China is moving closer to exploring stablecoins, a change that could reshape global payments and help push the yuan onto the world stage. Reports say the State Council is reviewing a roadmap that would set targets for using a yuan-backed stablecoin, assign roles to domestic regulators, and lay out rules to manage risks. Senior leaders are expected to meet this month to discuss yuan internationalisation and stablecoin policy — a notable shift from the 2021 ban on crypto trading and mining, and a development closely watched by projects like Conflux crypto, which position themselves as regulatory-compliant blockchains in China.

JUST IN: China pivots to stablecoins after US passes the GENIUS Act.

Beijing is now drafting a yuan-backed stablecoin roadmap, with pilots set offshore in

Hong Kong.

This marks a major shift: once focused only on the e-CNY CBDC (domestic use), China now sees stablecoins… pic.twitter.com/JLqSmbz5xD— Jessica Gonzales (@lil_disruptor) August 28, 2025

Beijing has long aspired for the yuan to rival the U.S. dollar and euro in global payments. Yet, despite China’s vast trade surpluses, strict capital controls have capped its international influence.

Stablecoins are digital tokens pegged to fiat currencies and offer instant, low-cost, borderless transfers. For a country that has long enforced strict capital controls, stablecoins present both an opportunity and a challenge: they could make cross-border yuan flows easier, but regulators will need safeguards to prevent capital flight and financial instability.

The yuan’s share of global payments recently fell to about 2.88%, underscoring why Beijing is interested in tools to boost international use of the currency.

EXPLORE: The 12+ Hottest Crypto Presales to Buy Right Now

Beijing’s Stablecoin Roadmap Could Redefine Yuan Internationalisation, Challenge U.S. Dollar Dominance, and Spark a New Era for China-Compliant Blockchains Like Conflux Crypto

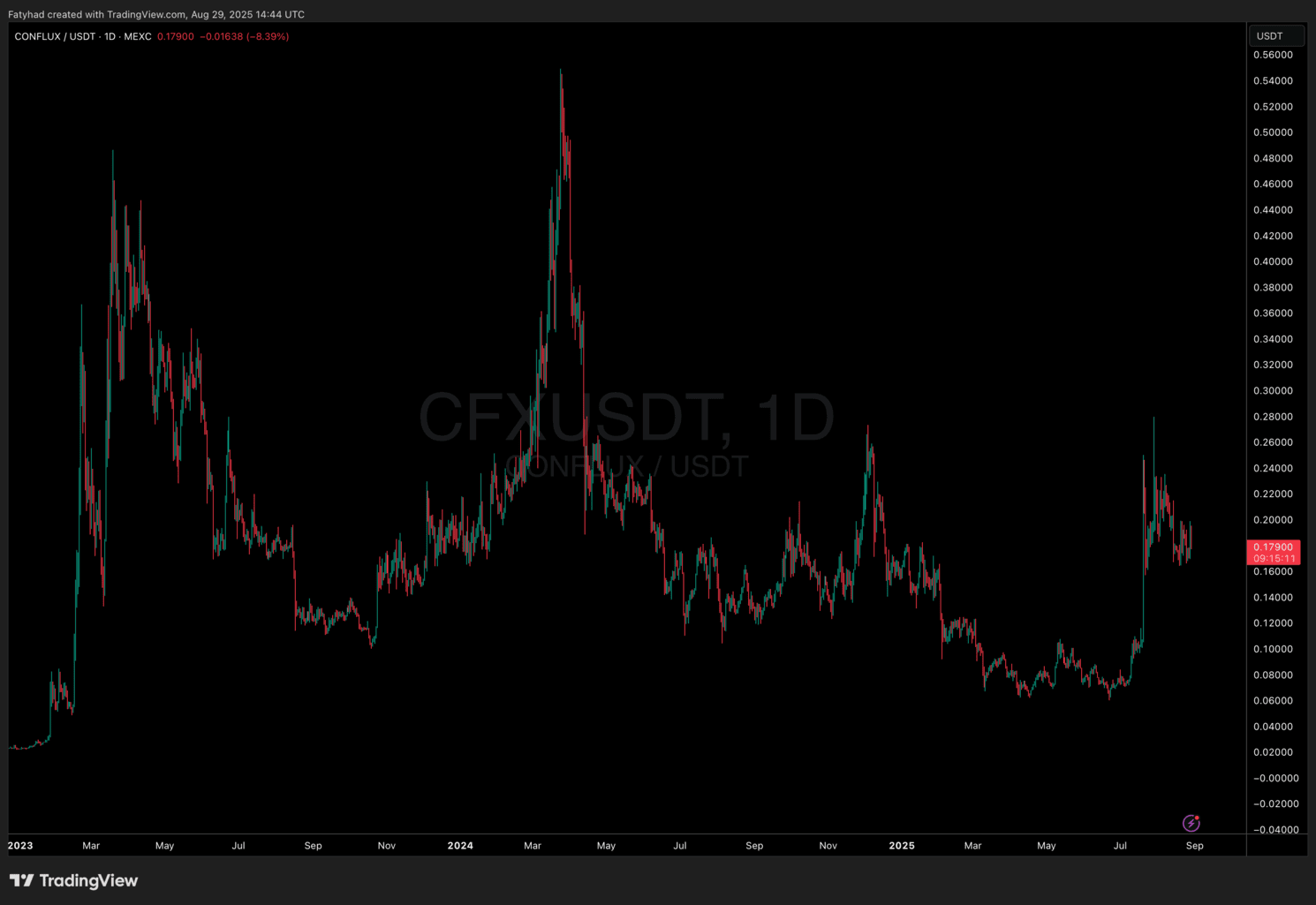

Following this change of heart, Conflux (CFX) crypto has exploded higher. Since July, CFX has climbed sharply after two headlines: a plan for an offshore yuan-pegged stablecoin built with fintech partners, and the rollout of Conflux 3.0, which promises much faster throughput (up to 15,000 TPS) and better cross-border settlement support.

Trading volume jumped from under $60 million to more than $1.7 billion in a couple of days, briefly pushing CFX market cap above $1 billion.

(Source: CFXUSDT)

Conflux is also preparing a critical network upgrade (v3.0.1). The hard fork is scheduled for August 31 (08:00 UTC+8); Binance has said it will suspend CFX deposits and withdrawals starting September 1 as a precaution during the upgrade — a standard practice to help ensure a smooth transition.

PetroChina’s Stablecoin Experiment Highlights Corporate Adoption and Hong Kong’s Regulatory Role

Meanwhile, PetroChina is studying whether stablecoins can be used for cross-border settlement and payments, citing Hong Kong’s new stablecoin rules (effective August 1) and close monitoring of the HKMA.

China National Petroleum Corporation, one of the world's largest energy companies, disclosed at its half-year results conference that the company is closely following the latest developments of the Hong Kong Monetary Authority regarding stablecoin issuer licenses, and will…

— Wu Blockchain (@WuBlockchain) August 29, 2025

If energy majors like PetroChina begin settling transactions in yuan-pegged tokens, the potential impact on global trade corridors could be massive. For China, it would mean a direct application of stablecoin technology to expand yuan-denominated settlement, reducing reliance on the U.S. dollar in oil and commodity markets.

Could Conflux crypto become a major player in this sector? The answer will depend on regulatory outcomes in Beijing and Hong Kong, how smoothly Conflux’s upgrade runs, and whether major firms actually move to settle in yuan-pegged stablecoins. For now, Conflux sits at the center of a story that mixes policy, infrastructure upgrades, and corporate pilots — and that blend is why traders can’t help but watch closely.

Key Takeaways

- China’s State Council is reviewing a roadmap for yuan-backed stablecoins. This signals a major policy shift.

- Conflux crypto gains momentum with its 3.0 upgrade and compliance edge, aligning with China’s blockchain ambitions.

- PetroChina explores stablecoin settlements under Hong Kong’s new framework, highlighting broader adoption in traditional industries.

The post China is Moving on Chinese Stablecoin: Is Conflux Crypto Pump Evidence of Smart Money Accumulation? appeared first on 99Bitcoins.