On-chain data shows the ‘Exchange Stablecoins Ratio’ for Bitcoin has shot up recently. Here’s what it could mean for the asset’s price.

Bitcoin Exchange Stablecoins Ratio Has Broken Above 5

As explained by an analyst in a CryptoQuant Quicktake post, the Bitcoin Exchange Stablecoins Ratio has registered an increase alongside the latest rally in the cryptocurrency’s price.

The Exchange Stablecoins Ratio here refers to an on-chain indicator that keeps track of the ratio between the Exchange Reserves of BTC and the stablecoins. The “Exchange Reserve” is naturally the total amount of the asset that’s sitting in the wallets of all centralized exchanges.

When the value of the indicator goes up, it means the Exchange Reserve of BTC is rising relative to that of the stablecoins. On the other hand, it going down implies stables are becoming more dominant on these platforms.

The Exchange Reserve of both of these asset classes represents something different with respect to the wider sector. In the case of Bitcoin (and other such volatile assets), the Exchange Reserve can be looked at as a measure of the available selling pressure in the market.

This is because of the fact that holders usually deposit their coins to these platforms when they intend to trade them away. The same remains true for the stablecoins as well, but since their price is ‘stable’ by nature, selling from investors has no effect on it.

While the selling of stablecoins doesn’t have any effect on their own price, it does hold implications for the volatile side of the market, if the stables are being swapped in favor of tokens like BTC.

The assets being purchased using stables naturally feel a bullish effect on their price. As such, the Exchange Reserve of the stablecoins may be considered as a representation of the buying pressure in the sector.

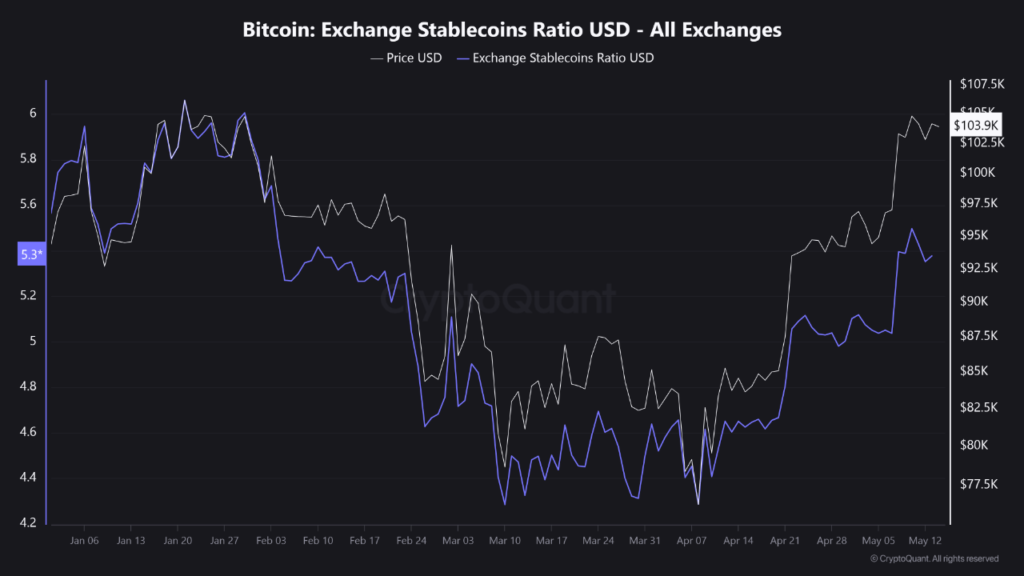

Now, here is a chart that shows the trend in the Bitcoin Exchange Stablecoins Ratio over the last few months:

As is visible in the above graph, the Bitcoin Exchange Stablecoins Ratio has been going up recently, a sign that investors have been depositing BTC at a faster rate than stablecoins. The metric is currently sitting at a value of 5.3, which suggests the BTC Exchange Reserve is more than five times that of the stablecoin one.

This may be a bearish development for the cryptocurrency, as it implies the potential selling pressure in the sector notably outweighs the buying pressure that stables can bring.

As the quant says,

This surge above the 5.0 threshold echoes the late-January peak near 6.1, which preceded a swift correction—implying traders may be gearing up to rotate BTC back into cash.

It now remains to be seen whether the Bitcoin rally would be able to keep going regardless of this trend or not.

BTC Price

Bitcoin has taken to sideways movement during the past few days as its price is still floating around the $103,500 mark.