Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Amid the Trump-Musk online feud, Bitcoin (BTC) has hovered within the mid-and-low areas of its local price range, hitting a one-month low near the $100,000 support. However, some analysts suggest that the cryptocurrency is preparing for the “real” price jump toward a new all-time high (ATH)

Related Reading

Bitcoin Prepares For ‘Real Breakout’

Over the past 24 hours, Bitcoin experienced significant volatility fueled by the online feud between US President Donald Trump and Tesla and X owner Elon Musk. The flagship crypto’s price took a beating on Thursday afternoon after dropping by over 5% from the $105,000 level to the $100,000 support.

Before the pullback, BTC had been attempting to reclaim its local mid-range area after its recent performance. Notably, the cryptocurrency traded sideways following its ATH rally to $111,980, hovering between the $106,800 and $109,700 price range.

However, the cryptocurrency lost the key $106,800 support amid last week’s market retracement, which saw Bitcoin drop to $102,000 over the weekend. Since then, BTC has been attempting to reclaim the current levels.

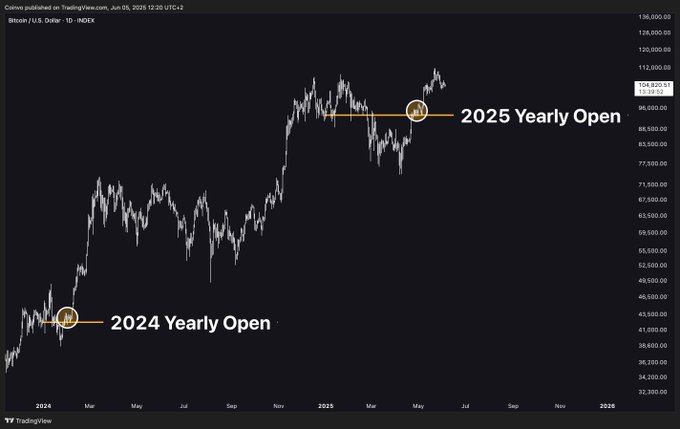

After yesterday’s drop, the largest cryptocurrency by market capitalization has surged 4.5%, climbing above the $104,000 level. Crypto trader Coinvo highlighted BTC’s one-year chart, pointing to the similarly looking price action between 2024 and 2025.

According to the chart, Bitcoin recorded its first major pump after reclaiming its yearly opening level, consolidating within its new range for weeks before climbing to its Q1 2024 ATH.

This year, the cryptocurrency has had a similar performance, although delayed, having reclaimed the yearly opening range and surging to the first major price surge in May.

Similarly, analyst Alex Clay suggested that Bitcoin is preparing for the “real breakout” following its retests of the range’s mid-zone resistance in Q1 2025 and a “false” breakout last month.

To the analyst, “We grabbed the liquidity below the Broken Supply Zone. Now looking for a Real Breakout” toward the $120,000 mark.

BTC Price To Range For Two Weeks?

The Cryptonomist noted that Bitcoin displays a 3-week bullish falling wedge formation, with the lower boundary sitting around the $101,000 level. Following the recent price drop, BTC bounced from that area, and could break out of the pattern if it reclaims the $105,000 barrier as support, targeting the $118,000-$120,000 levels.

Meanwhile, market watcher Daan Crypto Trades highlighted that its price now trades at the mid-range again, near the Monthly opening price. To the trader, “it’s pretty safe to assume that these range high/lows are good triggers for whatever larger trend follows,” as BTC has been having a “relatively large move early in the month.”

As he previously explained, Bitcoin tends to set its monthly high or low during the first week of the month, followed by a reversal in the opposite direction and a trend continuation until a new month begins.

Based on this, he warned that if the price drops below yesterday’s lows, it will continue to trend down for another week or two, displaying “weakness and confirming a larger correction is due.”

Related Reading

Nonetheless, if price surges above the monthly highs, around the $106,700 mark, “the correction is more likely to be over and there’s a good likelihood that we head to all-time highs and beyond.”

“Good chance we range around this area for a while, though, without any of these levels breaking,” he concluded.

As of this writing, Bitcoin trades at $104,224, a 2.6% increase in the daily timeframe.

Featured Image from Unsplash.com, Chart from TradingView.com