Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Ethereum is once again under heavy selling pressure after losing the critical $2,000 level — a psychological and technical zone that bulls have struggled to defend in recent weeks. With price action turning increasingly bearish, investor sentiment is weakening, and analysts are warning that a deeper correction may be on the horizon. As Ethereum slides lower, concerns are growing across the broader crypto market, which often relies on ETH’s strength to lead recovery phases.

Related Reading

The current situation is both tense and delicate. Ethereum’s inability to hold key support levels has rattled short-term holders and is now testing the resolve of long-term investors. Many are now closely watching for any signs of stabilization or fresh accumulation.

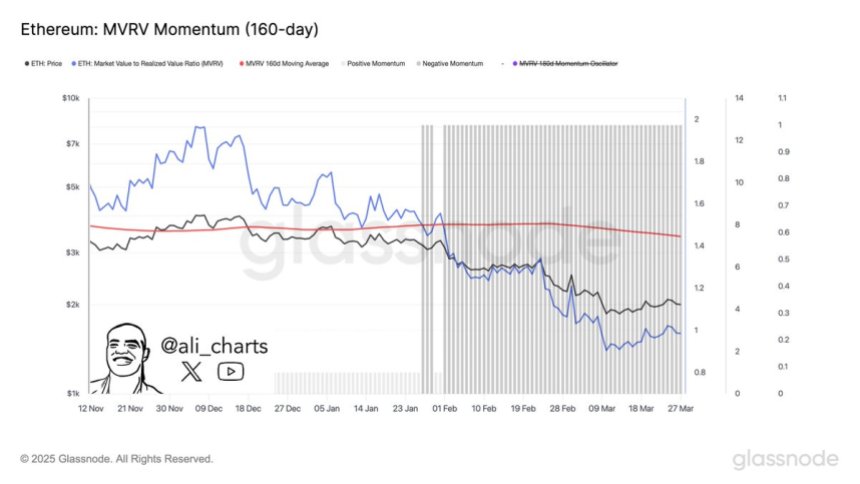

One promising on-chain signal comes from Glassnode’s MVRV (Market Value to Realized Value) metric. Historically, a crossover of the MVRV ratio above its 160-day moving average has marked the beginning of strong Ethereum accumulation zones — often preceding significant price rebounds. That signal is now approaching once again, and if confirmed, it could offer a glimmer of hope to bulls waiting for a shift in momentum. Until then, Ethereum remains in a fragile state.

Ethereum Faces Critical Breakdown As Accumulation Signal Nears

Ethereum is now in a critical position, with bulls continuing to lose control as key support levels break one by one. Selling pressure has intensified over the past few weeks, dragging ETH further into a prolonged downtrend that began in late December. Macroeconomic uncertainty, rising interest rates, and heightened global tensions continue to create a hostile environment for risk assets — and the crypto market has felt the impact most severely.

Currently, Ethereum is trading 55% below its local high of $4,100, reached earlier this cycle. The sharp decline has shaken investor confidence, and the continued breakdown in price structure leaves little room for error. Without a swift recovery and strong defense of support zones, Ethereum risks further downside, with analysts warning of continued weakness if sentiment doesn’t shift soon.

Amid the decline, some analysts are watching closely for signs of a potential bottom. Top analyst Ali Martinez shared a key insight on X, pointing to the MVRV (Market Value to Realized Value) ratio as a reliable indicator of accumulation zones. According to Martinez, when the MVRV ratio crosses above its 160-day moving average, it has historically marked strong accumulation phases — moments when long-term investors begin quietly positioning for the next leg higher.

This crossover has not yet occurred, but it is approaching. If confirmed, it could signal that Ethereum is entering a high-value zone despite the current bearish conditions. While the market remains fragile, such on-chain metrics offer a glimmer of hope that accumulation is quietly underway — even as price action continues to look weak on the surface. Bulls will need to act quickly to reverse the trend, but for now, Ethereum’s outlook remains on edge.

Related Reading

Bulls Defend Crucial $1,800 Support

Ethereum is trading at $1,830 after suffering a sharp 14% drop since last Monday, reflecting renewed selling pressure across the crypto market. The steep decline has pushed ETH toward a critical support level at $1,800 — a zone that now stands as a must-hold for bulls. This level has historically acted as a strong pivot point, and losing it could trigger a deeper correction.

If ETH fails to hold above $1,800, the next significant support lies near the $1,500 zone, which would mark a dramatic shift in market structure and likely accelerate bearish sentiment. A breakdown to this level would erase much of the year’s gains and deal a serious blow to investor confidence.

However, if bulls manage to defend $1,800 successfully, a rebound could follow, potentially pushing ETH back above the $2,000 mark. Reclaiming this psychological level would help restore momentum and open the door for a broader recovery.

Related Reading

The next few days will be crucial for Ethereum’s short-term outlook. With macroeconomic uncertainty still looming, bulls must step in with conviction — because if $1,800 breaks, the fall could be fast and steep.

Featured image from Dall-E, chart from TradingView