Investors have flocked to crypto mining stocks—think Marathon Patent Group, Riot Blockchain, and SOS Ltd.—as a way into the booming cryptocurrency market. But is mining the better play, or does direct investment win out? Here’s the breakdown.

When Bitcoin started, anyone could mine with an average laptop. But as the network expanded, the calculations required to mine new blocks became too complex for basic machines.

Why Are Crypto Mining Stocks Valuable?

Today, mining Bitcoin is a whole different ball of wax… that’s a gross metaphor. It demands high-tech hardware called ASIC miners, or what most call “mining rigs.”

The best rigs use the newest, highest-powered GPUs, making hot items like Nvidia’s 2080s and 3080s scarce and pricey.

The No.1 Reason to Invest In Crypto Mining Over BTC

While retail investors in most jurisdictions can buy crypto for themselves, the situation is different for big banks, investment companies, insurance firms, hedge funds, etc.

Since crypto is a new industry, many countries lack a legal framework allowing companies to invest in cryptocurrencies in a regulated way. Sometimes, these stocks are also positioned to outperform Bitcoin.

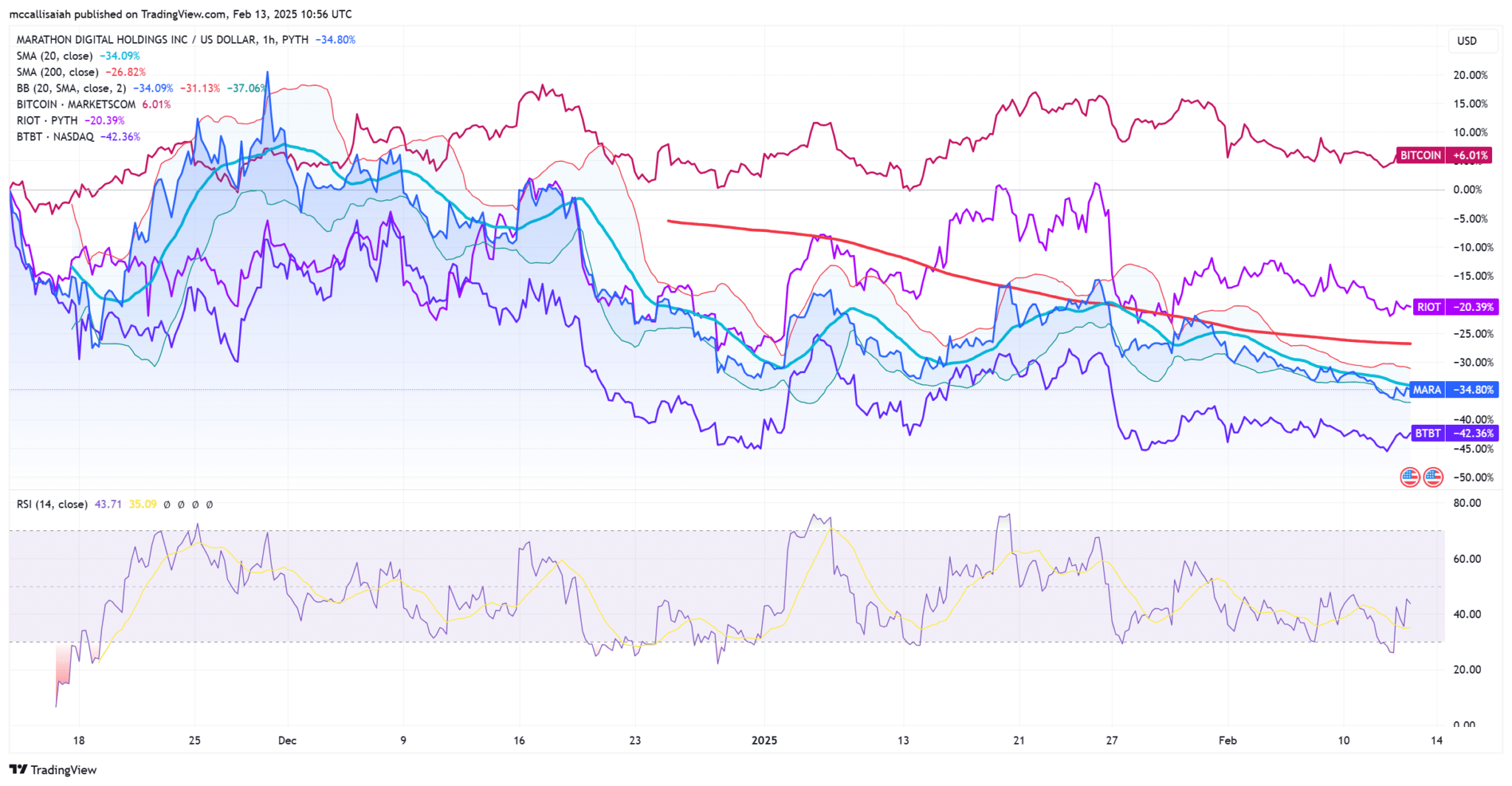

While stocks like RIOT and MARA are directly tied to the price of Bitcoin, they also have their own metrics for success, including total BTC mined and eco-friendly production plants.

Keep Your Eye On These Three Stocks

- Riot Blockchain (RIOT): Running its operations deep in the heart of Texas, it remains a top mining stock in 2025. It’s not the biggest by market cap, but the name holds sway in most households dabbling in crypto investments.

- Marathon Digital Holdings (MARA): Conversely, leads the pack with an energized hash rate of 53.2, outpacing Riot and securing its dominance in hash power.

- Bit Digital (BTBT): Meanwhile, New York City-based Bit Digital (BTBT) made waves in 2020, consistently outperforming Bitcoin’s price growth quarter after quarter.

Under Trump, North America is primed to become a hub of crypto mining, which is why mining stocks are continuing to thrive.

EXPLORE: 15 New & Upcoming Coinbase Listings to Watch in 2025

Join The 99Bitcoins News Discord Here For The Latest Market Updates

Key Takeaways

- Crypto mining stocks shouldn’t be considered competition or a replacement for cryptocurrencies.

- Rather they can be considered a supplementary asset with important use cases.

- Stocks like RIOT, MARA, and BTBT are worth looking into if you want to invest outside Bitcoin and traditional coins.

The post Crypto Mining Stocks Vs Bitcoin: Why Not Both? appeared first on 99Bitcoins.