Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Ethereum (ETH) has faced massive selling pressure and volatility over the past month as the crypto market trends downward, pushing ETH toward crucial demand levels. With uncertainty gripping the market, analysts expect even more volatility in the coming days as traders react to major developments in the crypto space.

Related Reading

According to White House Crypto and AI czar David Sacks, President Donald Trump signed an executive order on Thursday to establish a Strategic Bitcoin Reserve. This unexpected move has sparked renewed speculation about how government involvement in crypto could impact broader market trends.

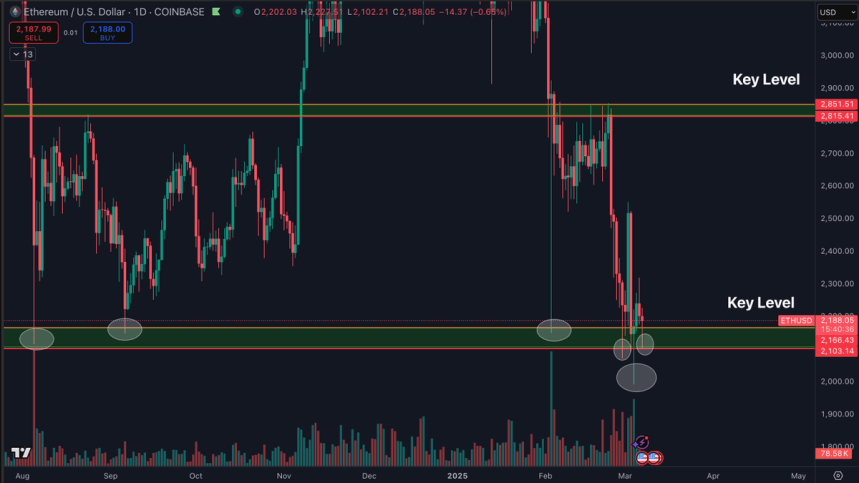

Despite the chaos, Ethereum has managed to hold the key $2,000-$2,100 support zone, a crucial level that traders are watching closely. Top analyst Daan shared insights on X, highlighting that ETH has so far defended this major demand level despite the extreme volatility.

The next few trading sessions will be pivotal, with Ethereum hovering near a critical price range. If ETH can hold support and regain momentum, a reversal could be on the horizon. However, failure to maintain these levels could trigger another wave of selling, deepening the current market correction.

Ethereum Faces A Crucial Test

The market enters a critical moment. Ethereum’s price has lost over 50% of its value since late December, sparking massive fear and panic selling. The steep decline has left many investors questioning whether the long-awaited alt season will even happen this year, as Ethereum and most altcoins struggle to reclaim bullish momentum.

With ETH failing to establish a strong uptrend, analysts remain divided on whether a recovery is possible in the near term. Some believe that the current price action signals deeper weakness, suggesting that Ethereum could face further downside before seeing any meaningful reversal. Others, however, see potential for a rebound, especially as ETH continues to hold key demand zones.

Daan’s technical analysis on X points out that Ethereum has managed to hold critical demand as a good sign amid recent market dynamics. This support, around $2,000, has been tested multiple times and remains a crucial area for bulls to defend.

Daan also noted that Ethereum has formed a higher low on lower timeframes, indicating a possible reversal if momentum builds. He emphasized that for ETH to regain bullish structure, it needs to break above $2,300 and fill the inefficiency left from Monday’s full retrace. A decisive move above this level would confirm strength and could trigger a push toward higher price targets.

Related Reading

While Ethereum’s outlook remains uncertain, its ability to hold key levels suggests that a recovery is still possible. The next few trading sessions will be critical in determining whether ETH can reclaim bullish momentum or continue to struggle amid broader market weakness.

ETH Price Action: Technical Levels

Ethereum has entered an intense phase where uncertainty dominates price action and speculation drives market sentiment. With traders searching for direction, ETH is currently trading at $2,200, having established key support above $2,000. However, this level remains fragile, and bulls must continue to defend it to prevent further downside.

For Ethereum to confirm a recovery rally, it needs to push above $2,500, reclaiming lost ground and shifting momentum back in favor of buyers. A move above this level would signal renewed strength, potentially setting ETH up for a strong rebound. However, until bulls break past resistance levels, ETH remains in a high-risk zone where volatility can drive price swings in either direction.

The $2,000 support zone remains the key factor in determining Ethereum’s fate for the coming year. If ETH holds this level, it could serve as a foundation for long-term growth. However, if it breaks down, selling pressure could intensify, leading to a prolonged bearish trend.

Related Reading

With Ethereum trading at a pivotal moment, the next few weeks will be crucial in shaping its market trajectory. Whether ETH sees a breakout or another decline depends on how well bulls can defend key support zones.

Featured image from Dall-E, chart from TradingView