Deutsche Bank warns of a USD collapse due to tariffs and geopolitical shifts. Bitcoin could surge as a safe-haven asset, with BTCUSD rising to fresh highs.

The world is closely watching U.S. tariff policies. If these policies falter, Bitcoin and other best cryptos to buy could face challenges in a risk-on environment. With focus on Donald Trump, Deutsche Bank strategists believe the world is in the early stages of a major geopolitical and financial shift that could significantly impact global markets, directly benefiting Bitcoin and alternative assets.

(BTCUSDT)

Explore: 9+ Best High-Risk, High–Reward Crypto to Buy in April 2025

Deutsche Bank Says USD Under Threat

In a note to clients, George Saravelos, head of FX Research, warned that the USD’s role as a reserve currency and safe haven is under threat. Alongside strategist Tim Baker, Saravelos intensified these concerns, citing a cascade of structural changes in U.S. financial and economic policy that could lead to a “megashock” in global markets.

This potent combination of tariffs, which now defines U.S. trade with the rest of the world, growing political instability, and the U.S. reassessing its global leadership could fuel a sustained downtrend in the dollar. “The preconditions are now in place for the beginning of a major dollar downtrend,” Saravelos and Baker declared.

Analysts worry that high U.S. tariffs will increase business costs, especially for firms reliant on imported goods or raw materials, forcing these costs onto consumers. This creates an inflationary environment, exacerbated by the Trump administration’s increasingly confrontational trade policies.

https://twitter.com/relai_app/status/1910638139707699453

Worse, high tariffs, particularly with China, are likely to persist, as Treasury Secretary Scott Bessent indicated a comprehensive agreement could take years. This prolongs uncertainty and heightens volatility, slowing momentum of crypto prices, including those of the best Solana meme coins to buy in Q2 2025.

Moreover, due to Trump’s criticism of the Federal Reserve and Jerome Powell, the central bank may yield to political pressure and cut rates beyond the two projected reductions.

If they yield to pressure, high inflation and low borrowing costs could increase price pressures, pushing Bitcoin to new highs as investors look to protect their capital.

https://twitter.com/FedGuy12/status/1914293454114570619

USD Declines, Will Bitcoin Fly?

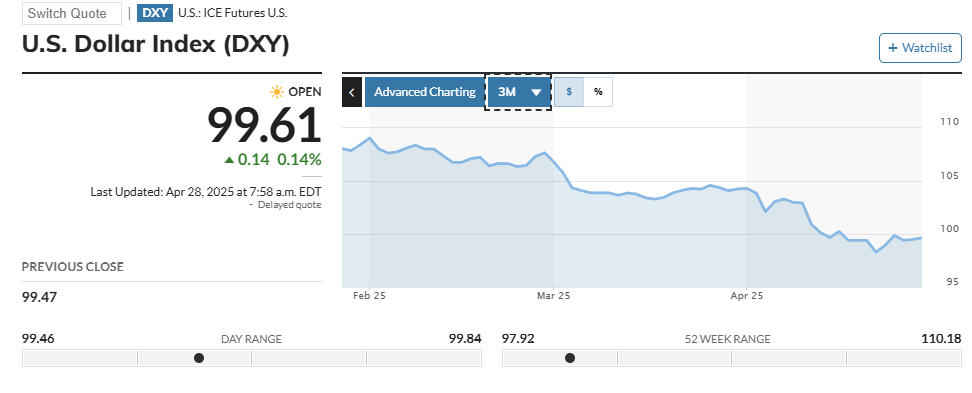

The USD Index is in a free fall, dropping below 100 to nearly 99 in April 2025. It is now down 8% from its 2025 highs.

(Source)

Goldman Sachs analysts forecast the greenback could lose nearly 10% against the euro, yen, and pound by year-end.

https://twitter.com/ceodotca/status/1915906196692754458

Amid U.S. trade wars, Goldman Sachs estimates a 45% recession risk, up from 35%. Tariffs, the bank noted, will erode citizens’ real income, squeezing an already fragile economy.

As the USD weakens, Jay Jacobs of BlackRock believes geopolitical fragmentation could create a “megaforce” shaping global finance for decades. In response, Jacobs added, investors will flock to decentralized, non-sovereign stores of value, particularly Bitcoin. Some of the best new cryptos to invest in in 2025, like Hyperliquid (HYPE), could soar as a result.

“Directly related to this geopolitical fragmentation is the rise of Bitcoin as people seek stability amid destabilization and demand alternative assets,” Jacobs observed.

He noted that Bitcoin is decoupling from tech stocks. It is presently trending on an uncorrelated trajectory as a safe haven and digital gold.

DISCOVER: 17 Next Crypto to Explode in 2025: Expert Cryptocurrency Predictions & Analysis

Deutsche Bank Predicts USD Decline, BTCUSDT To New Highs?

- Deutsche Bank and Goldman Sachs forecast USD decline due to Trump’s tariffs

- Analysts predict a “megashock” from U.S. trade wars and political instability

- High tariffs on China and beyond could raise consumer prices

- Trump’s criticism of the Fed may lead to aggressive rate cuts, weakening the USD

The post Deutsche Bank Warns of Geopolitical Fragmentation Megashock for BTCUSD as Trump Weakens Dollar appeared first on 99Bitcoins.