The cryptocurrency derivatives market has suffered heavy liquidations as altcoins like XRP (XRP) and Dogecoin (DOGE) have plummeted.

Crypto Has Seen Almost $1 Billion In Liquidations During The Past Day

According to data from CoinGlass, the cryptocurrency derivatives sector has been shaken up by a wave of liquidations in the last 24 hours. “Liquidation” here refers to the forceful closure that any open contract undergoes when its losses exceed a certain percentage (as defined by the platform).

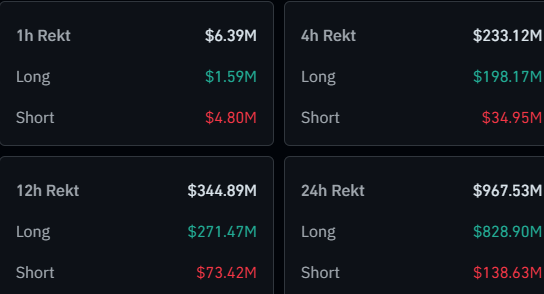

Below is a table that breaks down the numbers related to the latest liquidations in the digital assets market:

As displayed, the cryptocurrency sector has seen a whopping $967 million in derivatives contract liquidations over the past day. Out of these, an overwhelming majority of the positions involved were long ones. More specifically, users betting on a bullish outcome took a beating of around $829 million.

These mass liquidations have come as assets across the market have witnessed some degree of bearish price action. The likes of XRP and Dogecoin are currently down about 10%. Interestingly, Bitcoin (BTC) hasn’t been affected by this latest sector-wide downturn, suggesting that the decline could be a result of investors rotating capital out of altcoins.

Given BTC’s relatively flat action, it’s not surprising to see that the number one cryptocurrency hasn’t been leading in liquidations this time around.

From the above heatmap, it’s visible that Ethereum (ETH) has topped the market with a derivatives flush of almost $200 million, while XRP has come second with liquidations of $115 million. Despite the fact that Bitcoin hasn’t actually moved much in the past day, users have still managed to rake up $84 million in liquidations. Solana (SOL) and Dogecoin wrap up the top 5 with figures sitting at $58 million and $56 million, respectively.

The mass liquidation event from the past day may be a product of overheated conditions that had already been brewing in the sector. As on-chain analytics firm Glassnode has revealed in its latest weekly report, the Open Interest across the top altcoins has seen a significant increase since the start of July.

The “Open Interest” here refers to an indicator that keeps track of the total amount of futures positions related to an asset that are currently open on all centralized exchanges. As shown in the chart, the metric’s combined value for Ethereum, Solana, XRP, and Dogecoin sat at $26 billion at the start of the month, but it has now grown to $44 billion.

Historically, an excess of leverage has often led to volatility for the market, so the latest squeeze could just be this effect in motion.

XRP Price

At the time of writing, XRP is floating around $3.17, down 4% in the last week.