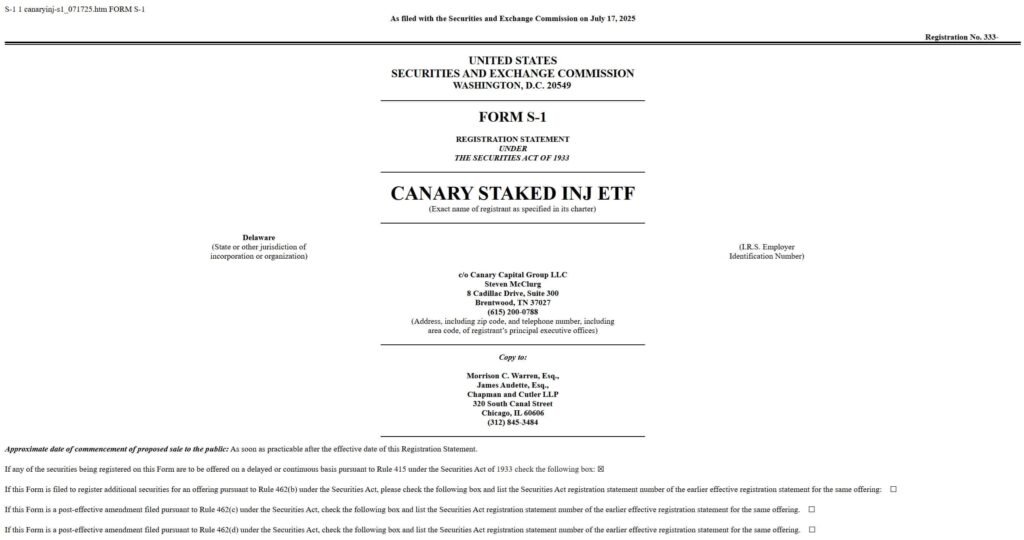

Canary Capital is back with another ETF proposal, this time targeting Injective. The New York-based firm has filed with the SEC to launch a fund that tracks INJ while also staking it. The idea is simple. Instead of just following Injective’s price, the ETF would also collect staking rewards along the way. Investors could earn yield automatically, with no wallets, no validators, and no crypto know-how needed.

Why Injective and Why Now

Injective is a fast, low-cost Layer 1 built for financial apps and DeFi trading. More importantly, it runs on proof of stake, which lets token holders earn rewards for helping secure the network. Canary plans to wrap that process into a single, regulated product that works like a traditional ETF.

For anyone familiar with staked Ethereum funds, this would follow a similar model. Investors would get exposure to INJ’s price while earning yield from staking, all in a package that’s easier to manage than doing it yourself on-chain.

DISCOVER: Best New Cryptocurrencies to Invest in 2025

Altcoin ETFs Are Heating Up

Until now, the ETF market has mostly focused on Bitcoin and Ethereum. But asset managers are pushing beyond the majors. Canary has already filed for funds tied to Solana, XRP, HBAR, SUI, and more. Injective stands out from that list because of its tight focus on real-world finance and DeFi, plus it already has working products and growing usage.

Adding staking to the mix gives the fund another edge. It turns it from a pure speculation play into something that generates passive returns. That’s a big draw for investors who want more than just price movement.

Still Early, But Eyes Are on the Filing

The SEC filing doesn’t include every detail yet. It’s not clear who will provide the staking services or what portion of the INJ holdings will actually be staked. But the core idea is clear enough. If approved, the fund would give buyers a way to earn staking rewards without touching crypto infrastructure.

This would be the first product of its kind in the U.S., although similar funds are already live in Europe. The success of Ethereum staking ETFs could give regulators more confidence that these structures can work safely.

DISCOVER: 20+ Next Crypto to Explode in 2025

Market Reaction and What to Expect

Injective’s price grew after the filing went public, rising more than 25 percent to around $13.50. Trading volume also jumped, and the project is now getting more attention from institutional circles. Daily users are still around 71,000, and about $37 million is locked in its DeFi ecosystem, but momentum is building.

Canary’s application is now in the hands of the SEC. If it goes through, it could be a major step toward broader altcoin access through traditional markets. This fund would blend crypto returns with familiar financial rails, and that’s exactly what many investors have been waiting for.

DISCOVER: 20+ Next Crypto to Explode in 2025

Join The 99Bitcoins News Discord Here For The Latest Market Updates

Key Takeaways

- Canary Capital has filed with the SEC to launch the first-ever staked Injective ETF, combining INJ price exposure with staking rewards.

- The ETF would give investors yield from staking Injective without needing wallets, validators, or direct blockchain interaction.

- Injective is gaining traction in DeFi with a proof-of-stake model and working products, making it a strong altcoin candidate for this fund.

- If approved, the ETF would offer a new way for U.S. investors to access altcoin staking through regulated financial products.

- INJ price jumped over 25 percent following the filing, signaling strong market interest in altcoin ETFs that go beyond just speculation.

The post Canary Files for Staked Injective ETF as Altcoin Funds Pick Up Steam appeared first on 99Bitcoins.