It’s fair to say most partisan Canadians and their political parties were not thrilled by the results of Monday’s

.

The

did not get their majority (as of press time), even in light of presenting an agenda, from a new shiny face who was not Justin Trudeau, that stoked fear about a supposed “national crisis.” As the number of seats is still being finalized, it’s obvious they will need to find dance partners.

The Conservatives’ fortunes quickly turned from being the frontrunner to runnerup despite a large improvement in the number of votes they got.

The NDP were devastated and seem to have lost official party status by running an incompetent and incoherent campaign. The Liberals cannibalized their vote. However, depending on the final seat count, they may end up being a dance partner for the Liberals.

The Bloc Québécois also lost votes by Liberal cannibalization. But, like the NDP, that party could be a dance partner for the Liberals.

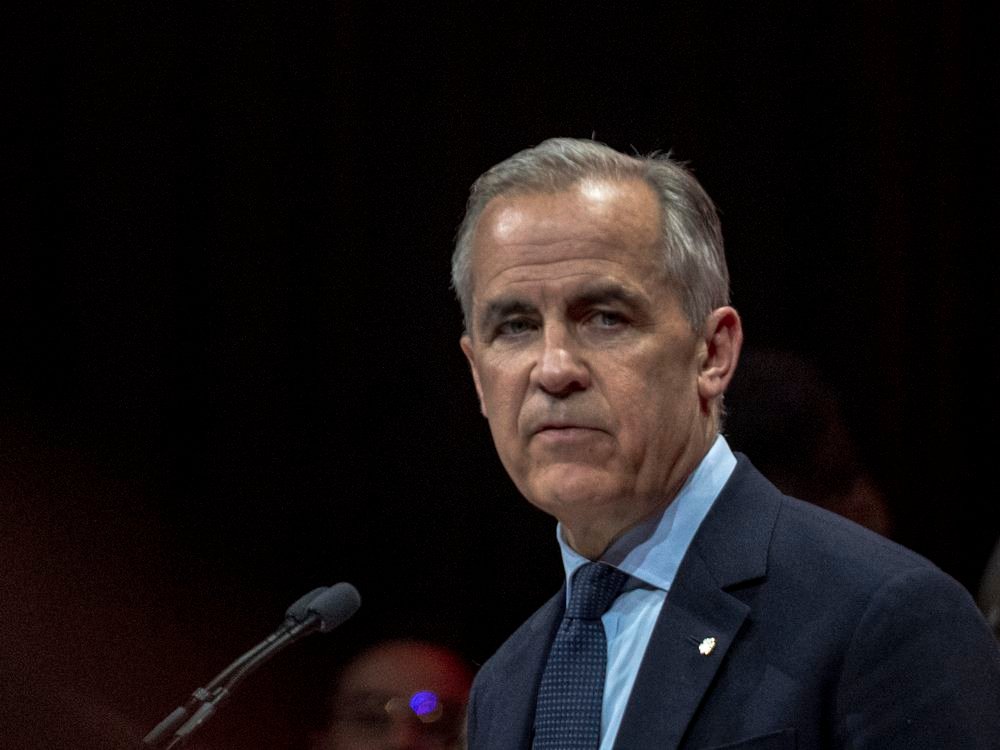

Despite some loud partisan Liberals, who are cheering that the victory sends a signal to the world that

has a strong mandate and will lead Canada out of its current mess, most reasonable Canadians don’t believe that.

Canadians are obviously very divided. A simple look at the vote count reveals that roughly 43.5 per cent voted for a Liberal candidate, whereas 41.5 per cent voted Conservative.

The Liberals’ playbook to stoke fear was obvious and proved to be a political winner: calling the chaos

caused by Donald Trump a national crisis

or the “biggest crisis of our lifetime” to get people motivated to vote for the so-called saviour. There are a lot of historical examples around this simple playbook. Unfortunately, it continues to be a winner with shallow policies that surround that simplicity.

So, with the wounds still fresh, here are some early observations.

First, will Carney be able to make sweeping changes to

Canada’s economic relationships

so as to

“decouple” our relationship with the U.S.?

“Our old relationship with the United States, a relationship based on steadily increasing integration, is over,” he said during the campaign. “The system of open global trade anchored by the United States … is over.”

Not a chance. Such a massive change would take a lengthy period of time accompanied by a great deal of pain that would be felt by all Canadians.

Diversifying markets has long been necessary, but it won’t happen overnight and if it’s even possible that it will take decades. The short-term plan and priority should be to ensure Donald Trump’s

can be tempered.

Second, regardless of the trade war, our country’s recent

by virtually any measure has been stagnant.

Should Carney carry out his plan that was presented during the campaign, it will lead to significant new government intervention and massive inflationary spending with little positive impact. And with the continued attacks on our precious and important energy industry, such a vital industry will not be able to contribute more to energy stability and important economic upticks.

This is not a recipe for recovery; it’s a continuing eviction notice for Canada’s wealth creators. Expect more entrepreneurs and capital to flee.

Third, our country can expect shallow

to continue as the norm.

Our income tax statute is filled with political tax gimmicks that need to disappear. A great example is the recently added prohibition of expense deductions if you happen to be an owner/operator of a short-term rental property in a jurisdiction where the municipality prohibits such operation.

This prohibition is nonsensical and dangerous, especially when you understand that drug dealers who wish to be tax compliant (which, of course, the vast majority are not) are able to deduct their expenses to earn such illegal income. This puts short-term rental owners in a worse-off position than criminals from a tax and public policy perspective.

From a personal perspective, the Liberal win hurts. Canada needs

and big-bang ideas to get our country back on track. The Conservatives had promised to convene a tax reform task force within 60 days of getting elected so as to carry out that necessary exercise. Unfortunately, the Liberals have historically shown zero interest in positive tax reform, other than carrying on with their political tax objectives.

The election campaign provided further evidence of that since none of their tax policy promises displayed any big ideas.

Most of their tax promises were copied from the Conservatives (personal tax cut for the bottom income bracket, elimination of the GST on new homes, elimination of the capital gains proposals and removal of the consumer carbon tax), with zero new big ideas other than one very silly idea to resurrect a 1970s-style tax shelter in an attempt to encourage housing construction. Good grief.

Tax reform will remain a fantasy until the Liberals discover a poll that its voter base suddenly cares about fiscal sanity and sound taxation policies. Wait, I just saw a unicorn cross the street.

Overall, Canada has significant work to do to unite. Is this Liberal government the one to do that? No. By stoking fears without plans for economic sanity and tax reform, it is likely that the day for Canadians to unite is a ways off.

The Liberal Party win is an example of incoherence bound together by temporary issues, and the lack of a plan to get our country firing on all cylinders will be greatly exposed when those temporary issues disappear or diminish.

In the meantime, buckle up, Canada. The ride is certainly not going to be turbulence free.

Kim Moody, FCPA, FCA, TEP, is the founder of Moodys Tax/Moodys Private Client, a former chair of the Canadian Tax Foundation, former chair of the Society of Estate Practitioners (Canada) and has held many other leadership positions in the Canadian tax community. He can be reached at

and his LinkedIn profile is https://www.linkedin.com/in/kimgcmoody.

_____________________________________________________________

If you like this story,

the FP Investor Newsletter.

_____________________________________________________________

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here.