Bitcoin is currently grappling with a crucial support region at the $80K mark, with sellers attempting to breach it.

If a breakdown occurs, the asset’s next target will be the critical $75K level.

Technical Analysis

By Shayan

The Daily Chart

Bitcoin sellers have been struggling to maintain the significant support at the $80K price range, which aligns with both the ascending channel’s lower boundary and the 0.618 Fibonacci level. The confluence of these support regions suggests a strong demand zone that could support the price and halt further declines.

However, if bearish momentum intensifies and sellers ultimately push below this decisive level, a drop toward the $75K mark will become likely. Bitcoin is currently trading within a tight range between $80K and $85K, and an impending breakout will provide a clearer outlook on the next move.

The 4-Hour Chart

On the lower timeframe, after dipping below the recent market low of $78K and triggering a liquidity hunt, BTC entered a consolidation phase, exhibiting slight volatility.

The RSI indicator shows a bullish divergence, indicating that bearish momentum is fading and increasing the likelihood of a retracement toward the upper boundary of the descending wedge at $85K. In the short term, Bitcoin is expected to remain within this consolidation phase until a decisive breakout dictates the next trend.

On-chain Analysis

By Shayan

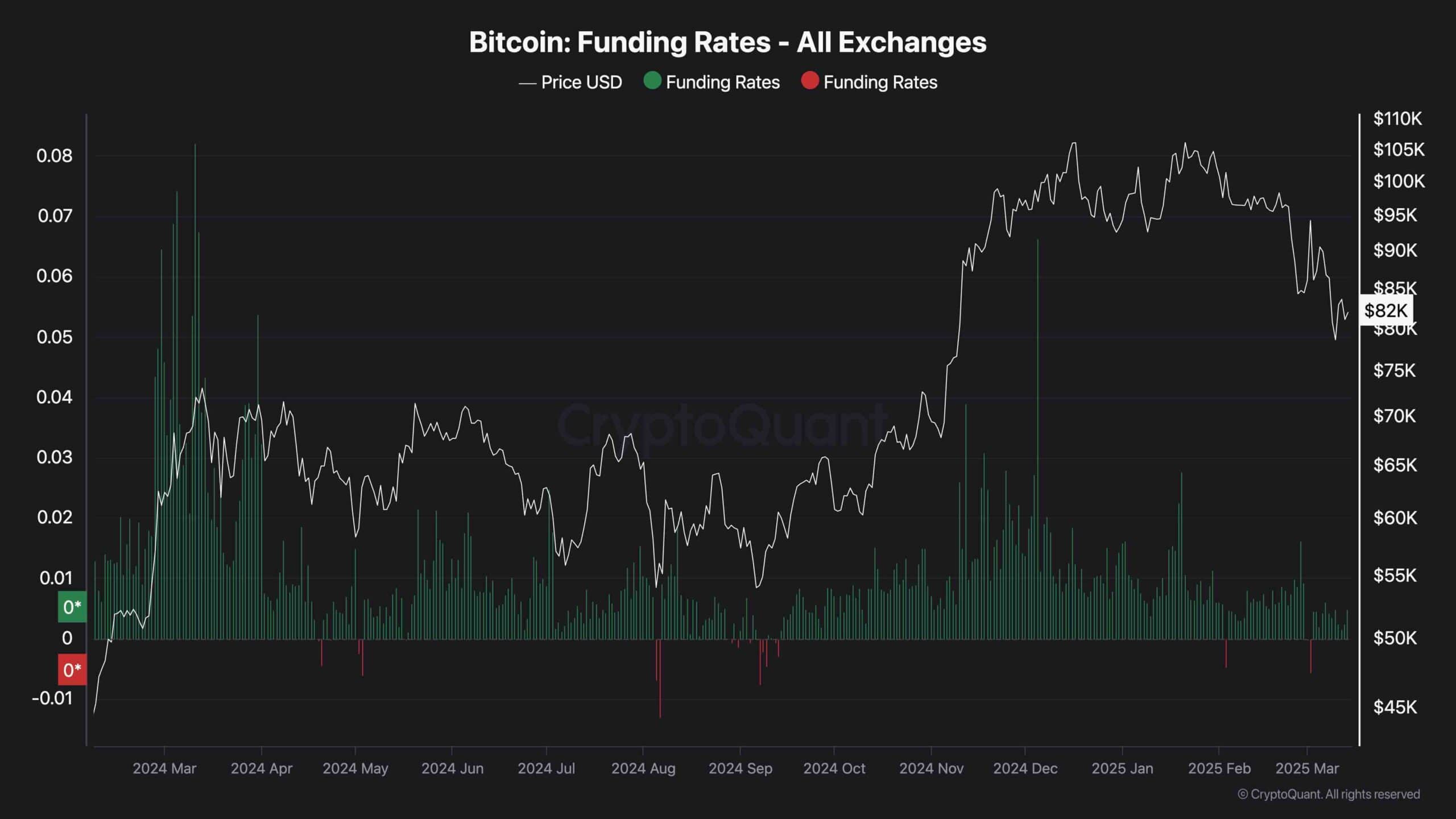

Analyzing futures market sentiment has consistently provided valuable insights into Bitcoin’s price trends. One of the most significant indicators in this regard is the funding rates metric, which reflects whether buyers or sellers dominate the futures market.

The chart shows that funding rates have been declining and even turning negative, signaling that sellers are aggressively opening leveraged short positions. While this pattern might initially appear bearish, it also mirrors the market behavior seen in the summer of 2024, when Bitcoin entered a prolonged corrective phase before staging a strong rally.

This suggests that the market may have entered a deep consolidation stage, which could persist in the mid-to-long term before resuming its upward trajectory.

The post Bitcoin Price Analysis: BTC Risks Falling to $75K if This Resistance Breaks appeared first on CryptoPotato.