Interest in wine and spirits investment is rising across Southeast Asia, and Decant Group is strengthening its position in Singapore to meet this demand.

The company’s digital platform, Decant Index, allows users to build and manage collections of investment-grade wine and spirits with portfolio tracking, verified storage and institutional oversight.

Over $126 million in assets are now stored through the platform. More than 44,000 users worldwide use Decant Index to monitor portfolio performance and market trends via a centralized digital dashboard. This model is helping turn fine wine and spirits into accessible, structured financial products for a growing pool of investors.

Rising Demand in Singapore Drives Regional Expansion

Singapore has become one of Decant’s fastest-growing markets. The company is setting up a local office and team in response to strong regional uptake. Professionals and collectors alike are allocating capital to wine and spirits, attracted by the blend of cultural relevance, physical ownership, and asset stability.

Minimum investment begins at $2,500. Since launch, Decant Index has supported over 1,600 successful exits and returned more than $6.1 million to investors. Most users are new to the category. Decant’s integrated platform offers them digital tools and guided insights that simplify asset selection and management.

Each product on the platform includes key details such as origin, production method, market history, and projected performance. Portfolios can include fine wine labels and premium spirits, offering both long-term growth potential and diversification.

Meeting the Needs of International Investors

In 2024, Decant Group opened Decant Bond in Alloa, Scotland. The warehouse, fully licensed and audited by HMRC, features climate controls and 24/7 security. Assets purchased through the platform are held at the facility, which connects directly to the digital system.

Users can access updated condition reports, valuation data, and logistics information through the app. This infrastructure is especially valuable to international users, who benefit from trusted physical custody without operational burden.

Subscriptions are also gaining traction. Decant’s Wine Cellar Plan, which starts at $330 per month, gives users access to rotating selections of fine wine. Each subscription is backed by bonded storage and integrated tracking, mirroring the experience of investing through the main platform.

House of Decant – Adding New Channels and Expanding Reach

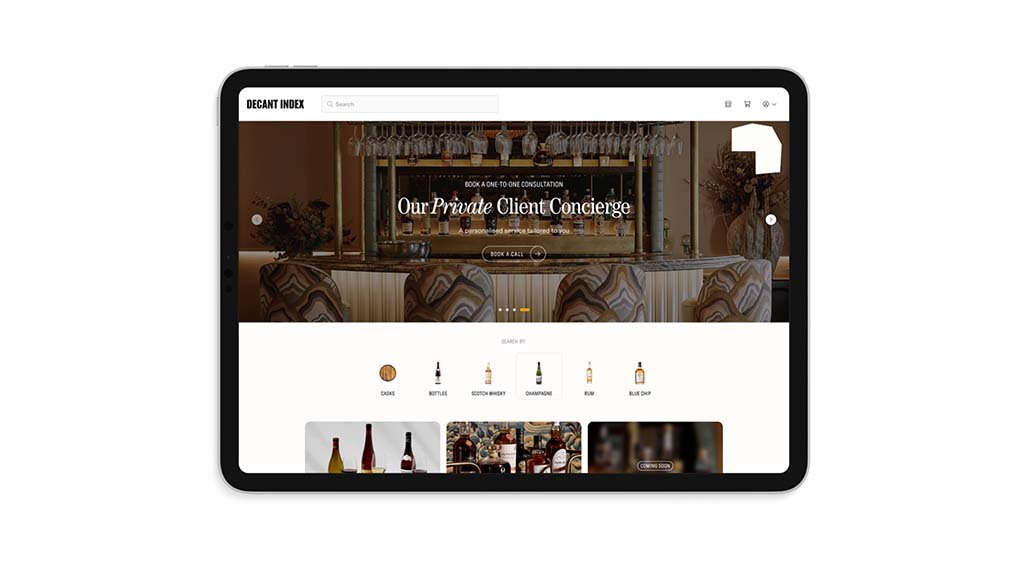

Decant Group is preparing to launch House of Decant, an e-commerce channel for collectable bottles. The online store will offer premium selections, fast delivery, and concierge-style customer service. It is designed to complement the firm’s investment platform while also reaching a broader audience.

Chris Seddon, managing director at Decant Group, said the company is focused on adapting to evolving consumer expectations. “We are building a platform that changes how premium wine and spirits are discovered, purchased and enjoyed—designed for what today’s luxury consumer expects.”

Learn more about what House of Decant has to offer here.

Product offerings have also widened. While wine and traditional spirits remain central, Decant Index now includes super-premium American Bourbon and premium rum. In 2023, sales of super-premium American Bourbon grew 17.8 percent, according to the Distilled Spirits Council. Decant is incorporating U.S. and Caribbean labels into its portfolio categories to reflect this growing demand.

Premium rum has seen increased interest among European and North American collectors. It fits into portfolios for those seeking to diversify while staying within the fine beverage category.

Positioning for Southeast Asia’s Investment Shift

Singapore is emerging as a key region for fine beverage investment. Rising demand, combined with Decant Group’s secure infrastructure and product transparency, has helped move the sector beyond traditional collectors. More investors are looking to tangible assets that combine cultural appeal with measurable financial performance.

Decant’s expansion in the region signals a broader shift toward structured ownership models in fine wine and spirits. Users value the balance of heritage and precision, and are responding to platforms that can deliver both. With a presence now in Singapore and operations expanding, Decant Group is positioned to serve a growing segment of international investors.

Disclaimer: This is an article written by Decant Group, Fintechnews does not endorse and is not responsible for or liable for any content, accuracy, quality, advertising, products or other materials on this page. Readers should do their own research before taking any actions related to the company. Fintechnews is not responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in the press release.

Please note this is no investment advice.

Featured image Courtesy of Decant Group