Newport, South Wales, may seem a quiet corner for seismic conversations, but this week, CreditWeek 2025 turned it into the epicentre of critical debates shaping the future of credit.

From AI breakthroughs to regulatory cautionary tales, the sessions have reflected a financial industry at a pivotal moment, navigating both the dual forces of technological transformation and rising global risks. As fintech finds itself increasingly embedded in the credit ecosystem, the lessons emerging here feel especially urgent.

Amigo Loans: A cautionary tale at centre stage

The conference opened with one of the most striking keynotes: Nick Beal, CEO of Amigo Loans, recounting how the once-prominent guarantor lender found itself winding down operations.

Amigo’s story is less about malicious intent and more about the perils of operating in an environment where the regulatory bar “keeps rising”. With affordability checks falling short of evolving FCA expectations, it led to serious breaches of core principles and, ultimately, a business collapse narrowly avoiding a £73million fine.

For fintechs pushing into lending, Beal’s reflections are a sobering reminder that in a sector driven by speed and innovation, compliance needs full attention – even when you think you’re in the green zone. The message was simple: what passes today as compliant practice may not survive tomorrow’s regulatory reinterpretation.

Vince Cable’s economic reality check

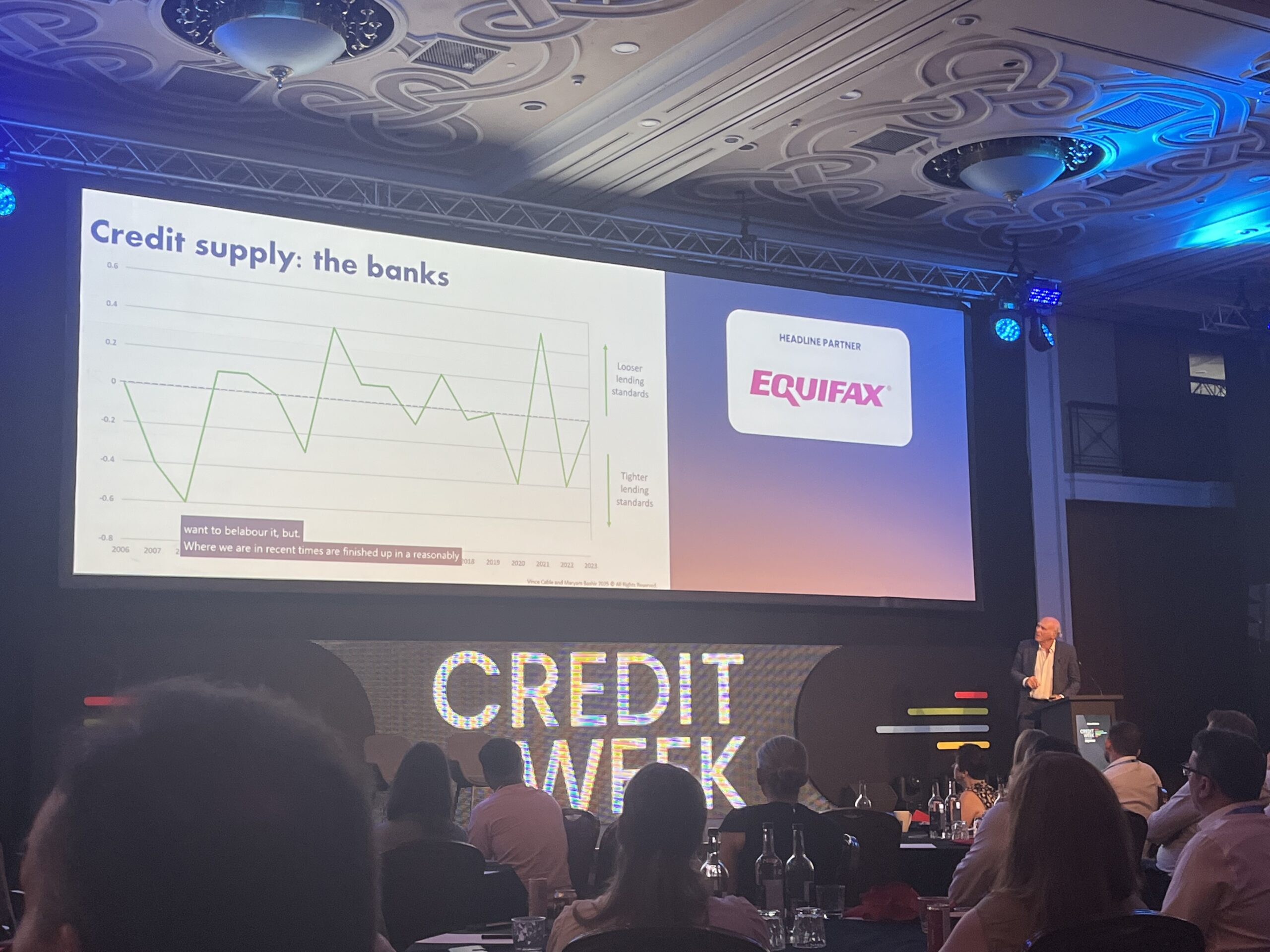

Also setting the stage was Sir Vince Cable, offering a global economic update grounded in stark realities.

Tracing shocks from the 2008 financial crisis through Brexit, the pandemic and the Ukraine war, Cable warned that government debt burdens have reached levels where “89 per cent of UK government spending goes on debt service”.

He highlighted the fragility of economic recovery and the risks posed by trade conflicts and financial instability. Though there was some brighter news, as he outlined other events in living memory that have been more of an economic breakpoint than our current conditions. Very much a glass half full moment.

However you see it, whether you’re a fintech lender or a credit innovator, it’s a timely caution: macroeconomic turbulence is not hypothetical. It’s a live hazard that must be built into every model and business plan.

AI’s double-edged sword in credit modelling

The buzz around AI in credit was impossible to miss. In a panel featuring Stephen Holmes (Novuna), Jake Rukin (Evlo), Mahesh Bharadhwaj (Jaja Finance), Ben O’Brien (Jaywing) and Kamini Patel (Equifax), speakers hailed machine learning as the industry’s most transformative force.

Equifax, for instance, has seen sustainable AI deliver a 15 to 20 per cent reduction in bad debt and up to a 10 per cent lift in customer acceptance rates. Yet alongside these gains, the panel issued strong warnings: model drift, bias, and regulatory hurdles loom large. Explainability is no longer optional; regulators, and customers, will demand it.

The conversation turned toward AI agents, hinting at a future where autonomous systems help manage customer relationships and dynamically adjust models in near real time. It’s an enticing vision, but the risk of falling behind in this technological race is palpable, and potentially existential for smaller players.

The enduring promise of transparent lending

Daniel Goldstone, co-founder and CEO of fintech Range Teller was there to meet industry players an offer a solution to a core problem: transparency. He reported that many banks are open to meetings but guarded. Influenced by regulatory uncertainty and capital constraints. It’s a telling snapshot of where fintech stands today: brimming with solutions, but still dependent on legacy institutions’ willingness to adopt them.

Climate risk: The mortgage market’s new frontier

Paul Broadhead of The Building Societies Association and Iain Clacher at the University of Leeds, delivered a key session on how climate change is becoming a financial risk that credit markets can no longer ignore.

Flooding, overheating and other climate-driven events threaten not only physical assets but financial stability itself. The £10million UK Centre for Climate Finance and Investment seeks to translate climate science into usable tools for lenders. Yet, a major challenge remains: the gap between scientific projections and public perception. Without bridging this cognitive divide, lenders risk building hidden vulnerabilities into the system.

A new agenda for credit

There were also panels that encouraged debates such as sustainability, innovation, and inclusion, especially ‘Inside the C-Suite: Predictions and priorities for the credit industry’, with speakers including Steve Hunt (BNP Paribas Personal Finance), Desmond McNamara (Zilch), Mark Thundercliffe (5CS Risk Advisory) and Cyrille Salle de Chou (Starling Bank), explored how leadership priorities are shifting.

Here the panellists stressed the importance of financial education and regulatory balance to protect consumers and preserve trust.

Whereas in a lively session titled ‘Honey, I Shrunk the Banks’ tackled the contraction of the lending sector. Speakers from Cockle Finance, Creditspring, JaJa Finance, Novuna and Plend spoke candidly about regulatory pressures, economic headwinds, and how customer expectations are forcing traditional models to evolve.

Innovations like subscription finance and open banking offer new paths forward. Yet industry consolidation threatens to reduce consumer choice and, worryingly, there’s been a rise in illegal lending to vulnerable groups as regulated providers retreat.

A financial industry on the edge of change

Stepping back, the mood at CreditWeek feels reflective of the industry’s wider crossroads.

A new UK government signals potential shifts in regulatory philosophy, a factor fintechs must watch closely. Globally, rising geopolitical tensions and ballooning debt burdens are pressuring financial markets in ways reminiscent of the last major crisis cycles.

Meanwhile, the rise of AI agents in credit modelling could become a great leveller, allowing smaller fintechs to compete.

Partnerships remain the industry’s secret weapon. Fintechs bring agility and fresh ideas; incumbents bring trust, scale, and regulatory relationships. But forging these partnerships demands mutual understanding and the courage to modernise deeply entrenched processes.

In the land of Dragon’s, one thing is clear: fintech’s role in credit is no longer peripheral. It’s central, but fraught with both opportunity and existential risk. For all the promise of AI, transparency and digital inclusion, this week has underscored an eternal truth of financial services: innovation may set the pace, but regulation and trust ultimately define who survives.