Throughout October, Bitcoin’s (BTC) price action has seen a constant tug of war between bullish sentiments on the back of institutional interest and cautious profit-taking. Earlier this month, BTC made its all time high (ATH) at $126,198, driven by a strong demand for BTC ETFs and a weakening dollar. In latest crypto news updates, its price action is consolidating jut above $112,400. Can it retest its ATH? Let’s find out.

Looking back, mid-October, BTC’s price action saw a strong pullback, slipping below $105,000. Emotions were running high, with some traders thinking of this as a potential bottoming of its price. But as we have witnessed time and time again, BTC is resilient.

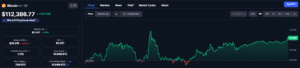

Since the major liquidation event on 10 October, BTC has clawed its way back. Currently trading at

, it has held steady above $111,000, slightly below its monthly average of $115,000.

For now, all eyes are on its price action as traders wait for a decisive breakout for BTC to continue its upward momentum. Now that BTC has breached $112,000 holding above it would clear its path to test $115,000.

$BTC BULLISH BETS SURGE!

$7.8 BILLION in #Bitcoin LONG positions are now stacked and ready to squeeze shorts. pic.twitter.com/ZQ1P9xcvqm

— Coin Bureau (@coinbureau) October 26, 2025

However, a slide down from its current position will test the support at $107,535. If this level fails to hold, the next level to watch out for is at $105,600.

(Source: CoinMarketCap)

At the same time, major BTC proponents have maintained their bullish outlook on the crypto king. In a recent interview with Anthony Pompliano, BitMine’s CEO, Tom Lee said that the long term value of BTC could hit $2 million per coin if it can achieve parity with Gold’s market capitalization.

Meanwhile, Strategy CEO Michael Saylor has projected BTC to reach $21 million per coin in the next 21 years.

EXPLORE: Top Solana Meme Coins to Buy in 2025

Crypto News Updates: BTC Price Action At Daily Resistance, $115K Retest On The Cards?

For now, BTC is consolidating in a symmetrical triangle, a signal that a big power move is on the horizon. On the 4-hour chart, its price action is tightening between its support at $107,535 and a resistance at $114,094.

(Source: TradingView)

At the same time, its price action has re-captured its 50-day EMA at $111,523 and the Relative Strength Index (RSI) reads at 59, indicating an improving bullish sentiment without entering the overbought territory.

If the BTC closes above $114,000, $117,000 and $120,000 won’t be too far away, along with a potential move till $125,000.

$BTC UPDATE

Plan’s simple

We’re currently right at the daily resistance.

If $BTC pumps above it and builds support, the next target is around $113.6K–$114.4K.

However, that zone will also act as a strong resistance.

If it breaks and holds above, we could be heading toward… pic.twitter.com/4f2G0WFnzJ— Crypto Spotter (@CryptoSpotter05) October 26, 2025

However, it is all contingent on BTC holding firm above $111,000.

Despite $40 million in liquidations that flushed out leveraged traders, BTC’s bigger picture, based on fundamentals including, clearer regulations, growing institutional lending and easing inflation support its near term recovery.

EXPLORE: The 12+ Hottest Crypto Presales to Buy Right Now

ISM Data Suggests That Bitcoin’s Market Cycle Might Outlast Expectations

Bitcoin’s current market cycle could be longer than expected and the US manufacturing data might be the reason.

An analyst named Colin Talks Crypto, in his analysis pointed out to the ISM Manufacturing PMI. This indicator measures how well the US factories are doing.

Historically speaking, BTC has usually peaked when this index has risen above 50, signaling growth in manufacturing. Meaning, BTC’s peak and the ISM Manufacturing PMI have moved in tandem.

This time however, the PMI has stayed below 50 for seven straight months, meaning the sector is still shrinking. If history was to repeat, BTC will not hit its peak till manufacturing starts to recover.

Is the ISM (aka "business cycle") going to be correlated with the next $BTC top?

If so, it would indicate a considerably longer cycle than bitcoin cycles typically run for. Such an extension would be an outlier amongst traditional measurements of bitcoin cycles. Because of this… https://t.co/DJ0MAFO52y pic.twitter.com/OFFa35wxVb

— Colin Talks Crypto

(@ColinTCrypto) October 24, 2025

Why this matters? Well, because when the economy picks up and factories are busy, investors usually take on more risks, which often leads to more money flowing into assets like crypto. But because of weak demand and high costs, the recovery signal hasn’t shown up yet.

That being said, manufacturing in the US isn’t as big as it used to be, therefore this indicator might not be as reliable as before.

A low PMI doesn’t guarantee a recession or a longer bull run, but it’s still worth watching.

Crypto Trader Nets $17M on BTC & ETH Rebound

A crypto trader known as 0xc2a earned $17million in profit by going long on BTC and ETH during October’s dip and rebound.

When BTC dropped below $105,000 mid-October, the trader accumulated long positions anticipating a recovery, that soon followed with BTC and ETH rising 4% and 2% respectively.

According to Arkham Intelligence and Lookonchains’s data, the trader’s wallet (0xc2a) now holds 1,483 BTC ($165 million approximately) and 33,270 ETH ($131.3 M), totaling nearly $300 million in active long positions.

THIS GUY IS UP $17 MILLION IN 2 WEEKS

Trader 0xc2a opened his Hyperliquid account only two weeks ago and he is already up $17 MILLION.

His current positions? Long $131M $ETH and $155M $BTC. pic.twitter.com/IUQr6hLgkn

— Arkham (@arkham) October 25, 2025

Notably, the account has maintained a 100% win rate with no recorded losses.

EXPLORE: Next 1000X Crypto – Here’s 10+ Crypto Tokens That Can Hit 1000x This Year

Whale Alert: $356M In BTC Accumulated Under Five Hours

A whale bc1qd3, just bought more than $356.6 million in BTC within five hours in one of the biggest single-address buys in recent months.

The massive purchase fits a broader narrative of whales moving BTC off exchanges and into private wallets, strategically accumulating in this current phase of market uncertainty.

Whale bc1qd3 has accumulated 3,195 $BTC($356.6M) in the past 3 hours.https://t.co/huOxKK9ANP pic.twitter.com/H5nNUyumm3

— Lookonchain (@lookonchain) October 26, 2025

In the meantime, mid0sized whales are also buying aggressively, showing growing positive sentiment of a potential price rebound.

The post Crypto News Updates: BTC Claws Back And Holds Above $111k, Is $115k Retest On The Cards? appeared first on 99Bitcoins.