Bitcoin price (BTC) climbed to a new all-time high overnight, reaching about $125,700 during Sunday’s Asia session before pulling back to the low $123,000 range.

The rally extended an eight-day winning streak and came as spot ETF inflows surged alongside a weaker US dollar amid renewed concerns over a potential government shutdown.

The move surpassed Bitcoin’s previous mid-August peak, marking another milestone in the asset’s strongest run since early 2024. Price action turned volatile near 12:45 a.m. ET, when BTC spiked to new highs before slipping a few thousand dollars.

How Long Can Bitcoin’s Bullish Momentum Last Amid Rising Shorts?

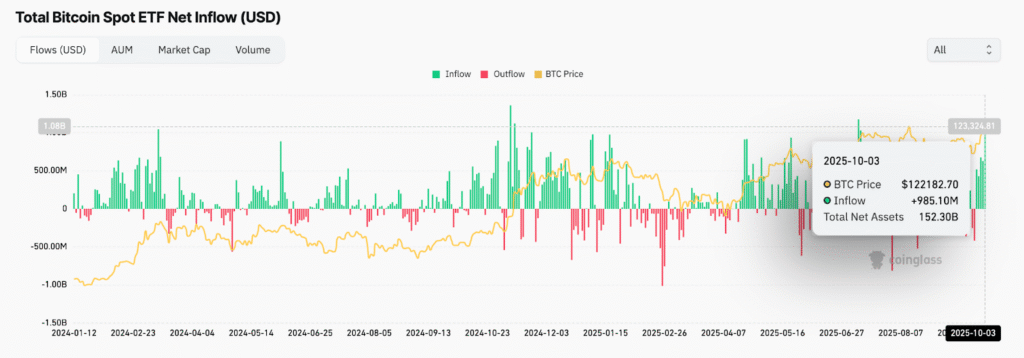

A major catalyst behind the move has been continued buying through US spot Bitcoin ETFs.

CoinGlass data shows roughly $+985.10M in net inflows as of today, the second-largest since their January launch, coinciding with Bitcoin’s climb to fresh records.

On-chain data support the bullish setup: exchange-held BTC has dropped to around 2.83 million coins, the lowest level in six years.

Analysts believe that the decline in available supply can restrain selling, which will support the broader bearish trade story as investors hedge against a weaker dollar.

Trader Skew noted on X that the rally might be “bait” for overconfident longs, observing that “passive shorts” are building near current highs, a sign that bearish bets are quietly stacking up despite the bullish headlines.

In the short term, the question for Bitcoin is whether ETF inflows and macroeconomic tailwinds will be able to sustain the breakout or if the market will heat up into a new consolidation period.

EXPLORE: Best Crypto To Buy in Q4 2025

Bitcoin Price Prediction: Will Bitcoin’s $118K Support Hold or Trigger a Deeper Correction?

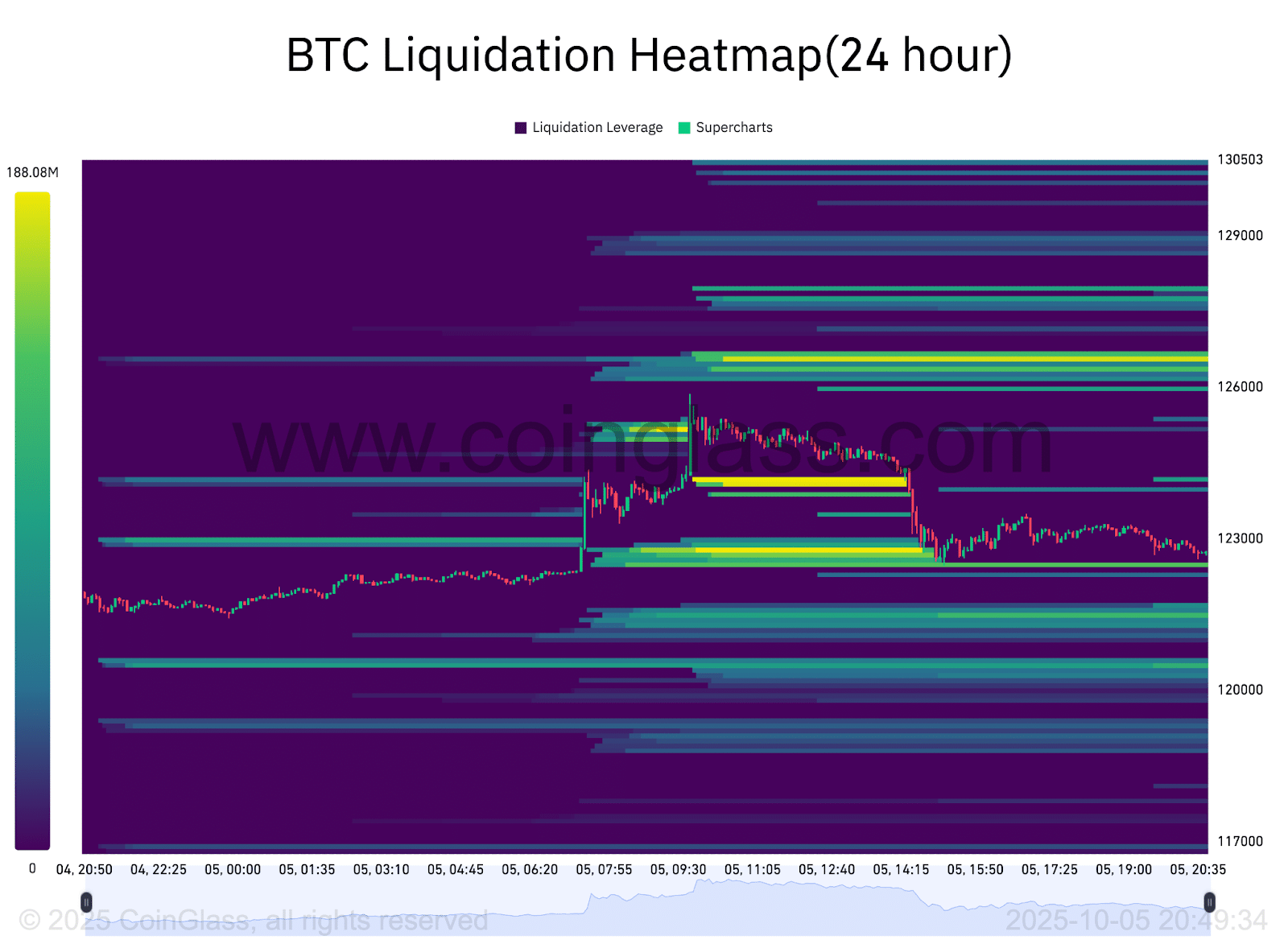

CoinGlass data indicated that traders were gearing up for higher volatility, and liquidity was being sucked out across the order book.

Weekend trading tends to exaggerate price movements due to thinner volumes, making recent price swings less reliable as indicators of long-term direction.

Analyst CrypNuevo highlighted the 50-period EMA on the four-hour chart now sitting just above $118,000 as a possible short-term support if Bitcoin’s pullback deepens.

For the week ahead, I think we could see a 4h50EMA retest – it's overextended and you can see the retests in previous similar Price Action.

After that, we should see a new move up higher.

Therefore, I'm still favoring longs over shorts from the 4h50EMA. pic.twitter.com/gEqDGmLbA8

— CrypNuevo

(@CrypNuevo) October 5, 2025

That level, he said, could act as a “cooling zone” where the market resets before any new leg higher.

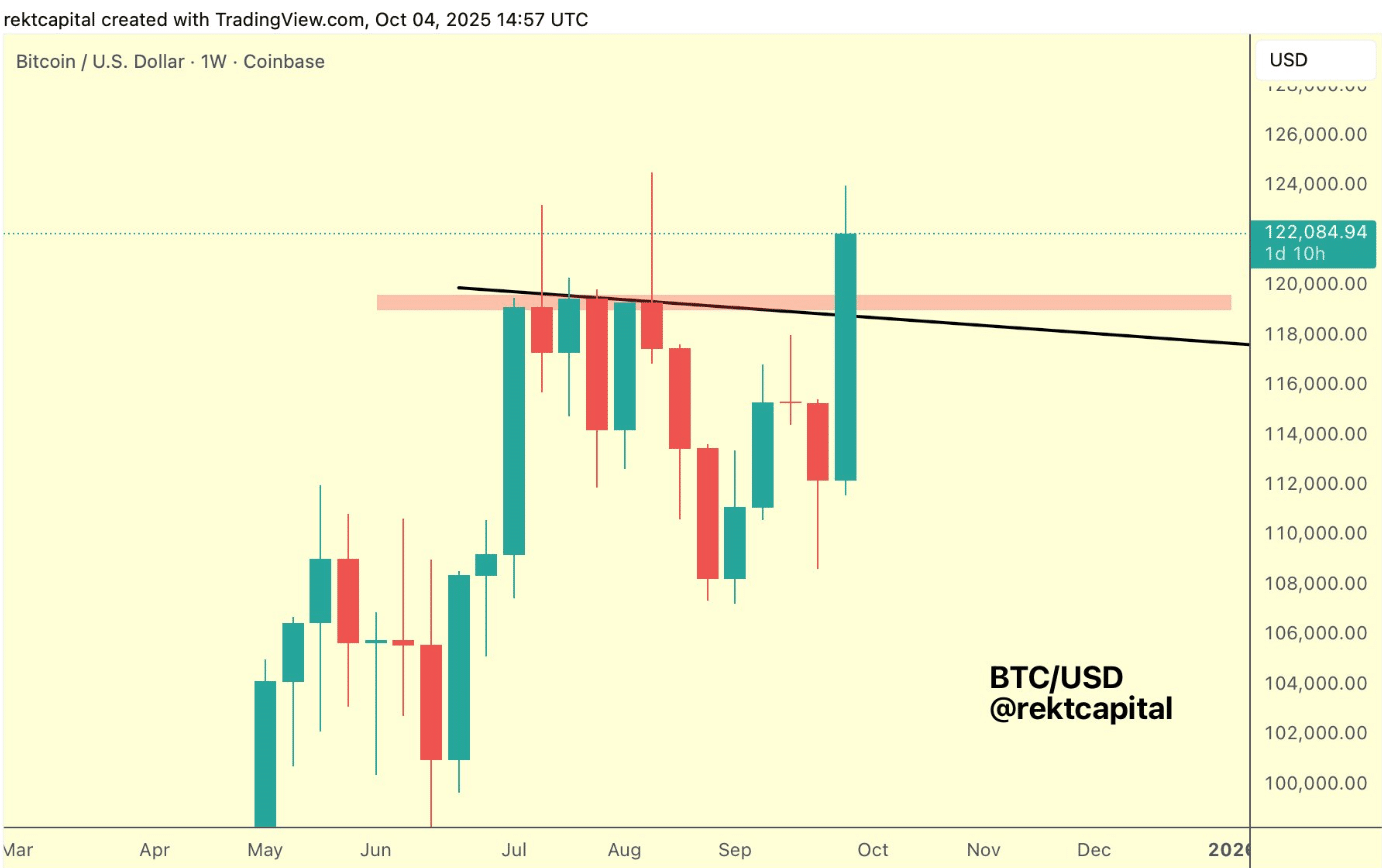

At the same time, Rekt Capital pointed out that Bitcoin’s rejection near $124,000 wasn’t unusual.

There's should be no surprise that Bitcoin has rejected from ~$124k on the first time of asking in this uptrend

After all, the last time Bitcoin rejected from $124k, the rejection preceded a -13% pullback

Bitcoin needs to prove this $124k resistance is a weakening point… https://t.co/gcdXXQVyDv pic.twitter.com/GoXeBtyUlO

— Rekt Capital (@rektcapital) October 4, 2025

He noted that this level served as resistance in past cycles, once leading to a 13% drop.

The next few sessions will be important. Traders are watching whether BTC can stabilize above key support or slide into a deeper correction as the market cools.

Bitcoin has technically exited a declining channel that contained price action since August.

It represents a similar breakout that occurred earlier in the year, characterized by a solid upward movement following several weeks of horizontal action.

In a chart posted by Bitbull, there were two parallel tracks, each with steep rallies. At approximately $124,700, he estimates that he can extend to around $135,000-$140,000 in the near future.

$BTC uptrend is not over yet.

There could be some corrections, but this isn't the top.

I think BTC could rally towards $135K-$140K this month and possibly $160K by November before a cycle top. pic.twitter.com/VvxgGjad78

— BitBull (@AkaBull_) October 5, 2025

Bitbull even opined that the current cycle would reach a peak of up to $160,000 by November, as the market had not yet reached its maximum.

In another analysis by Daan Crypto, a clear indicator of strength in Bitcoin on the weekly chart is the rebound of the Bull Market Support Band.

Following a few weeks of consolidating around that area, BTC shot up over $124,000, affirming a rejuvenation of the larger uptrend. In the past, that band has usually been the beginning of big bull runs.

The analyst indicated that the rebound out of this zone reinforces the bullish construction of Bitcoin.

Without losing the support band, he added, the trend is still headed upwards as long as the buyers are in charge.

DISCOVER: 15+ Upcoming Coinbase Listings to Watch in 2025

The post Bitcoin Price Prediction: BTC Price Sets New All-Time High at $125.7K as ETF Inflows Surge appeared first on 99Bitcoins.