Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin (BTC) continues to face massive selling pressure, with prices dropping below the $85,000 mark, marking a 12% decline since last Friday. The recent downturn has fueled panic selling and heightened fear, leading many investors to speculate about the potential start of a bear market. As uncertainty grips the market, traders remain cautious about Bitcoin’s next major move.

Related Reading

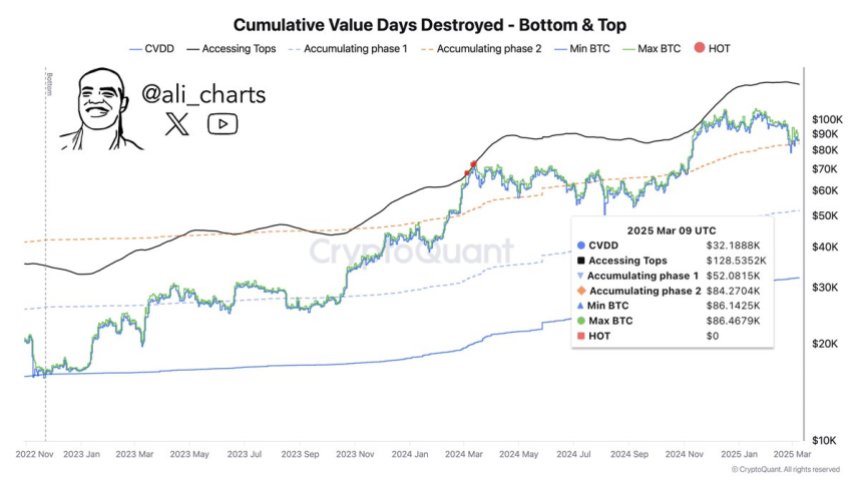

However, despite the ongoing sell-off, key on-chain data from CryptoQuant suggests that Bitcoin could be setting up for a recovery rally. The Cumulative Value Days Destroyed (CVDD) indicator, a metric that tracks long-term holder behavior and capital inflows, suggests that BTC could soon enter a new uptrend. If Bitcoin stabilizes and reclaims key support levels, it could pave the way for a rally toward a new all-time high of $128,000.

With Bitcoin at a critical inflection point, the next few trading sessions will be crucial in determining whether BTC can regain momentum or if further downside is ahead. Investors are now closely watching whether selling pressure continues or if long-term holders step in to accumulate, signaling a potential market rebound.

Bitcoin Insights Give Hope To Bulls

Bitcoin is at a critical juncture, facing a serious risk of continued correction as bearish sentiment grips the market. Many analysts now believe that the Bitcoin bull cycle may be over, as BTC struggles below $85,000 while barely holding above $80,000. With selling pressure intensifying, investors are expecting another leg down, potentially pushing BTC into lower demand zones.

Despite the negative outlook, some analysts argue that a recovery is still possible if Bitcoin can reclaim key levels. Top analyst Ali Martinez shared insights on X, stating that if BTC reclaims $84,000 as support, it could open the path toward a rally to a new all-time high of $128,000. This suggests that while the market remains fragile, there is still potential for Bitcoin to regain strength if bulls step in at critical price points.

The coming weeks will be crucial in determining the strength or weakness of this cycle. If BTC continues to struggle below key resistance levels, a deeper correction could follow, reinforcing bearish sentiment. However, if bulls manage to push BTC back above $84K, it would indicate a shift in momentum, potentially reigniting the uptrend.

Related Reading

With uncertainty dominating the market, traders are closely watching BTC’s next move, as its ability to hold or reclaim support levels will determine whether this cycle is truly over or if another rally is still on the horizon.

BTC Struggling Below $85K

Bitcoin has faced massive selling pressure, with the most significant drop occurring on Sunday, when the price plunged from $86,000 to $80,000, marking a 7% decline in just hours. This sharp downturn has fueled panic selling as investors remain uncertain about Bitcoin’s short-term direction.

For bulls to regain control, BTC must reclaim the $86,000 level and push above $90,000 to confirm a potential recovery rally. A strong move past these key resistance levels could restore confidence in the market, signaling that Bitcoin’s correction phase might be nearing its end.

However, failure to break above $86K could keep Bitcoin under bearish control, increasing the risk of another leg down. If BTC drops below $80,000, it could test the $78,000 low, a level that, if breached, may lead to further downside pressure.

Related Reading

With Bitcoin at a critical turning point, the next few trading sessions will determine whether bulls can reclaim key levels or if bears will continue to dominate the market, pushing BTC into deeper correction territory.

Featured image from Dall-E, chart from TradingView