Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Dogecoin (DOGE) is facing a critical moment, having lost over 40% of its value since the start of March. The entire crypto market is under intense selling pressure, driven by macroeconomic uncertainty and heightened volatility. However, meme coins like DOGE have been hit the hardest, as bears continue to short them aggressively, pushing prices lower with no signs of relief.

Related Reading

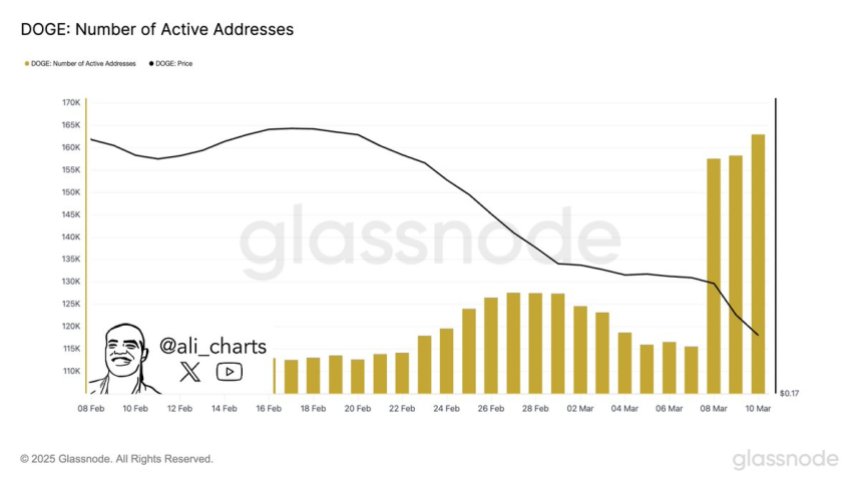

Despite the heavy downturn, on-chain data suggests potential signs of recovery. Glassnode metrics reveal that Dogecoin network activity is surging, with a 47% increase in active addresses over the past month. Historically, increased network usage and transaction activity can indicate renewed interest and potential accumulation by long-term holders.

If this trend continues, DOGE could see a rebound once market conditions start to improve. However, bulls still have a lot of work to do to regain lost ground and push Dogecoin back into a bullish trend. The coming days will be crucial, as traders closely watch whether network growth can translate into price stability or if further downside is ahead for DOGE and the broader meme coin sector.

Dogecoin Down 70% As Network Activity Shows Grows

Dogecoin has suffered a brutal sell-off, now trading 70% below its December high as selling pressure remains relentless. Meme coins, in general, have been the most affected assets in the market, as fear and speculation drive investors away from high-risk assets. With DOGE failing to find strong support, bulls have a lot of work to do before any meaningful recovery can take place.

Related Reading

The broader crypto market downturn has only added to the struggles. Bitcoin (BTC) has been in a downtrend since late January, and as fear continues to spread, investors are lowering their expectations and setting even lower targets. If this truly marks the end of BTC’s bull cycle, meme coins like Dogecoin will be among the hardest hit, as speculative assets tend to suffer the most in bearish conditions.

However, not all signals are negative. Analyst Ali Martinez shared on-chain data on X, revealing that Dogecoin’s network activity is increasing. Active addresses have surged by 47% in the past month, rising from 110,000 to 163,000. Historically, rising network activity has often preceded a recovery in price, as it indicates renewed interest and engagement in the ecosystem.

While DOGE still faces significant resistance, this spike in activity could be an early sign that buyers are returning. If Bitcoin stabilizes, the meme coin sector could see a relief bounce, potentially leading Dogecoin back toward key resistance levels. For now, DOGE remains under pressure, but its growing network activity provides a glimmer of hope for bullish traders watching for a turnaround.

Dogecoin Struggles At $0.17 As Bears Maintain Control

Dogecoin is currently trading at $0.17 after enduring massive selling pressure and a dramatic shift in market sentiment toward fear. The broader crypto market downturn has hit meme coins the hardest, with DOGE struggling to find stability amid relentless sell-offs.

For a potential recovery, DOGE must hold above the crucial $0.15 support level. If bulls manage to defend this zone, they could attempt a push toward the $0.20 mark, a key psychological resistance. Reclaiming $0.20 would signal a possible reversal, providing DOGE with the momentum needed to sustain a recovery rally.

However, if selling pressure continues and DOGE loses the $0.15 level, the situation could become even more bearish. A break below this support could trigger a further decline toward $0.10, a level that hasn’t been tested since early 2023.

Related Reading

With market sentiment still fragile, traders are closely watching whether DOGE can hold its current range or if more downside is ahead. The next few trading sessions will be crucial, as bulls must step in quickly to prevent another major drop.

Featured image from Dall-E, chart from TradingView