The on-chain analytics firm Glassnode has revealed in a report how sell-side pressure may see an uptick from Bitcoin long-term holders around this price level.

Bitcoin Long-Term Holder Profit Will Hit 350% At 99,900

In its latest weekly report, Glassnode has talked about the latest trend related to the Bitcoin long-term holders. The “long-term holders” (LTHs) refer to the Bitcoin investors who have been holding onto their coins since more than 155 days ago.

The LTHs make up for one of the two main BTC holder cohorts divided on the basis of holding time, with the other side being known as the “short-term holders” (STHs).

Statistically, the longer an investor holds onto their coins, the less likely they become to sell them at any point, so the LTHs with their long holding times can be considered more resolute than the STHs.

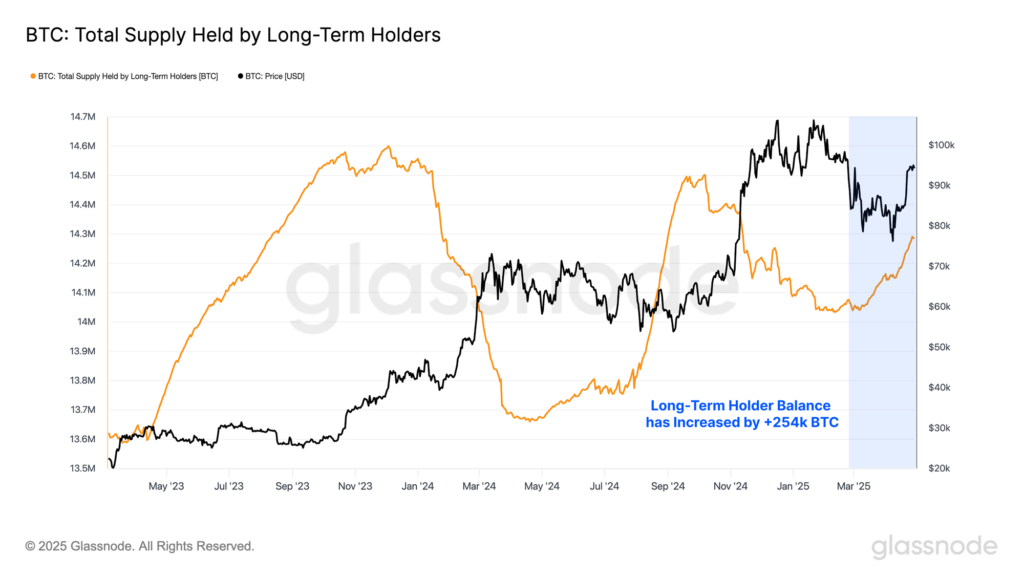

Below is the chart shared by the analytics firm that shows how the total supply held by these HODLers has changed during the last couple of years.

As is visible in the graph, the Bitcoin LTH Supply has witnessed an increase over the past two months or so, a sign that some STHs have been maturing into the cohort. In total, the metric has gone up by 254,000 BTC during this period.

While the LTHs tend to be resolute entities, it’s not as if they never sell at all. From the chart, it’s apparent that these diamond hands took profits during both the major rallies from last year.

Recently, BTC has once again been trying to put together bullish momentum, but the continued uptrend in the LTH Supply implies these HODLers haven’t decided to sell yet.

As for when this cohort would become enticed enough to sell, perhaps history can provide a hint or two.

In the chart, Glassnode has attached the data for the average cost basis or Realized Price of the LTHs and some price lines that correspond to a specific degree of profit/loss for this cohort.

At present, the BTC price is far above the LTH Realized Price, so the members of this group would be carrying a significant amount of profit. Despite this fact, these HODLers don’t seem to be willing to part with their coins just yet.

As for when their tune might change, the report has explained:

Historically speaking, the Long-Term Holder cohort typically ramps up their spending pressure when the average member is holding a +350% unrealized profit margin.

Based on their current cost basis, the LTHs can be expected to reach this 350% profit threshold when Bitcoin hits the $99,900 mark. Thus, if BTC’s recovery run continues this far, it’s possible that the cryptocurrency might find some trouble due to the HODLer selling.

BTC Price

At the time of writing, Bitcoin is trading around $96,500, up around 4% in the last seven days.