A crypto selloff triggered by macro tensions wiped out $19.37 billion in leveraged trades in just 24 hours. However, now that the storm has passed and the chips have fallen where they did, let’s look at how the two biggest cryptocurrencies are faring at the moment.

But first, a precursor. On 10 October, 2025, US President Trump announced his trade war against China in a response to China restricting rate earth mineral exports.

(Source: CoinGecko)

He said, “Based on the fact that China has taken this unprecedented position, and speaking only for the U.S.A., and not other Nations who were similarly threatened, starting November 1st, 2025 (or sooner, depending on any further actions or changes taken by China), the United States of America will impose a Tariff of 100% on China, over and above any Tariff that they are currently paying.”

lol WHAT DID CHINA THINK TRUMP WOULD DO?!?!

100% tariffs on top of all the other tariffs. pic.twitter.com/gcPhIbl4C5

— China Uncensored (@ChinaUncensored) October 10, 2025

Additionally, he announced export control of critical software, that drove the speculation of a full blown tariff war between the two countries, crashing the crypto market.

.cwp-coin-chart svg path {

stroke-width: 0.65 !important;

}

0.82%

Bitcoin

BTC

Price

$111,593.88

0.82% /24h

Volume in 24h

$60.13B

<!–

?

–>

Price 7d

// Make SVG responsive

jQuery(document).ready(function($) {

var svg = $(‘.cwp-graph-container svg’).last();

if (svg.length) {

var originalWidth = svg.attr(‘width’) || ‘160’;

var originalHeight = svg.attr(‘height’) || ’40’;

if (!svg.attr(‘viewBox’)) {

svg.attr(‘viewBox’, ‘0 0 ‘ + originalWidth + ‘ ‘ + originalHeight);

}

svg.removeAttr(‘width’).removeAttr(‘height’);

svg.css({‘width’: ‘100%’, ‘height’: ‘100%’});

svg.attr(‘preserveAspectRatio’, ‘xMidYMid meet’);

}

});

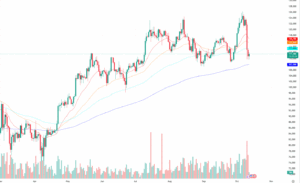

dropped to $107,468 on Friday, before bouncing back to close at $114,559 down nearly 6% for the day. The price action saw a brief uptick and touched $110,000 again, before slipping by 1.82% on Saturday to end at $112,69.

For now, BTC is trading below its 50-day EMA, but has maintained its position above the 200 EMA, signaling a bearish short-term but the long-term bullish sentiment is intact.

Source: TradingView

If it breaches through $115,000 it would bring its 50-day EMA into play. If it manages to hold and sustain above that level, it is possible for BTC’s price to move towards the $125,761 level.

$BTC update

BTC hit new ATHs, then flash-crashed through all liquidity boxes down to $102K.

A quick recovery from $108K shows strong absorption, but $116K (Oracle line) must flip to support for upside continuation.This wasn’t a normal correction, it was a liquidity flush.… pic.twitter.com/CoTZ5Z80y5

— Pirow (@DanielPirow) October 12, 2025

On the flipside, if BTC falls below $110k, the next major support is at $100,000.

EXPLORE: Top 20 Crypto to Buy in 2025

ETH Stable At $3,825 After Huge Crypto Selloff

Panic liquidations saw ETH price slip briefly to around $3,500. Since then however, ETH has bounced back to reclaim the support level at $3,825. It is currently trading at

.

A whale shorted $600 million in Bitcoin and $300 million in ETH, contributing to nearly $19 billion in a crypto selloff, one of the biggest in recent history.

BREAKING:

WHALE JUST OPENED A MASSIVE $330M $ETH SHORT

IS THE DUMP COMING? pic.twitter.com/f49YjKhGmE

— AlΞx Wacy

(@wacy_time1) October 10, 2025

Analysis Donald Dean noted that $3,825 is now the key short-term support level. However, this depends as macro developments could lead to more downsides the coming week.

$ETH $ETHUSD Ethereum – Big Drop, What's Next

As mentioned, $3825 appears to be our short-term support after the huge move down from a whale shorting BTC along with mass liquidations. $19 Billion Impact for crypto, unreal.

Monday could show additional weakness, but long-term… https://t.co/unr786Qx7A pic.twitter.com/f6lYzt3mC3

— Donald Dean (@donaldjdean) October 11, 2025

Despite the recent shakedown, ETH’s technical setup is still promising. Dean pointed out to a bull flag pattern forming on the daily chart, which signals a potential rebound if ETH maintains about $3,875.

If the support holds, ETH can potentially target resistance levels between $4,500 and 5,766. On the flipside, a drop below $3,500 could lead to deeper support zones.

(Source: TradingView)

Market analyst Alex Wacy stated that the recent shakedown has cleared excess leverage and weak hands, setting the stage for a strong rally and that ETH could reach a new ATH in the coming weeks.

Funny how so many “experts” are suddenly calling for a BEAR MARKET.

Leverage wiped. Liquidity cleared. Weak hands capitulated.

This is exactly when MASSIVE RALLIES are born.

All signs to me point to a new $ETH ATH in the coming weeks. pic.twitter.com/E5xOoqTh21

— AlΞx Wacy

(@wacy_time1) October 11, 2025

According to Wacy, ETH could reach somewhere between $4,300 and $5,175 in October and around $12000 in the long term by late 2025.

EXPLORE: Best New Cryptocurrencies to Invest in 2025

WLFI, Aster and Sonic Labs Launch Major Token Buybacks After The Crypto Crash

After the world was witness to one of the worst crypto crashes in recent times, three altcoin projects have stepped in and launched massive token buybacks, meant to reduce selling pressure and restore confidence among users.

World Liberty Financial (WLFI), announced a $10 million buyback using the USD1 stablecoin. According to blockchain data, the buyback was carried out gradually using a TWAP model, which helps spread purchases over time and avoid sharp price movements.

While others panic, we stack.

Today we bought $10 million worth of $WLFI — and this won’t be the last time.

We know how the game is played.https://t.co/do3wPuiuZc— WLFI (@worldlibertyfi) October 11, 2025

The repurchased tokens will be removed from circulation to support price over time.

Aster moved 100 million of its ASTR tokens from its treasury to buy back from the market, just after the platform rolled out its Stage 2 Airdrop Checker.

Sonic Labs committed $6 million to purchase its native $S tokens, which were added to the treasury.

While most networks were struggling to stay online, Sonic operated flawlessly. Zero pending transactions, near-instant finality, and sub-cent fees across every DEX and app.

And while others pulled back, we stepped forward by adding $6 million in open-market buying, increasing… https://t.co/56bYdob3rN pic.twitter.com/BjlyIkzm7D

— Sonic (@SonicLabs) October 11, 2025

It emphasized that network remained stable despite the crash, with CEO stating that native assets may offer better long-term returns than relying on stablecoins.

EXPLORE: Next 1000X Crypto – Here’s 10+ Crypto Tokens That Can Hit 1000x This Year

Veteran Trader Peter Brandt Is Bullish On Bitcoin, XRP, Ethereum, and XLM

Legendary trader Peter Brandt believes BTC, ETH,XRP and Stellar (XLM) could be getting ready to move higher.

In his post on X, he shared that BTC’s chart looks similar to past patterns that led to big rallies.

A few final posts for the weekend, then I will leave you youngsters with your dreams$XRP – just a minor reaction in bigger theme of things$BTC – bull still alive and well$XLM – a bull waking from a nap$ETH – ready to rock and roll

If I change my mind I won't let you know pic.twitter.com/rL1nVETYSn— Peter Brandt (@PeterLBrandt) October 11, 2025

He also said the ETH is holding strong despite recent market drops.

For XRP and XLM, Brandt pointed out signs of accumulation, meaning traders might be quietly buying the dip and that these coins could follow a similar path upwards.

In short, his message being, short term volatility notwithstanding, long term setup for these assets look promising.

EXPLORE: 9+ Best Memecoin to Buy in 2025

BitForex CEO Linked To $735M BTC Short

A recent on-chain investigation by crypto researcher “Eye”, has linked a mysterious whale on Hyperliquid who controls over 100,000 BTC to Garett Jin.

Jun is the former CEO of BitForex, an exchange that was shut down following fraud allegations.

1/ An investigation into the alleged identity of the mysterious Hyperliquid/Hyperunit whale, who holds over 100,000 BTC. Recently, he sold over $4.23B in BTC to acquire ETH and is the same person behind the $735M BTC short order placed on the same platform. pic.twitter.com/WeNvmiYP8v

— Eye (@eyeonchains) October 11, 2025

In his post on X, Eye pointed out to the whale’s main wallet, named ereignis.eth. This wallet is connected to another ENS address, garrettjin.eth, which leads directly to Jin’s verified X account, @GarrettBullish, suggesting a strong link between the two.

Eye explained, “The ENS name ereignis.eth (“event” in German) confirms his link to this wallet, identifying him as the actor behind the large-scale operations on Hyperliquid/Hyperunit.”

The wallet’s transaction history also lines up with Jin’s business dealings, including transfers to staking contracts and wallet funded by exchanges he was previously associated with, like Huobi (HTX).

Also, the wallet received and sent funds tied to BitForex-related addresses and Binance deposits, which were used to execute massive trades, one of which involved $735 million worth of BTC.

Not everyone is convinced though. Crypto analyst Quinten François argued that the evidence is a little too convenient for his take.

It doesn’t add up to me.

Why would you have an .eth name leading to your X handle in a wallet that directly connects to market manipulation wallets and wallets for other crime?

I don’t think anyone is stupid enough.

— Quinten | 048.eth (@QuintenFrancois) October 12, 2025

EXPLORE: 20+ Next Crypto to Explode in 2025

The post Can BTC And ETH Rebound After A $19B Liquidation Storm? appeared first on 99Bitcoins.