Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Although Bitcoin (BTC) appears to have stalled in the mid-$100,000 range, on-chain data indicates that the top cryptocurrency’s bullish momentum is far from over. BTC recently hit a new all-time high (ATH) of $111,980, prompting several crypto analysts to forecast even higher prices in the near term.

Bitcoin Rally Far From Over, Data Suggests

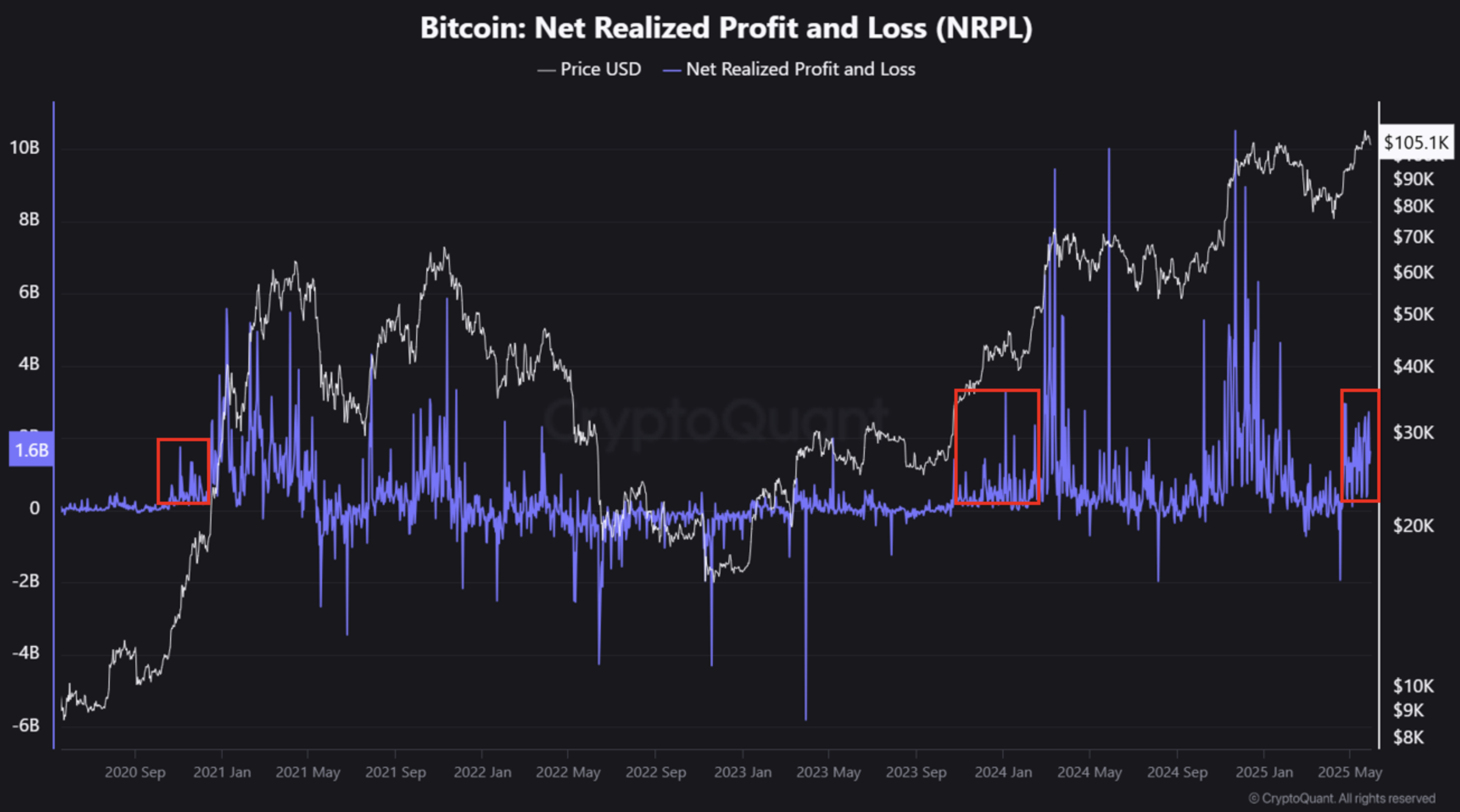

According to a recent CryptoQuant Quicktake post by contributor Crypto Dan, Bitcoin is still “highly likely” to continue its upward trajectory. The analyst shared the Bitcoin Net Realized Profit/Loss (NRPL) chart to support this outlook.

Related Reading

The NRPL chart highlights the scale of realized profits and losses by market participants who are selling BTC. A relatively low NRPL during price increases typically signals that profit-taking is limited, often indicating the continuation of a bullish trend.

In the chart, the current level of profit realization is highlighted in right-most red box. While the recent price surge may trigger a short-term correction, the extent of realized profits does not suggest the end of the ongoing upward cycle. As Dan noted:

Compared to the NRPL spikes at past cycle peaks, this round of profit-taking is relatively limited. In particular, when compared to the movements at the highs in March and November 2024, the current level of profit realization is notably lower.

Dan concluded that the current level of profit-taking does not point to a major trend reversal. Instead, Bitcoin is poised to continue climbing, potentially targeting levels beyond $120,000 in the coming weeks.

Despite the optimism, some market watchers remain cautious. Noted crypto analyst Ali Martinez recently suggested that Bitcoin’s current price action might be a bull trap, with BTC at risk of falling below the $100,000 threshold.

For the uninitiated, a bull trap refers to when the asset briefly breaks above a well-established resistance range, leading traders to believe a breakout is occurring, but then quickly reverses and falls back below the resistance level. This move often plays out to lure in long positions before liquidating them as the price drops back into the previous range.

Bitcoin Selling Pressure Weak, Retail Yet To Arrive

On a more positive note, multiple on-chain indicators suggest Bitcoin is not yet near its cycle top. Notably, retail investor participation in the current rally remains limited – a sign that the market may still have room for a second wave of capital inflow.

Related Reading

Likewise, Binance inflow data shows that certain investor groups are not eager to sell their BTC, possibly anticipating further gains. At press time, BTC is trading at $105,659, down 2.5% over the past 24 hours.

Featured image from Unsplash, charts from CryptoQuant, X, and TradingView.com