Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

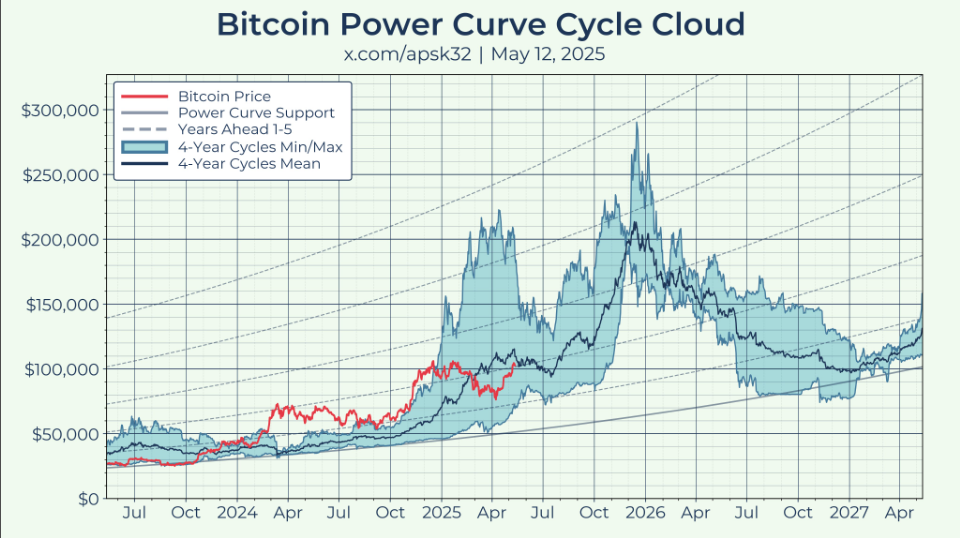

Bitcoin’s price may surge above $200,000 next year, according to recent analysis by X account Apsk32. He warns that the familiar four‑year cycle for BTC often lines up with fresh highs. Short swings have hit traders hard before. This time, bulls say Bitcoin could even top $250,000 in 2025.

Related Reading

Bitcoin Gold Link

According to Apsk32, Bitcoin often trails gold by a few months. Gold hit a record $3,500 per ounce earlier this year. If Bitcoin follows that path, it could surge. He measures Bitcoin’s market value in ounces of gold instead of dollars. That way, money printing and inflation don’t skew the view.

Power Curve Model

Apsk32 uses what he calls a “power curve” tool. It fits Bitcoin’s market cap in gold ounces to a smooth curve. The tool stretches back to the 2017 high near $20,000. When plotted, it suggests a 2025 bull‑market peak above $200,000. He told X followers that “if Bitcoin’s position relative to gold keeps improving, returns could top expectations.”

Bitcoin’s position relative to gold has improved considerably since April. This is the indicator that gives me hope for higher than expected returns later this year.

BTC-USD is close to extreme greed, which sounds scary, but it’s also where we would expect to be if Bitcoin… pic.twitter.com/CY1Qxy4Hdi

— apsk32 (@apsk32) May 16, 2025

Realistic Price Targets

While some models push for $444,000 this year—what Apsk32 credits to “five years ahead of support”—he thinks a more realistic goal is $220,000. He added there’s a “decent chance” BTC hits $250,000, but he doesn’t see that as the most likely outcome. The $220,000 level would still mark a 10× jump from Bitcoin’s low near $22,000 in late 2022.

Gold Market Scenarios

Other market experts ran a different test. They looked at how much Bitcoin could be worth if it claimed part of gold’s total value. If gold reaches, say, $5,000 per ounce by 2030 and Bitcoin grabs half of gold’s market cap, BTC could hit a price of more than $920k. But then, these figures are scenario‑based, not firm predictions.

Supply And Demand Factors

Bitcoin’s supply is capped at 21 million coins. Every block halving makes new BTC rarer. These events come roughly every four years. The next one is expected in 2024. After that, miner rewards fall from 6.25 BTC to 3.125 BTC per block. Scarcity has driven prices up in past cycles. But demand could shift if big investors pull back.

Related Reading

Risks And Opportunities

Volatility in both gold and Bitcoin could upend these models. Gold can face sudden drops when traders take profits. Bitcoin has swung 20% or more in a single day before. Regulatory moves, geo‑political events, and tech upgrades all play a part. Still, setting clear price scenarios helps investors plan.

Featured image from Unsplash, chart from TradingView