Dogecoin, the industry’s premier meme coin, has consistently led most altcoins in price performance in recent months. However, it faces its toughest challenge amidst falling network activity and a price slump.

According to an analyst, Dogecoin experienced a massive 95% drop in active addresses on its network, suggesting a considerable decline in activity.

Related Reading

#Dogecoin $DOGE network activity has declined by 95%, dropping from 2.66 million active addresses in November to just 130,282 today! pic.twitter.com/SlH3qTuMP6

— Ali (@ali_charts) February 25, 2025

Should Dogecoin Holders Worry?

As Dogecoin’s price starts to recover, its network activity suffered. Crypto expert Ali Martinez notes the decline in the network activity, sharing that the drop in the number of active addresses began three months ago.

According to Martinez, the Dogecoin network registered 1,292,770 new active addresses by November 21st, 2024. The number soon surged to 2.4 million active addresses, but this number immediately dropped. Between December 2024 and February 2025, the number of addresses dropped by around 95%.

Meanwhile, Dogecoin’s price has declined substantially in the last few days, with holders incurring losses. The popular meme coin is currently trading at $0.2077, a slight improvement from its $0.1977 price a few hours ago. Despite DOGE’s minimal gains, it’s still down from last week’s performance.

Drop In Network Activity

On February 23rd, it was noted that the network only had 30,815 new addresses, confirming the slide in network activity. The decrease in Dogecoin’s network activity was reflected in its price movement, which dipped from $0.4868 to $0.196. With price dipping and a decline in network activity, many commentators argued it’s a sign of weak demand for Dogecoin.

According to one data, there’s a 2.67% decline in the percentage of long-term Dogecoin investors, which means a less accumulation. Also, there’s a drop of 11.81% in mid-term coin holders, meaning they have already exited their positions.

Finally, the data indicates a 107.45% increase in short-term holders, which suggests an increase in speculative trading. This information shows that Dogecoin traders are more interested in short-term and speculative trading activities than long-term investment.

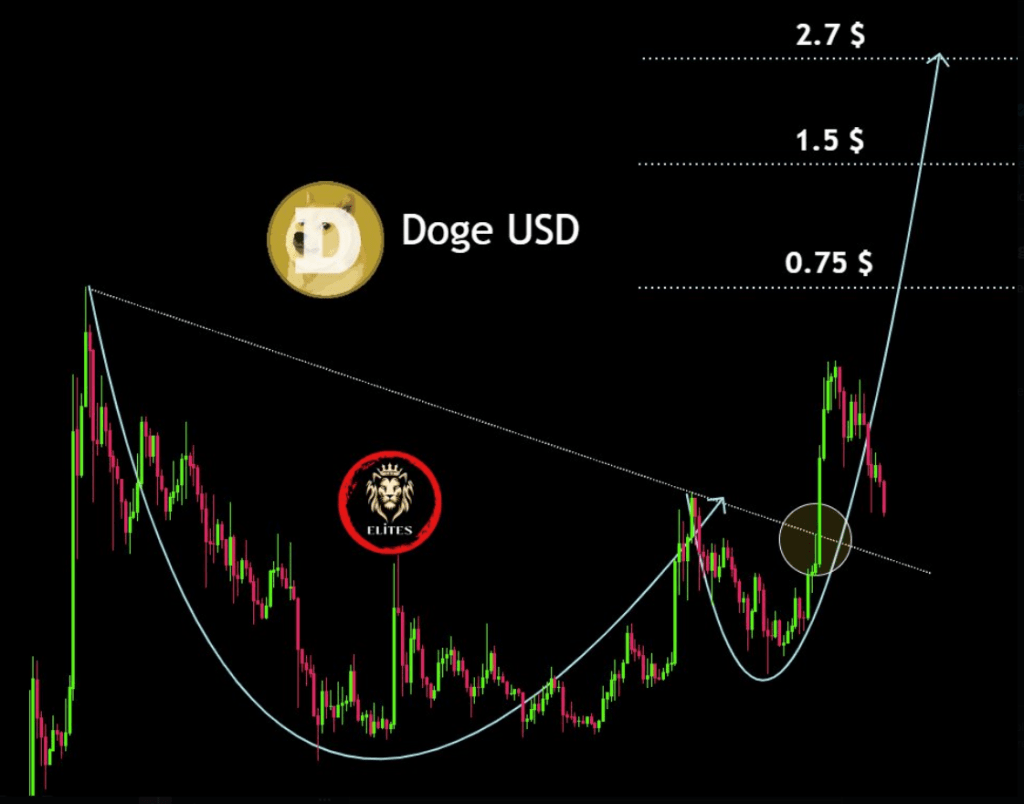

DOGE is starting its big move!

Heading to $5 soon.$DOGE #DOGE #Dogecoin #Memecoin pic.twitter.com/VaztdMxmSn

— @CryptoELlTES (@CryptooELITES) February 25, 2025

DOGE Price Targets

Although Dogecoin’s price is currently down, a few commentators expect a rebound soon. According to CryptoELITES, Dogecoin is up for a rebound, and poised to hit a new higher target.

Related Reading

The analyst offered three price targets for Dogecoin: $0.75, $1.5, and $5.

Featured image from Pexels, chart from TradingView