Bitcoin prices are stable, recovering after the dip last week. Although whales are selling, there is strong demand from institutions and Strategy who are accumulating. Will BTCUSDT rise to $120,000?

Bitcoin bulls took a hit on Friday, selling off sharply. However, buyers quickly stepped in over the weekend, stabilizing prices before a recovery earlier today.

Despite this refreshing bounce, traders await more confirmation before doubling down, expecting another wave of higher highs above $112,200 to $120,000. If bulls take off, some of the best Solana meme coins could rip to fresh all-time highs.

(BTCUSDT)

Why Are Bitcoin Whales Selling?

Though bullish, Glassnode analysts suggest bulls might wait longer if the current price action persists.

Their analysis notes powerful market shifts as whales, key price drivers after the approval of spot Bitcoin ETFs in early 2024, appear to be cashing out.

On X, Glassnode reveals that Bitcoin whales holding at least 10,000 BTC have shifted to net selling, with a wallet flow metric of around 0.3.

As of May 26, the >10K $BTC cohort has pivoted to net distribution (~0.3), signaling a notable shift in positioning among the largest holders. Apart from that, accumulation remains broad, but leadership is shifting down the wallet size curve:

>10K BTC: ~0.3

1K–10K BTC:… pic.twitter.com/VxEy2LHcFE

— glassnode (@glassnode) May 26, 2025

Whales holding between 1,000 and 10,000 BTC are also slowing down, with their wallet flow metric dipping to 0.8.

Similarly, whales holding 100 to 1,000 BTC show a drop to 0.7.

This across-the-board decline in accumulation suggests that, despite record-high prices, the upward momentum is slowing down as whale activity fades.

The dip in accumulation may hint that Bitcoin is in a late-stage bull run, with large players taking profits in anticipation of a capital rotation.

Will Institutions Drive BTC to $120,000?

Interestingly, institutions remain active, buying aggressively, helping create demand for some of the best meme coin ICOs.

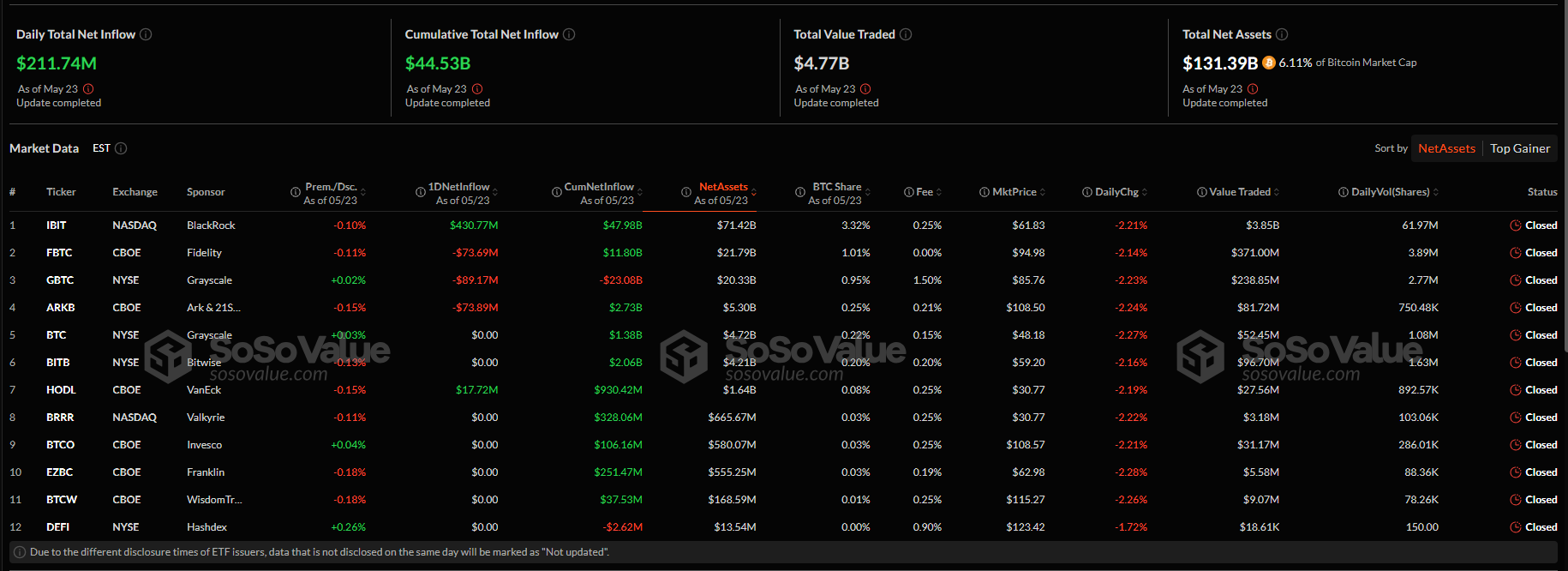

As of May 23, SosoValue data shows over $211 million in spot Bitcoin ETF purchases, primarily via BlackRock.

Other issuers, including Fidelity and Grayscale, posted outflows. Institutional engagement often stabilizes prices by locking up supply, creating a welcome floor.

(Source)

If inflows continue this week, they could counter whale distribution, absorb selling pressure, and pave the way for gains above $112,500 to $120,000.

This expansion would be a relief for retail investors, as short-term holders, or addresses that bought Bitcoin within the last three months, are currently up 27%. Historically, short-term holders, mostly speculators, sell when profits exceed 40%, triggering volatility.

(Source)

An analyst on X predicts price gains over the next two weeks, projecting a breakout by mid-June that could push speculators into profitability and trigger profit-taking.

If institutions and whales absorb this selling, the market could avoid a major correction, lifting prices to new all-time highs.

This scenario is supported by fresh capital entering the market, similar to July–December 2024. Over 420,000 BTC clustered around $94,000 provides support in case of a sell-off.

(Source)

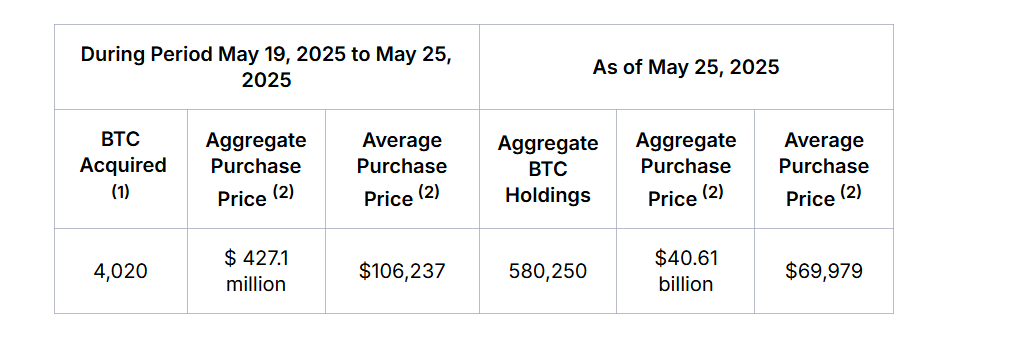

Strategy, formerly MicroStrategy, bolstered the case for more gains, buying more BTC.

(Source)

They bought $427 million worth of BTC, raising their average price to $106,000 and pushing their holding to $580,250 BTC.

DISCOVER: 10 Best Crypto Presales to Invest in May 2025 – Top Token Presale

Bitcoin Whales Selling As Institutions Buy: BTCUSDT To $120k?

- Bitcoin prices stabilize after dip

- Bitcoin whales distributing

- Institutions and Strategy loading up

- BTCUSDT could spike to $120,000 if bulls win

The post Bitcoin Stagnates, But as Some Whales Sell, Fresh Capital Enters: Up Next, $120,000? appeared first on 99Bitcoins.