Binance co-founders Changpeng ‘CZ’ Zhao and Yi He, through their YZi Labs investment firm, have confirmed that they will back 10X Capital (VCXA) in a new endeavour. The publicly traded investment company aims to establish a US-based firm that will invest exclusively in BNB.

YZi Labs, which holds around $10 billion in assets under management (AUM), will “support” 10X Capital in establishing the BNB treasury company, 10X Capital said in a statement.

BNB meets Wall Street.

YZi Labs is officially supporting @10XCapitalUSA to develop the BNB Treasury Company.

U.S. investors now have a gateway for BNB’s growth.

YZi Labs champions BNB as a treasury asset, and chooses our partners with care.

Rely only on our official channels… https://t.co/4zEGKki0ve

— YZi Labs (@yzilabs) July 10, 2025

CZ’s YZi Labs Backing 10X Capital In Its BNB Treasury Strategy

10X Capital announced today that it is launching the first US-based, publicly traded company that will exclusively focus on being a BNB Treasury, similar to Strategy with Bitcoin and Sharplink Gaming with Ethereum.

The endeavour is being supported by YZi Labs, the investment firm of Binance co-founders CZ and Yi He, and will be headed up by Russell Read, CIO of 10X Capital; David Namdar, co-founder of Galaxy Digital; and Saad Naja, former director of Kraken Exchange.

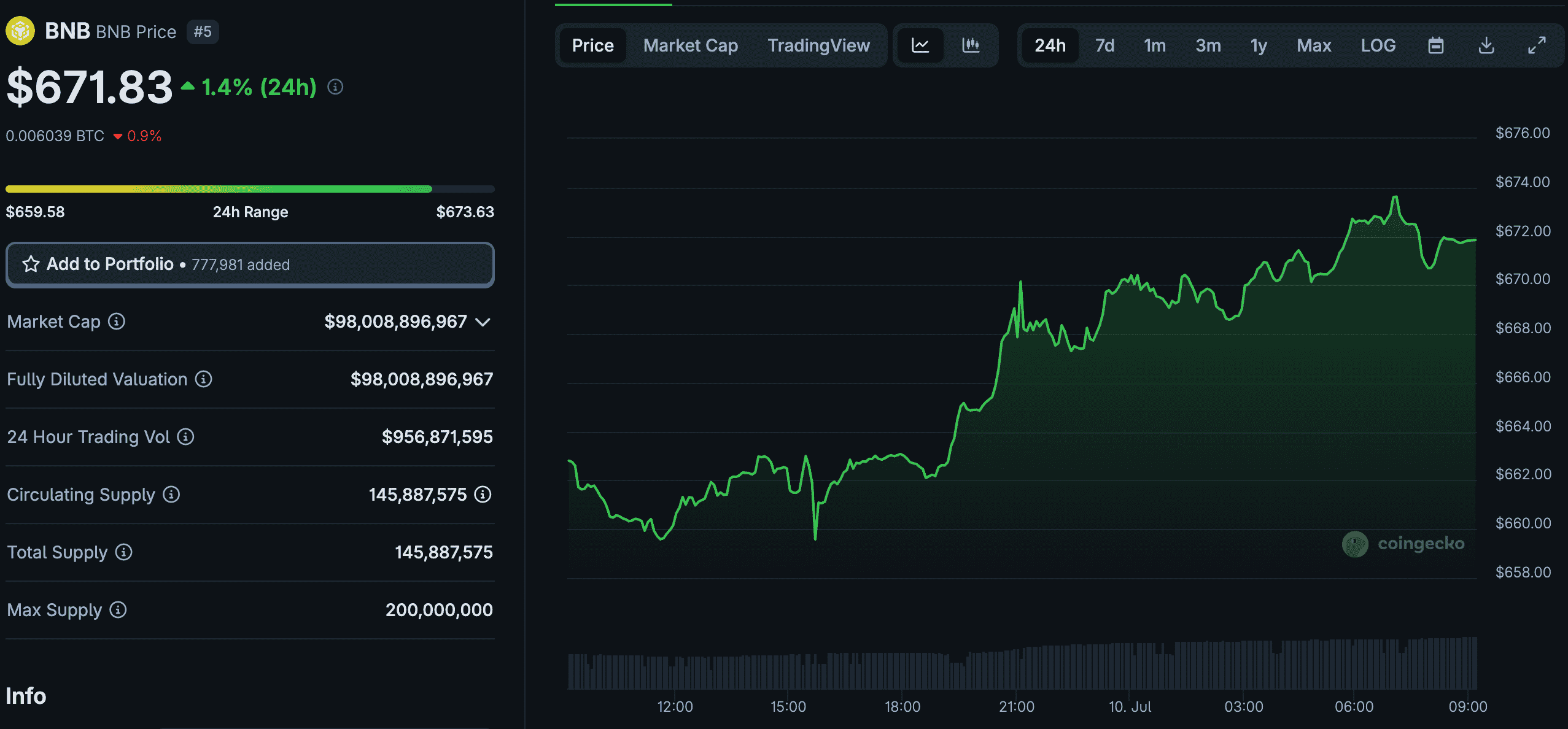

10X Capital intends to pursue a public listing on a major U.S. stock exchange for its BNB Treasury firm, marking a first-of-its-kind move. The BNB token is the fifth-largest digital asset by market cap, currently valued at $98 billion and trading for around $671.

On the announcement, Head of YZi Labs, Ella Zhang, said, “BNB Chain is one of the most widely adopted blockchain ecosystems. BNB is the gas, the glue, and the governance layer for a scalable, decentralized future — powered by builders, for builders, and we believe expanding its institutional access can deliver meaningful benefits to the broader public.”

Per the statement, 10X Capital state that the BNB Treasury Company will emphasize transparency and verification of holdings, strong engagement with the BNB ecosystem and community, and expects to announce the closing of its related financing in the coming weeks.

DISCOVER: Best Meme Coin ICOs to Invest in July

10X Capital Following Michael Saylor’s Strategy Playbook With The First BNB Treasury Firm

The newly established company will focus exclusively on the BNB Chain ecosystem, according to the 10x Capital statement, referring to the blockchain that supports the BNB token, following Saylor’s blueprint for publicly traded companies pivoting to digital asset treasury firms.

We now have Sharplink Gaming (SBET), an Ethereum Treasury firm and DeFi Dev Corp (DFDV), which recently adopted a Solana Treasury strategy, with both companies trading on the NASDAQ.

There is also a growing movement of smaller, struggling firms pivoting to a crypto accumulation strategy to try and reverse poor share price performance, with one of the more quirky examples being Spanish coffee chain, Vanadi – it began accumulating 1 BTC a day recently, with aspirations to raise $1 billion to purchase more Bitcoin.

(SOURCE)

Since the coffee chain made its plans public and began buying 1 BTC each day, its share price has surged by over 135% and is up by more than 430% in the past six months, highlighting the early success of its Bitcoin accumulation strategy.

This is a fast-emerging trend for publicly traded companies, both big and small, indicating that institutional adoption of digital assets is here to stay and has become a viable investment strategy following years of scepticism and ridicule.

BNB Only Up 1.5% On The News: Is A New All-Time High On The Way?

While BNB is only up 1.5% following the 10X Capital announcement, it is holding incredibly strong above the $645 level, currently trading at around $670. It is just 15% away from a new all-time high, which came in December 2024 when BNB hit $788.

For a long time, $1,000 has been the psychological target for BNB investors, with many believing it is a formality; this bull market could finally deliver on those longstanding price targets.

BNB has just broken out of an ascending triangle zone at $665, and there is no actual resistance level now until $735, meaning a 10% move in the short term is looking more likely for the fifth-largest digital asset.

The fundamentals are all lining up for an explosive breakout for BNB, most notably the BNB Treasury plans from 10X Capital and YZi Labs. A Saylor-style strategy for BNB, backed by CZ and the broader Binance leadership, will surely create a fresh wave of institutional demand for the token as we head deeper into this bull market.

EXPLORE: 10 Best AI Crypto Coins to Invest in 2025

Join The 99Bitcoins News Discord Here For The Latest Market Updates

The post CZ and YZi Labs Backing Brand New US-Based BNB Treasury Company appeared first on 99Bitcoins.