Crypto news today reflects a sharp downturn triggered by rising global tensions and unexpected policy moves. The Bitcoin price plunged below $101,000 for a moment, and ETH USD sank under $3,300 before slowly climbing back to $3,800 amid a wave of liquidations. This came right after a dramatic announcement of new China tariffs from the one and only US President, the big Donald Trump. The US requires 100% duties on Chinese tech imports, which intensified risk-off behavior across both crypto and equities.

BREAKING:

President Trump to impose 100% tariff on China starting November 1st. pic.twitter.com/eBCzqjqIhh

— Watcher.Guru (@WatcherGuru) October 10, 2025

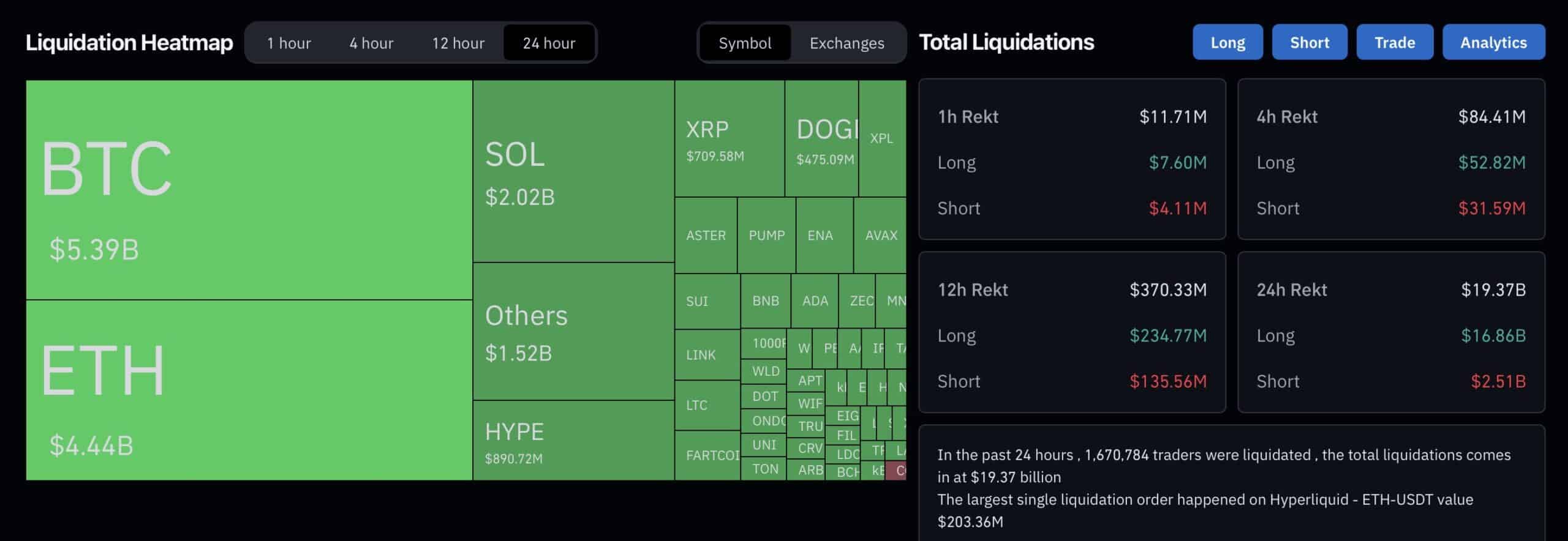

According to CoinGlass, over $19 billion in crypto positions were liquidated within 24 hours—more than what was seen during the FTX collapse or even the Covid crash. CoinGecko reports that roughly $200 billion was wiped from the total crypto market cap before a slight recovery to $3.83 trillion.

Covid crash: $1.2B in liquidations

FTX crash: $1.6B in liquidations

Today: $19.31B in liquidations

You wished you bought during the COVID crash.

This is your COVID crash. pic.twitter.com/OnmNY7e86s— Quinten | 048.eth (@QuintenFrancois) October 11, 2025

Bitcoin Price Resilience Tested by China Tariffs and Liquidations

Despite the chaos, Bitcoin price rebounded above $110,000, signaling strength in the face of macro pressures. CoinGlass shows that BTC long liquidations alone totaled $5.39 billion, while ETH saw $4.44 billion in similar losses.

(source – Long Liquidation, Coinglass)

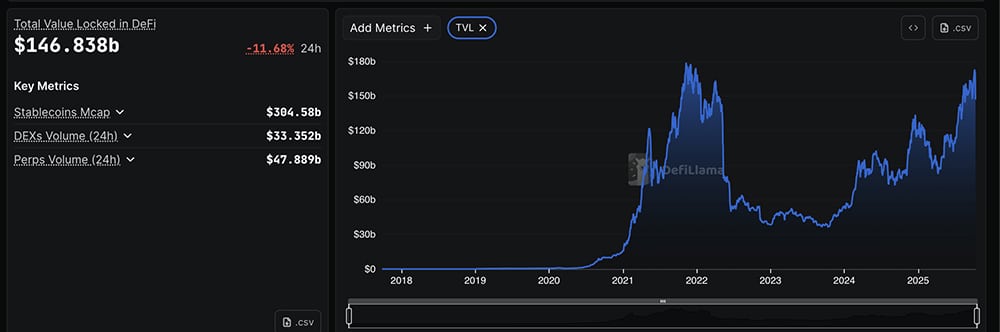

Meanwhile, DefiLlama data indicates DeFi TVL has dropped to $147 billion, down 11% in 24 hours. Yet, perpetual futures volume rose 24% this week, a big evidence that traders are still around, adapting.

(source – Defi TVL, Defillama)

With Bitcoin dominance holding steady at 58% , crypto markets appear shaken, with some calling that more pain is expected in the next week. ETH USD, though down, has recovered to above $3,800, still more than 3x from the bottom of $1,200 in bear 2-3 years ago. This event was a big sell-off following a macro spillover. The big dump is largely fueled by rising yields and China tariffs, rather than an internal crypto issue. It was not a black swan crypto event like the FTX collapse.

DISCOVER: 16+ New and Upcoming Binance Listings in 2025

ETH USD Recovery and Potential Altcoin Rotation

ETH USD fell 13% on the day, yet has already bounced back 12% from the lows. Historical seasonality, often dubbed “Uptober,” still holds with two green days logged this week. If past cycles are any guide, meme coins and smaller altcoins may soon see inflows once the panic settles. Yes, this kind of market movement was seen a lot during 2012-2016.

Lmao funniest thing is this kind of crypto price action was completely normal from 2012-2016

Almost a weekly occurrence.

Be grateful

— Crypto Bitlord (@crypto_bitlord7) October 10, 2025

DefiLlama reports $47 billion in daily perpetuals volume and $33 billion in DEX trading as another sign that crypto interest hasn’t vanished. With ETH USD climbing and Bitcoin price stabilizing, the market could be setting up for a rotation phase.

Most crypto news today may look grim, but deeper analysis proves this is a macro shakeout, not a structural failure. As China tariffs shake global sentiment, crypto’s next leg higher may only be a dust settling away.

Stay strong, hold spot, and chill. Leveraged trading is easily manipulated. Exchanges won’t give their money for free. Today might be the time for shopping.

DISCOVER: 9+ Best Memecoin to Buy in 2025

Join The 99Bitcoins News Discord Here For The Latest Market Updates

Crypto Crash Wipes $20B as Ethena USDE Depeg Revives LUNA Flashbacks

What a night for the market. The latest crypto crash has become one of the most severe in digital asset history, erasing nearly $19.37 billion in leveraged positions within 24 hours and briefly causing the Ethena USDE depeg.

Although the stablecoin has since returned close to $0.99, the event revived memories of past collapses such as LUNA’s UST and FTX, reminding traders how fragile stability can be in extreme market conditions.

Read the full story here.

PepperFest Hits 1 Year Anniversary: How High Will CHZ Price Climb in Q4

Chiliz turns up the heat: PepperFest’s first birthday brings rewards, contests, and a major community burn as CHZ price trades near weekly lows.

Chiliz, the sports blockchain behind CHZ and Socios.com, launched PepperFest on Friday, October 10, marking the first digital anniversary of its community token, PEPPER.

The two-week campaign runs through October 24 across the project’s social and community platforms. It features a surprise airdrop for stakers, a “raid-to-earn” event, creator bounties paid in CHZ, and a community-driven burn that could remove up to one trillion PEPPER from circulation.

The launch comes as CHZ trades between $0.039 and $0.042, hovering near its weekly lows in a choppy crypto market.

According to Coingecko data, CHZ is trading around $0.0393, with a 24-hour range of $0.0391-$0.0421 and trading volume near $88M.

(Source: Coingecko)

Read the full story here.

Crypto Down But Solana Treasuries Expanding: 3 Best Solana Meme Coins to Buy

Institutional money keeps building in Solana even as the broader crypto market cools, putting fresh focus on the chain’s most liquid meme-coin trades.

A newly rebranded public company focused on Solana (ticker: HSDT) said Friday it added Coinbase, BitGo, and Anchorage Digital as custodians while continuing to build a SOL-denominated corporate treasury.

The move, announced at 8 a.m. ET release, highlights how institutional infrastructure around Solana is expanding at a time when crypto prices have softened over the past 24 hours.

Read the full story here.

Will STBL USDY Pick Trigger Major ONDO Crypto Price Breakout?

A $50 million mint window just opened for a new dollar-pegged stablecoin, and traders wonder if that’s the push ONDO crypto needs.

STBL.com, the platform behind the USST dollar token, said Friday it picked Ondo Finance’s USDY as its main collateral, allowing up to $50 million in new USST issuance.

The partnership, announced Oct. 10 across hubs in Dubai, London, and New York, shows STBL’s plan to expand its dollar liquidity using tokenized US Treasuries as backing.

Read the full story here.

The post Crypto Market News Today, October 11: What Just Happened to Crypto? Bitcoin Price Tanking, ETH USD Under $4K, More Pain Coming? More China Tariffs? appeared first on 99Bitcoins.