in a “roughly 2027–2033” window—emphasizing wide error bars and sensitivity to hardware assumptions.

Pauli Group summarized the upshot plainly: “The first attack on 256-bit ECC will plausibly happen between 2027–2033.” The firm also provocatively stated via X: “PQC BTC will go to $1M+ by 2030. ECC BTC won’t.”

The core risk vector is well-established: once a Bitcoin address reveals its public key on-chain—by spending from it or by using legacy formats that expose the key outright—a sufficiently powerful quantum computer running Shor’s algorithm could, in principle, derive the private key quickly enough to steal funds.

Security researchers and industry teams note that coins in already-exposed keys are the first in line, while coins still sitting behind hashed (unrevealed) public keys are safer until they move. Several analyses estimate that a non-trivial share of outstanding BTC resides in exposed-key outputs, including early “pay-to-pubkey” era coins often associated with Satoshi. Edwards leaned into that tail risk, claiming “Satoshi’s coins will be market dumped” absent a migration.

Related Reading

Not everyone agrees on the clock speed. Some conservative estimates still point to millions of error-corrected qubits for practical, fast ECDSA breaks, and standards bodies have published transition guidance that implicitly assumes a longer runway.

In late 2024, material circulated in the NIST/PQ ecosystem sketched migrations away from vulnerable algorithms by roughly 2035—a horizon many security engineers view as realistic for broad IT systems, even if niche breakthroughs arrive sooner. The spread between the “thousands” versus “millions” of logical qubits camps reflects fast-evolving algorithmic optimizations, differing error-correction models, and varied assumptions about gate speeds and code distances.

Notably, Edwards is taking the message to TOKEN2049 this week, where he is slated to present “DOUBLE THREAT: Quantum & the Treasury Bubble” on Wednesday, October 1 at 10:45 a.m. local time—positioning quantum compromise and a growing “Bitcoin Treasury Bubble” as the two dominant downside risks for BTC over the next cycle.

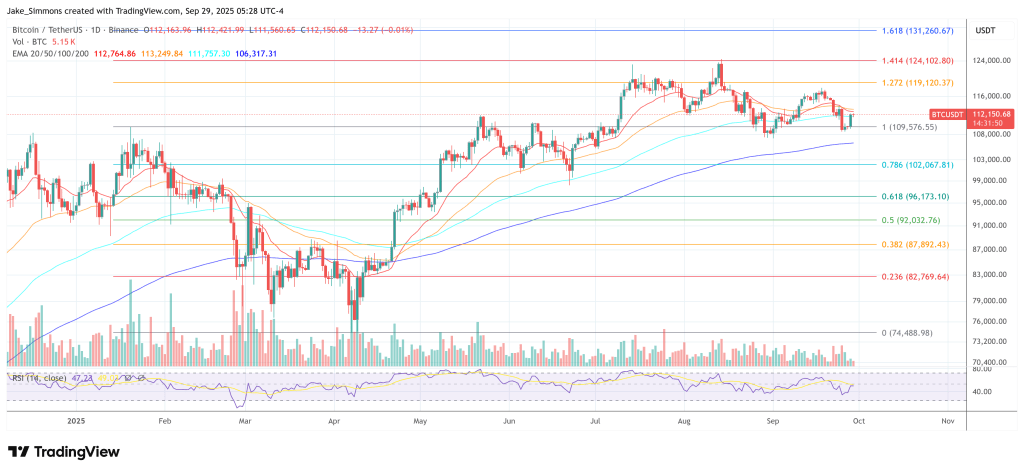

At press time, BTC traded at $112,150.

Featured image created with DALL.E, chart from TradingView.com