Image source: Aston Martin

For years, Aston Martin (LSE: AML) has had the potential makings of a brilliant business despite a lacklustre share price: a unique brand, well-heeled customer base, and management focus on optimising the model range for a changing market.

Despite it all, Aston Martin shares have turned out to be a value trap. The carmaker’s share price has fallen 36% so far this year, 53% over one year, and 83% over the past five years.

With a quarterly trading statement released today (30 April), is there any glimmer of news that might suggest a turnaround could be on the cards that may justify a higher share price and make me consider investing? Or is the share still a potential value trap?

The same old problems

As I write this on Wednesday afternoon, the Aston Martin share price is down just 1% during the day’s trading. That suggests the latest set of performance figures from the company, while not arousing excitement, did not dismay the City either.

Wholesale volumes grew year on year (yoy), albeit only by 1%. The loss before tax narrowed considerably, but still came in at £80m. On revenue of £234m, that is a hefty loss.

There was more bad news. That revenue was down 13% yoy. So, given the wholesale volumes, the average selling price showed a sharp decline.

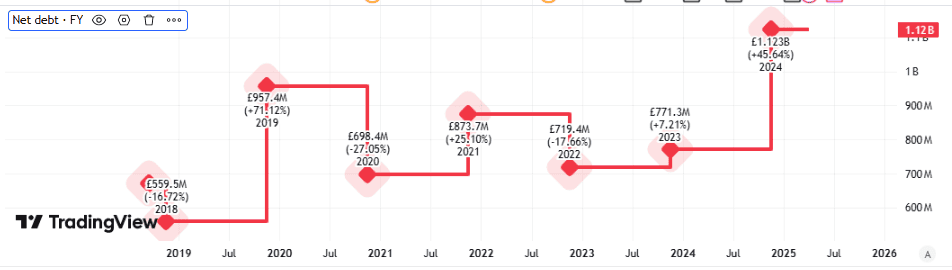

Meanwhile, the business has long been bedevilled by operating losses. Furthermore, its non-operating losses like finance costs have also threatened its long-term viability. In the first quarter, net debt rose over a fifth to £1.3bn.

Created using TradingView

Net debt has long been a key challenge for Aston Martin. It has repeatedly diluted shareholders to raise more capital and I see a risk that could happen again. Despite that, net debt remains stubbornly high — and has been heading in the wrong direction.

The share could end up going to zero

Long-term problems continue to look familiar to me – but there are also some new ones for the firm to contend with.

While sounding upbeat (as usual) about its near-term prospects, the heavily loss-making company repeatedly mentioned the impact US tariffs and an uncertain global economic outlook may have on its performance.

If Aston Martin really can pull off a turnaround, its share price ought to be much higher than it is today.

Encouragingly, the company stuck to its full-year forecast, including positive adjusted EBIT (earnings before interest and tax) for the full year and positive free cash flow in the second half. That would make a welcome change from negative free cash flow.

Created using TradingView

I am not persuaded, though. Sales volumes are flat, the company continues to bleed cash, and it is heavily loss-making. Meanwhile, its balance sheet goes from bad to worse.

If sales and profitability do not improve at some point, I see a risk that debt holders take over the company and shareholders are wiped out.

The Aston Martin share price is in pennies and getting lower for good reason, as I see it. It screams potential value trap to me, even after recent falls.