What a wild ride for BTC USD and crypto investors! The largest ever liquidation cascade in crypto history, wiping out 1,600,000 traders with a total loss of $20 billion. What hopes are there left to hold onto for the future of BTC? Will price continue it’s ATH exploration or is the bullrun over? Follow along as we uncover what insights are hidden in the charts.

Strategy has acquired 220 BTC for ~$27.2 million at ~$123,561 per bitcoin and has achieved BTC Yield of 25.9% YTD 2025. As of 10/12/2025, we hodl 640,250 $BTC acquired for ~$47.38 billion at ~$74,000 per bitcoin. $MSTR $STRC $STRK $STRF $STRD https://t.co/v3IsCOaoeQ

— Michael Saylor (@saylor) October 13, 2025

In the meantime, Strategy continues to slowly DCA into Bitcoin, buying another$22.7 million worth. Michael Saylor seems to never loose conviction, which might be a beam of hope for some. As Wyckoff liked to use the “Composite man theory” (the Composite man being market makers) and I would add “the collective mind,” it is good to remember that price is dictated also by what most investors consider low or high. Thus causing volatility.

Has the collective mind decided one Bitcoin is rather expensive at the moment? What does the chart say – ring-ding ding…

DISCOVER: The 12+ Hottest Crypto Presales to Buy Right Now

BTC USD At Support: What Comes Next?

(Source – Tradingview, BTCUSD)

Before you read today’s analysis, please read last week’s analysis, if you haven’t.

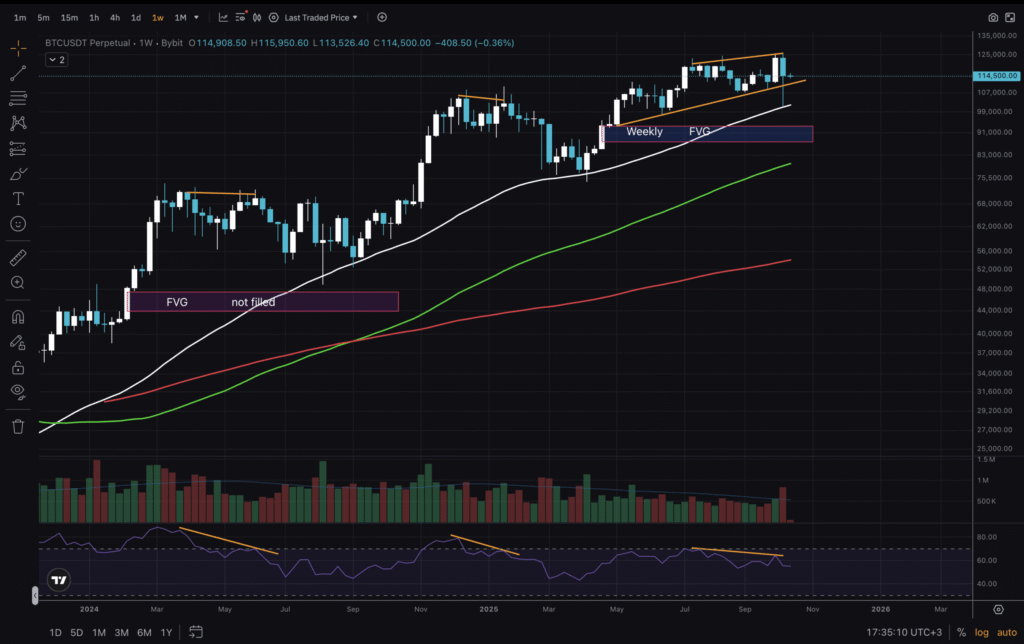

Today we begin with the weekly timeframe, as usual. Even though we looked at it 3 days ago – we just had a weekly close! And it matters. We have a wick that dipped below the trend-line and touched MA50. RSI is showing hidden bearish divergence against a growing price. Not great. Though the Weekly FVG is not filled yet and the candle closed above the trend-line. BTC USD is holding support so far!

DISCOVER: Best New Cryptocurrencies to Invest in 2025

(Source – Tradingview, BTCUSD)

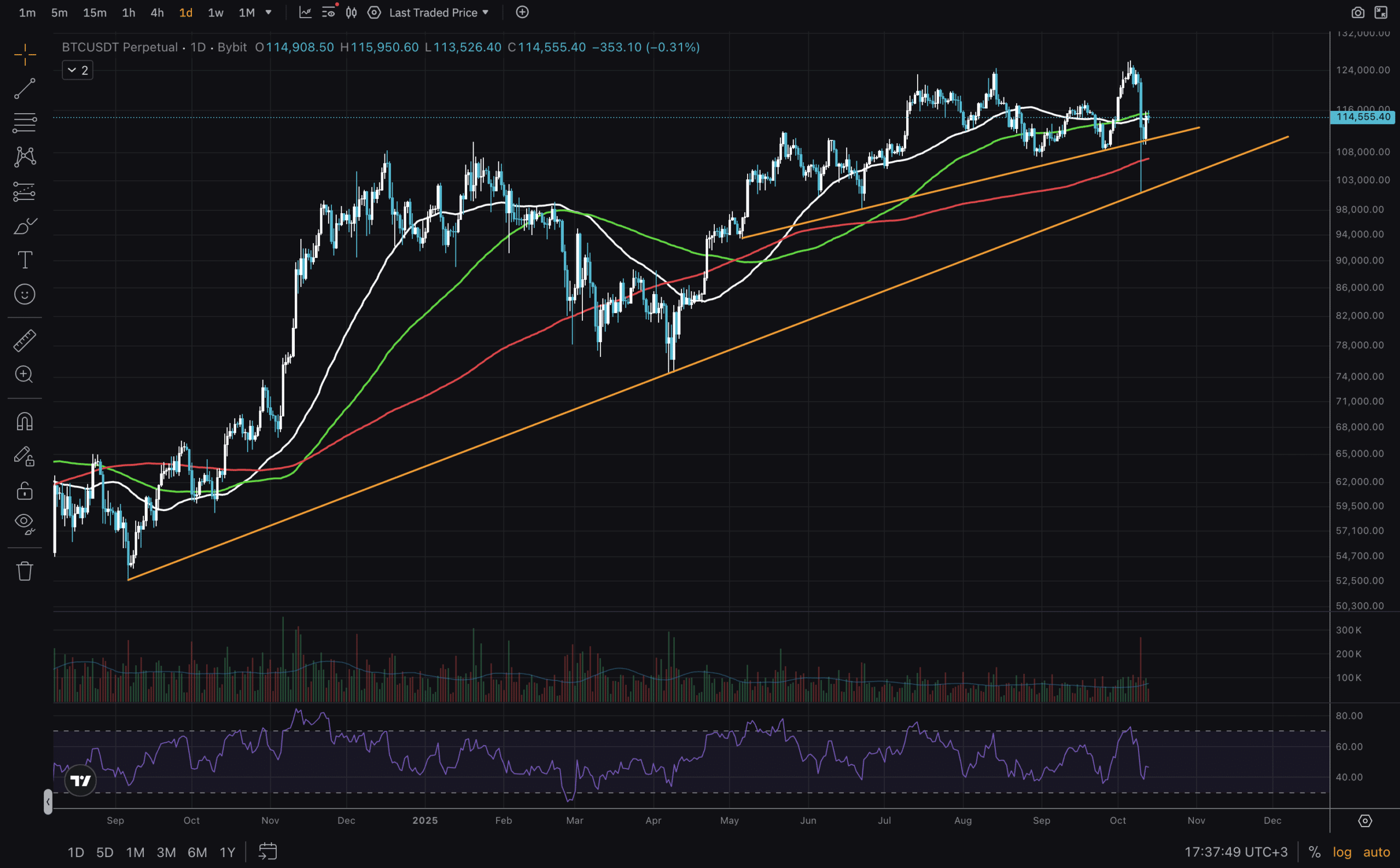

On the daily timeframe we are adding another trend-line to observe a lower-timeframe support than the weekly. Still, it is good to keep in mind that diagonal lines can be deceptive. That said, we also see price broke below MA50 and MA100, and wicked through MA200.

Currently BTC is sitting on the 1D trend-line and above MA200, but below MA50 and MA100. A preferred scenario for bulls is those MAs to be reclaimed – only then we can see a new ATH.

DISCOVER: 20+ Next Crypto to Explode in 2025

So I Should Sit On My Hands?

(Source – Tradingview, BTCUSD)

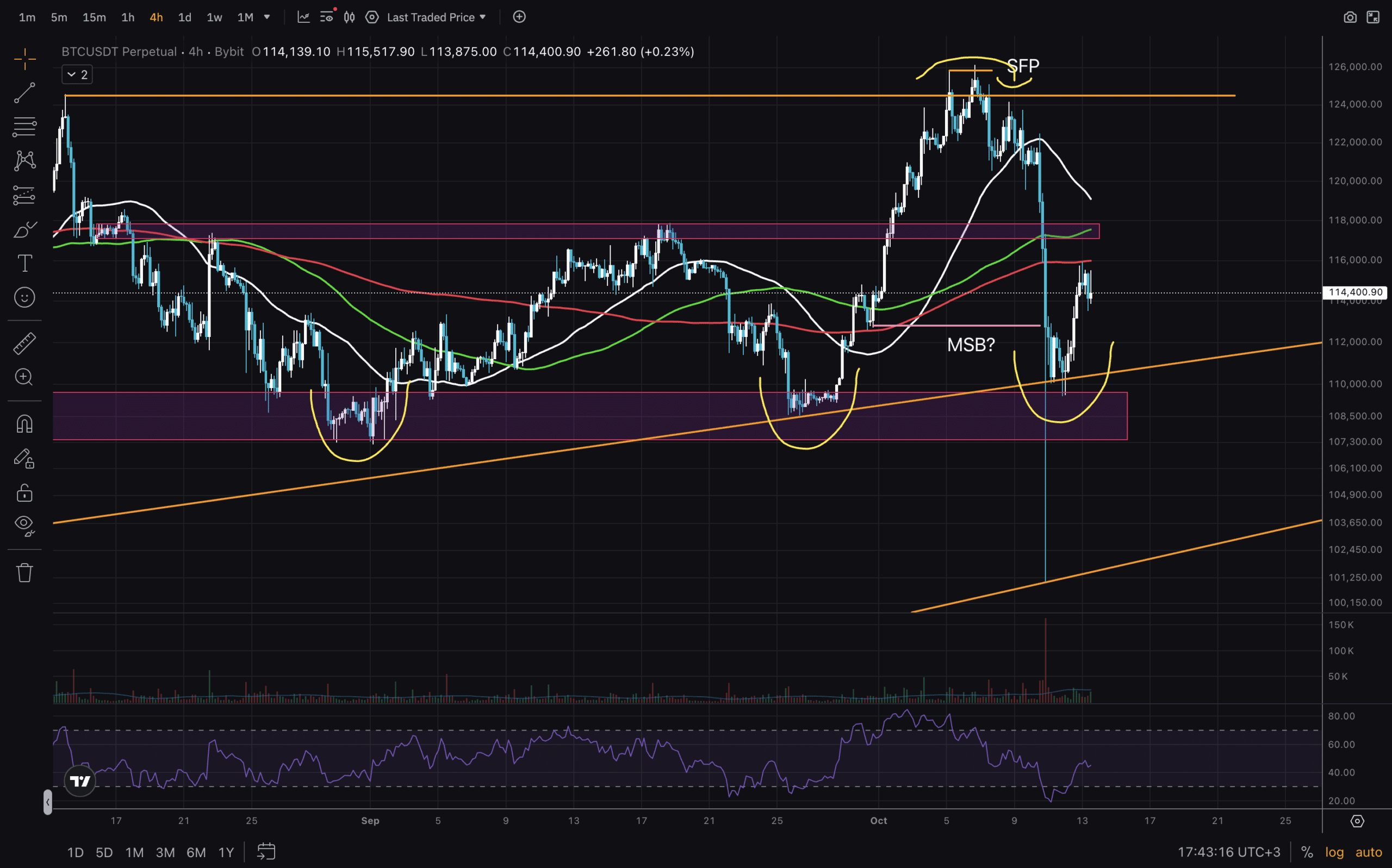

Well, this is not a financial advise kind of article. We can only discuss what experienced traders would do. And they would probably wait to see how the next few days move the market. For that purpose, we will finish with a 4H timeframe chart.

A lot of heavy buying absorbed the sell pressure from the liquidation cascade. Price wick’d down to weekly trend-line and managed to close above the $107,000-$110,000 orderblock. So far so good. But we are also below all MAs on this LTF. A reclaim of the $117,000 – $118,000 level is critical. If not – we can expect for the Weekly FVG to get filled.

Stay safe out there!

DISCOVER: Top 20 Crypto to Buy in 2025

Join The 99Bitcoins News Discord Here For The Latest Market Updates

BTC USD Holding Support: What Can Traders Expect?

- First Key level to hold ($117,000) broke. Next is $110,000

- 1D chart shows bearish factors, yet structure still remains bullish

- Weekly FVG at $86,000-$92,000 zone. Will it get filled?

- Key level to break for upward continuation is $117,000-$118,000 orderblock.

The post BTC USD Holding Support: What Can Traders Expect? appeared first on 99Bitcoins.