Binance Coin (BNB) is gaining fresh interest as investors closely watch a potential breakout. The token is facing resistance around $593, with daily trade volume at $1.24 billion. Its market cap is $83 billion. The current trend is being attributed to sustained buying interest and continuous technical cues.

Traders Identify Triangle Pattern On BNB Chart

Technical analysts are keenly watching a triangle price pattern forming on the chart of BNB against USDT’s 1-day chart. As analyst Andrew Griffiths explains, this formation is recognized for contracting price action, whereby the highs become lower and the lows become higher. It typically indicates a significant move in the near future, either higher or lower.

#BNB analysis on the 1D chart vs USDT shows price movement within a triangle pattern, indicating room for the current side trend. Potential targets: T1 = $599, T2 = $617, T3 = $644. For risk management, consider Stop-Loss levels: SL1 = $580, SL2 = $559, SL3 = $542, SL4 = $521.… pic.twitter.com/Qku1eChZ4R

— Andrew Griffiths (@AndrewGriUK) May 3, 2025

The graph indicates BNB trending in a narrower range for the past few sessions. Such a setup typically indicates that there is a breakout on the horizon. As BNB has been on an upward trend prior to this pattern forming, some assume it will keep going up—if the support zones hold. However, a breach below those support levels might reverse the trend and push the price down.

Price Targets Established At $599, $617, And $644

If BNB keeps surging, analysts have cited three possible targets. The first is $599, which is just below the psychological barrier of $600. The second is $617, a place where BNB fought to move above back in March.

The third is $644, which is the entire range of the triangle formation. These will likely be checkpoints if there is momentum.

Although short-term bullish indications are there, the token has not yet breached any of these levels. For now, BNB is probing a significant level of support and resisting. This type of price action is typical before bigger moves in either direction.

BNB: The 32% Prediction

In spite of all the short-term hype, a different forecast shows BNB plummeting in the next year. Based on a price forecast, the token might decline by 32% and hit $402 on June 4, 2025. That prediction doesn’t coincide with the existing chart strength, creating an extra layer of uncertainty for long-term investors.

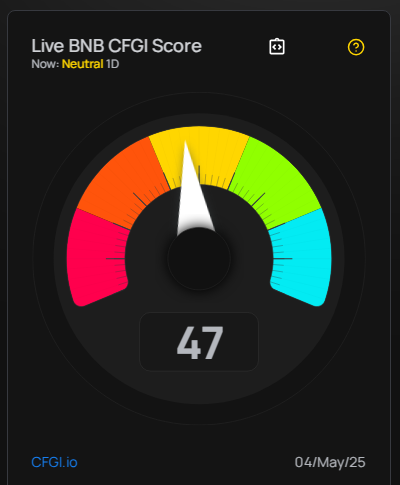

BNB has experienced 15 green days out of the past 30, and its price volatility has been only 2.5%. The sentiment of the market seems to be neutral for the time being, with the Fear & Greed Index standing at 52. Everyone is still focused on the triangle formation and if BNB will extricate itself from it.

Featured image from Gemini Imagen, chart from TradingView