According to CryptoQuant’s data, the long-awaited altcoin season may have officially arrived. The CEO of the crypto market company, Ki Young Ju, has pointed out a significant surge in altcoin volume on Centralised Exchanges (CEXs).

Related Reading

CryptoQuant CEO Says Altcoin Season Has Begun

Presenting a detailed price chart of the volume ratio of Bitcoin versus altcoins on CEXs, Ju disclosed that altcoins have been seeing significantly higher trading volume than BTC. Unlike previous bull market cycles, Bitcoin Dominance (BTC.D) is no longer the sole factor in determining the start of the altcoin season. Some analysts even suggest that the altcoin season is no longer dependent on Bitcoin dominance.

Typically, during past altcoin seasons, investors and holders rotated their profits between Bitcoin and altcoins. This time, the CryptoQuant CEO suggests that even stablecoin holders move the market, favoring altcoins more than BTC and directly entering positions.

Yu’s chart shows that altcoin volume on CEXs has exceeded that of Bitcoin by 2.71x based on the 90-day Moving Average (MA). Despite this increase, the CryptoQuant CEO warns that the rally set to follow the altcoin season will be selective, and not all altcoins may benefit.

During the last bull run, the same event occurred, where only the most prominent coins, with proper utility, robust community, and a grand narrative, skyrocketed. On the other hand, low-cap altcoins experienced an increase, however, not as explosive as the ones recorded by coins like Solana, Cardano, and more.

Based on Yu’s analysis the Bitcoin dominance no longer defines an altcoin season; rather, the trading volume does. Historically, a rise in BTC.D is seen as a deterrent to an altcoin season as the market is supposedly more interested in Bitcoin. Conversely, a decline in Bitcoin dominance is an indication of a shift in the market’s sentiment toward altcoins, signaling the possible onset of the altcoin season.

Analyst Forecasts A Final Market Decline Before Altcoin Season

While the start of an altcoin season could alleviate current bearish pressures on altcoins in the market, uncertainty still looms about whether this highly anticipated and recurring historical trend will occur in this bull cycle.

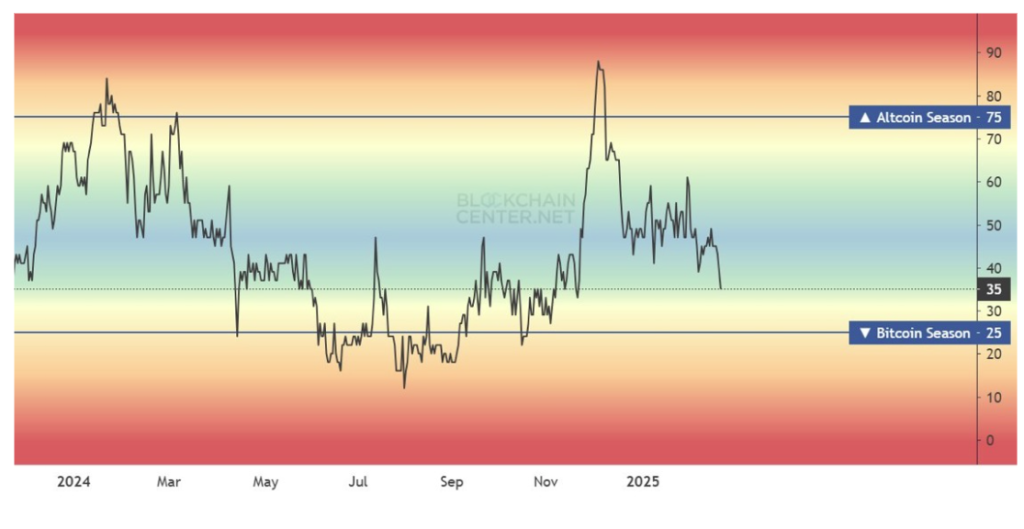

A crypto analyst, identified as the ‘Alternative Bull’ has projected a final decline before the potential start of an altcoin season. The analyst forecasts that the altcoin season index chart will experience a significant drop and then skyrocket towards the 90 threshold before the end of 2025, as seen in the chart.

Related Reading

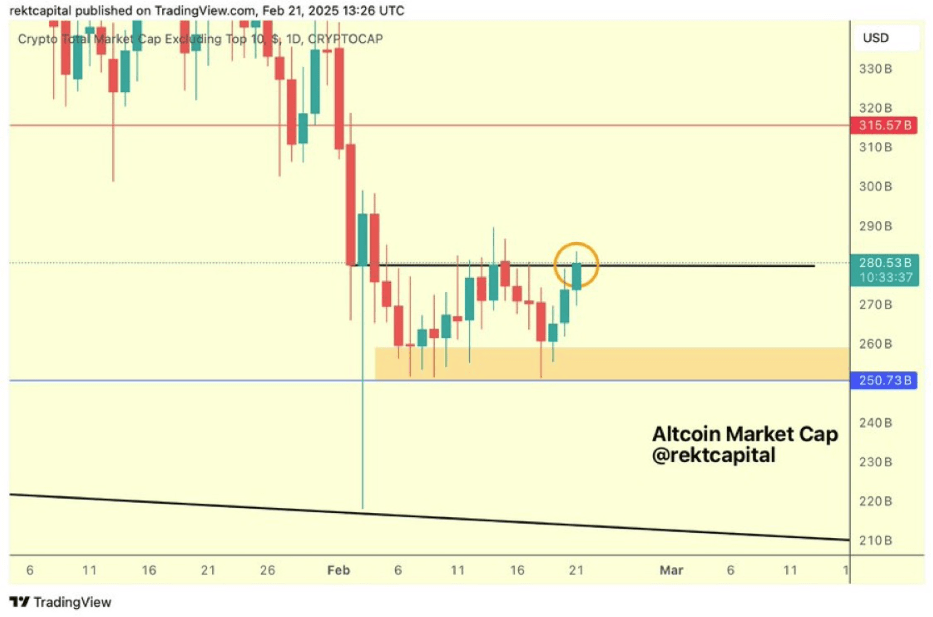

Presently, the altcoin market cap, standing at $280.5 billion, has completed the second part of its previously formed Double Bottom pattern. This unique technical pattern is often seen as a bullish indicator, signaling a potential reversal from a downtrend to an uptrend. According to Rekt Capital on X, the altcoin market cap is attempting to break out of this pattern and initiate a bullish move towards a $300 billion valuation.

Featured image from Reddit, chart from TradingView