If the crypto market feels a little quieter lately, it’s not just you. According to Coinbase’s April 2025 Monthly Outlook, the numbers confirm what many traders and builders have sensed: we’re deep in a cooldown. However, there could be a crypto rebound later this year.

The altcoin market cap—that’s everything except Bitcoin—has dropped about 41% since December, falling from $1.6 trillion to around $950 billion. Ouch. It’s not quite full meltdown territory, but it’s a hefty comedown testing patience across the board.

New Coinbase report!

Crypto entering bear territory with total market cap down 41% from December peak. COIN50 index below 200-day MA signals continued weakness. But potential stabilization late Q2, recovery in Q3 possible if global conditions improve#CryptoMarkets pic.twitter.com/rdiwvNjhbh

— NeomaVentures (@NeomaVentures) April 16, 2025

And it’s not just prices. Venture capital funding, the lifeblood for startups building in the space, is also down. Compared to the 2021–2022 peak years, VC interest has plummeted by 50–60%. Why? Mainly because the macro environment is messy. Inflation, rate changes, geopolitical tensions, and lingering fear that the other economic shoe could drop have made investors skittish. The result? Fewer checks, slower rounds, and a lot of “let’s wait and see.”

Indicators of Market Sentiment

Coinbase’s head of research, David Duong, isn’t sugarcoating it. He says the data shows we’ve entered a neutral-to-bearish market, and that the bull run likely topped out in February. That timing lines up with many traders asking, “Wait… was that it?”

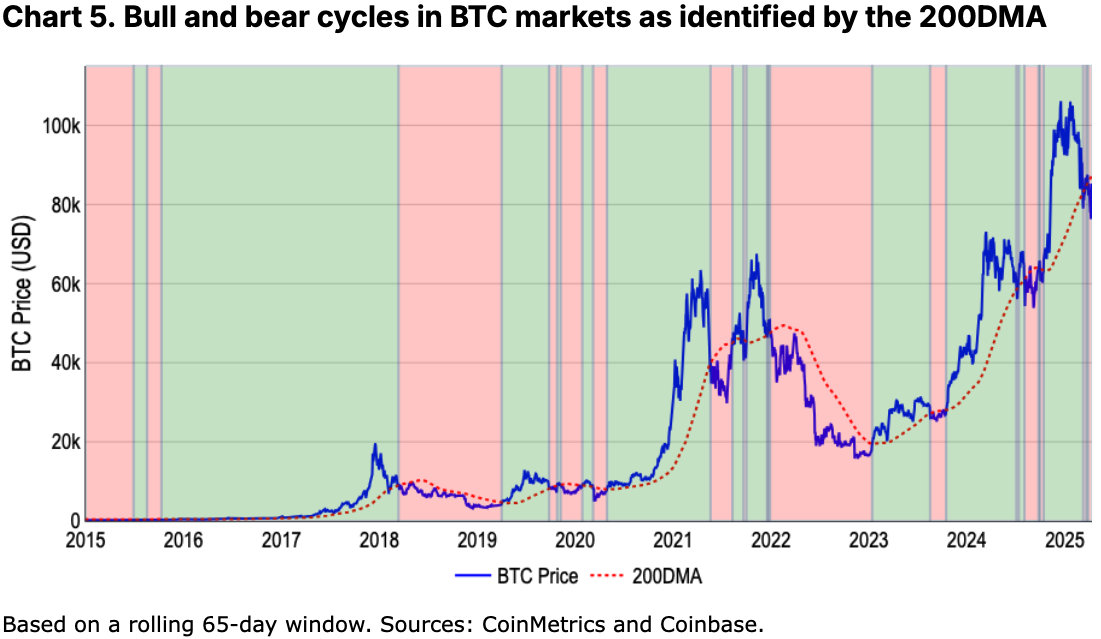

He points to a few key indicators, including the 200-day moving average, which showed that between November 2021 and November 2022, Bitcoin dropped a lot, about 76%, but when you adjust for risk, that drop was similar to the S&P 500’s 22% decline.

In other words, both had big moves relative to what’s normal for them, even if the percentages look very different.

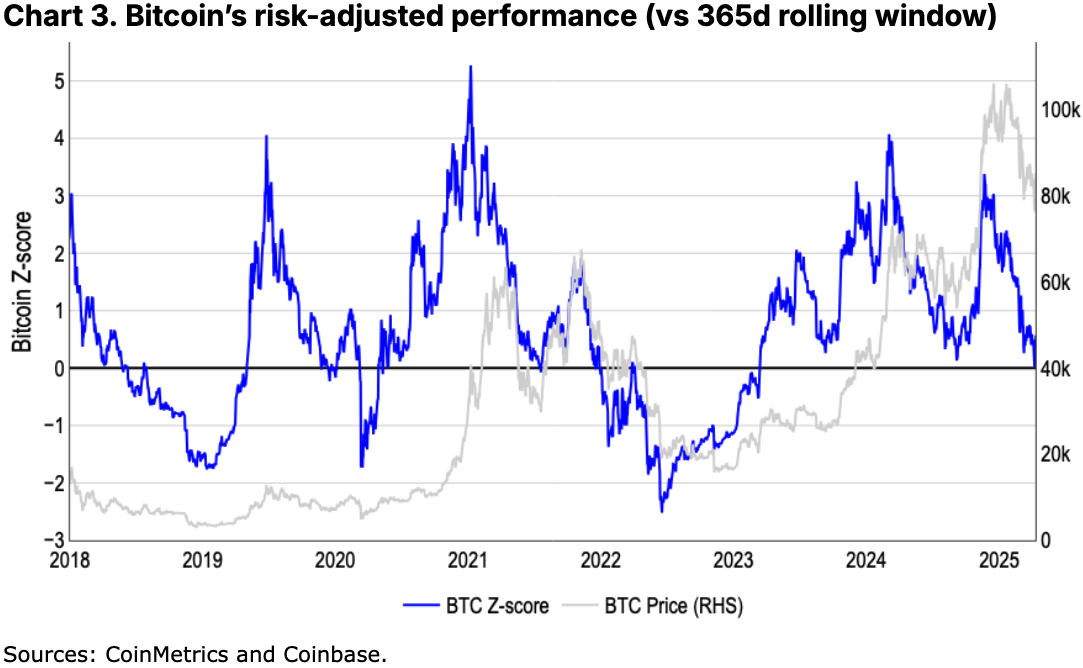

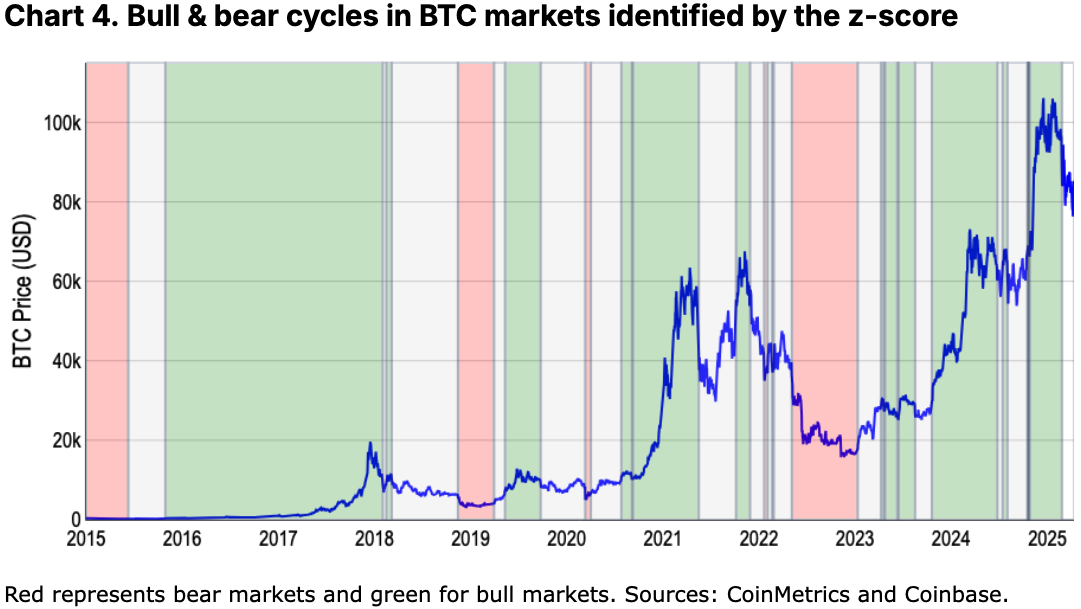

Another metric that was examined was the Bitcoin Z-score (which basically measures how extreme current prices are compared to historical norms). Both are flashing yellow, not red, but definitely not green.

Z-scores work well for crypto because they adjust for how wild the price swings can be, but they’re imperfect. They’re a bit harder to calculate and don’t always pick up on trends quickly, especially in calmer markets. For example, the model showed the last bull run ended in late February, but since then, it’s called everything “neutral,” which shows it can lag behind when the market shifts fast.

So yeah, it’s fair to call this moment what it is: a pause, a reset, maybe even the early days of another “mini crypto winter.”

DISCOVER: Best New Cryptocurrencies to Invest in 2025

Potential for Crypto Rebound in the Second Half of 2025

But, and it’s a big but, Duong also sees light at the end of the tunnel. While Q2 might be bumpy, Q3 could look very different.

Why the optimism? According to Coinbase, these types of pullbacks can be healthy. They shake out the noise, reset valuations, and cool down overheated sentiment. And once sentiment bottoms out, a rebound can hit fast and hard, especially if the macro picture improves or new narratives kick in.

That’s not a promise, of course. But it is a reminder that crypto’s cycles are cyclical. Things go down, but they often come back stronger.

Right now, the market is taking a breather. Prices are down, funding is tighter, and many investors are on the sidelines. But as Coinbase points out, that doesn’t mean it’s game over. These pauses often lay the groundwork for the next wave, especially if confidence returns and macro headwinds calm down.

So, whether you’re building, investing, or just watching from the sidelines, keep an eye on the second half of 2025. There could be a crypto rebound and the market might surprise you, again.

DISCOVER: 20+ Next Crypto to Explode in 2025

Join The 99Bitcoins News Discord Here For The Latest Market Updates

Key Takeaways

- Altcoin market cap has dropped 41% since December 2024, falling from $1.6 trillion to around $950 billion.

- Venture capital funding in crypto is down 50–60% from peak levels, as investors navigate macroeconomic uncertainty.

- Coinbase research suggests the market is in a neutral-to-bearish phase, with indicators like the 200-day average and Bitcoin Z-score flashing caution.

- Despite the downturn, Coinbase sees potential for a Q3 rebound, noting that cooldowns often reset valuations and sentiment before recovery.

- While Q2 may remain choppy, the second half of 2025 could mark the start of a new wave—if macro conditions stabilize and new narratives emerge.

The post Crypto Market Slumps 41%, But Coinbase Sees Q3 Comeback appeared first on 99Bitcoins.