An analyst has pointed out three key resistance levels for Dogecoin that could be to keep an eye on, based on on-chain data.

Dogecoin URPD Shows These Price Levels Stand Out

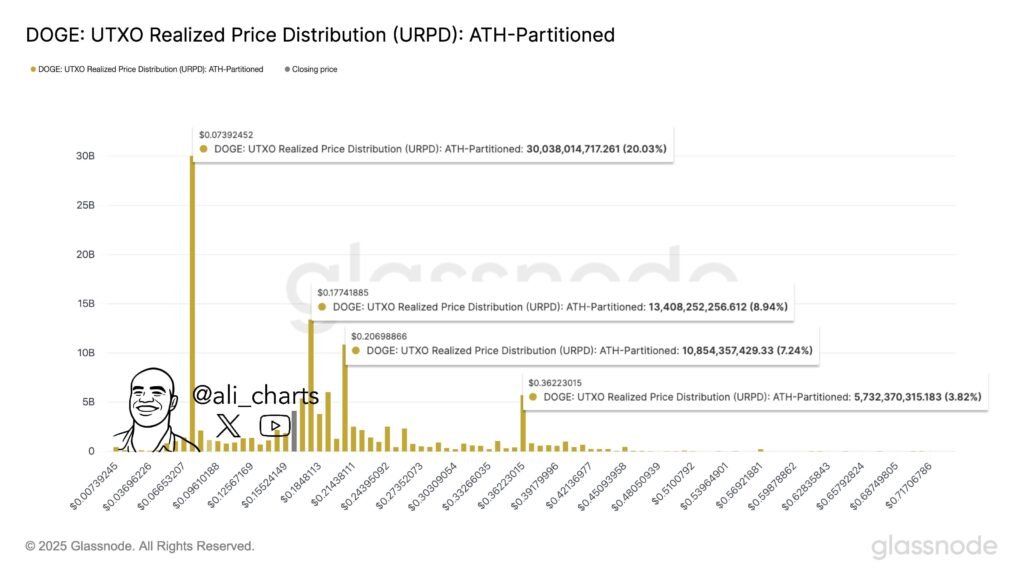

In a new post on X, analyst Ali Martinez has shared DOGE levels that could be important resistance boundaries. The levels in question correspond to major supply walls on the Dogecoin UTXO Realized Price Distribution (URPD).

The URPD is an on-chain indicator from the analytics firm Glassnode that tells us about the total amount of the memecoin’s supply that was last purchased at the different price levels that it has visited over history.

Now, here is the chart posted by Martinez that shows how the URPD looks for Dogecoin right now:

As displayed in the above graph, the level closest to the latest Dogecoin spot price that stands out in terms of the URPD is $0.18. The investors last purchased around 8.94% of the asset’s supply around this mark.

Naturally, as the level is above the spot price, all of these holders would be in the red at the moment. Generally, investors in loss look forward to retests of their break-even mark so that they can get their money ‘back.’ Often, these holders push for the exit as soon as this happens, fearing that the price would go back down again in the near future.

As such, whenever the price retests the cost basis of a notable part of the supply from below, a significant selling reaction can sometimes appear in the market. This can provide resistance to the cryptocurrency.

Considering that the $0.18 level is particularly large, it can act as a point of notable resistance. Similarly, the analyst has also flagged two other levels: $0.21 (7.24% of supply) and $0.36 (3.82% of supply). Interestingly, between these two, there aren’t any significant supply walls, meaning that if Dogecoin can get into this zone, it may, at least in theory, have an easier time climbing up.

In the scenario that DOGE gets rejected at the resistance, however, it may have to find support at the in-profit supply zones. Holders belonging to these levels can react to declines to their cost basis by buying more, as they may believe the drawdown to be just a dip-buying opportunity.

The only level below the current Dogecoin spot price that stands out in terms of supply is all the way down at $0.07. It hosts the acquisition mark of 20.03% of the memecoin’s supply, which means that it’s massive in size, and so, could be a strong support center.

DOGE Price

At the time of writing, Dogecoin is floating around $0.168, up 1.6% in the last seven days.