Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin is currently changing hands just above $108,000, consolidating after Tuesday’s fresh all-time high. Charles Edwards, founder of the digital-asset hedge fund Capriole Investments, believes that price could be at least 50% higher by November. In his latest market note, “Saddle Up,” released on 27 May, the manager argues that a rare confluence of macro, technical and on-chain factors has created “the most bullish technical setup we could ask for for Bitcoin at all-time highs.”

Bitcoin 50% Rally Is “Conservative”

Edwards first set the stage for the call in late April, when Bitcoin was trading near $93,000. “We noted the bullish Bitcoin setup and expectation to be ‘pushing new all-time highs […] quite soon’,” he recalled. One month later the market has risen 16%, validating that view and, in Edwards’s telling, clearing the decks for the next leg higher.

Central to the thesis is what Edwards dubs the “Hard Asset Era.” A breakout in the Gold-to-S&P 500 ratio above its 200-week moving average signals that investors are again favouring scarce stores of value over equities.

Historically, such regimes are “sticky,” he writes, adding that the ensuing outperformance of gold over stocks has ranged from 150% to 650% in past cycles. “If you think gold has already rallied a lot, think again,” Edwards said. On that analogue, Bitcoin — which tends to lag gold by several months — could be poised for even steeper gains.

Related Reading

Recent policy changes have underpinned the rotation. Basel III rules elevated gold to Tier-1 reserve status in 2022, forcing banks to back paper positions with physical metal, while last year’s approvals of spot-Bitcoin exchange-traded funds opened institutional flood-gates to the cryptocurrency.

Washington’s creation of a Strategic Bitcoin Reserve in early 2025 provided an additional layer of state-level legitimacy. Against the same backdrop, persistent inflation, tariff frictions and the precedent of freezing Russian foreign-exchange reserves have catalysed demand for politically neutral assets.

Bitcoin Technicals And Fundamental

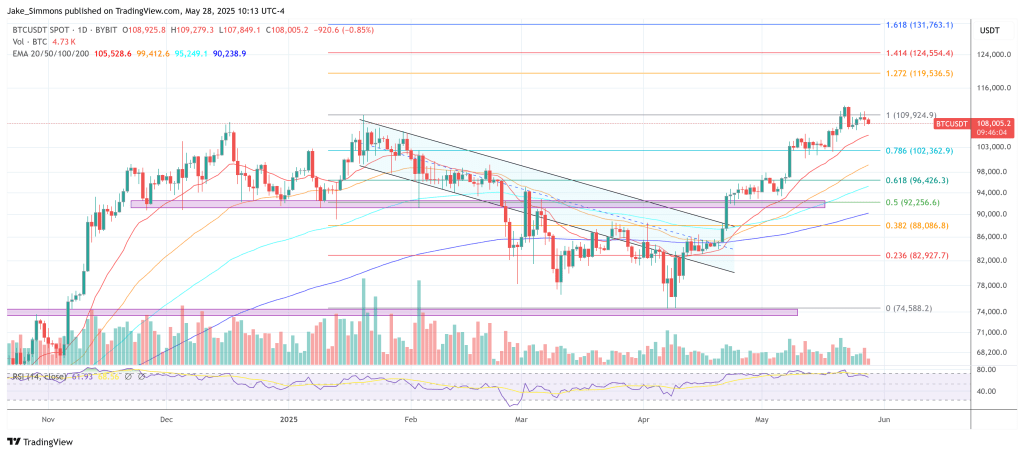

From a market-structure standpoint, Bitcoin’s April slide to $75,000 and sharp recovery above $90,000 is described as a text-book “fake-out” — a failed breakdown that often precedes powerful upside trends. The weekly close reclaim above $90,000 “marked the start of a new trend,” Edwards contends, making the $104,000 level the first line of defence. “As long as price is above $104K, this is the most bullish technical setup we could ask for,” he wrote, reducing near-term risk management to a single number.

Related Reading

Capriole’s machine-learning-driven Bitcoin Macro Index, which blends more than 100 on-chain, macro and equity-market variables, continues to register in “bullish growth.” Apparent demand (production minus dormant supply) has turned positive, US liquidity remains supportive, and Capriole’s new “Volume Summer” metric shows trend-confirming expansion in trading activity. Taken together with the historical three-to-five-month lag between gold breakouts and Bitcoin rallies, the firm argues that “a 50 %-plus rise over the next six months is a conservative target.”

Policy Wild-Cards

The clearest threats to the projection lie on the policy front. Edwards highlights a 30- to 60-day window for the United States to strike tariff compromises with China and the European Union; failure could dent risk appetite. He also warns that the flourishing “Bitcoin-treasury arbitrage” — whereby corporates issue low-cost debt to accumulate BTC — could amplify downside in a future deleveraging, though leverage levels remain manageable for now.

For the moment, however, the combination of a hard-asset bull cycle, confirmed technical strength and improving fundamentals keeps Capriole “very optimistic about the mid- to long-term potential for both gold and Bitcoin.” As long as the market holds above that $104,000 weekly pivot, Edwards suggests investors should — in his own closing words — “saddle up.”

At press time, BTC traded at $108,005.

Featured image created with DALL.E, chart from TradingView.com