Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

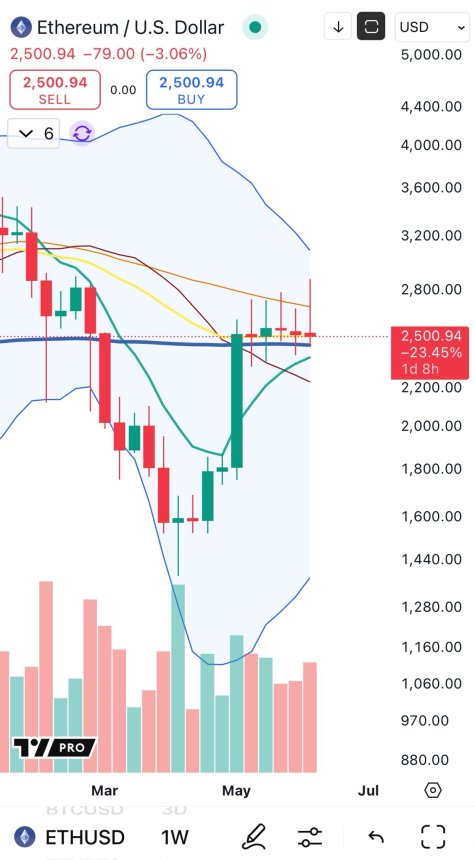

Ethereum is trading at a critical juncture after intense volatility rocked the broader market following renewed conflict in the Middle East. After pushing above the $2,800 resistance earlier this week, ETH bulls appeared to regain control. However, the price action failed to hold above that level, pulling back sharply and signaling hesitation among market participants.

Related Reading

This retracement comes as macroeconomic and geopolitical tensions rise, particularly after Israel’s strike on Iran triggered widespread risk-off sentiment across global assets. Ethereum, often seen as a high-beta asset, has not been immune to the turbulence. Despite this, it continues to hover near important technical zones, maintaining the potential for a larger move in either direction.

Top analyst Big Cheds weighed in on the situation, highlighting a notable technical pattern: ETH is flexing another small body with an upper shadow on the weekly chart. This suggests indecision and potential weakness at the top, although the structure is not yet fully compromised. The next few daily candles could be pivotal in defining Ethereum’s short-term trend. Bulls must reclaim $2,800 with conviction to re-establish momentum, while further downside could open the door for a deeper correction toward previous consolidation zones.

Ethereum Holds Range As Market Awaits Next Move

Ethereum has lost over 15% since last Wednesday, retracing from local highs near $2,830 and falling back into the trading range that has held since early May. Despite the drop, ETH remains structurally intact, still respecting the broader consolidation zone. However, price action continues to stall below the $2,770 resistance, keeping traders and analysts split on the next move.

Some market participants believe Ethereum could ignite the next altcoin season if it manages to break above its current range with conviction. A decisive close above $2,800 could reestablish bullish momentum and signal capital rotation from Bitcoin into ETH and broader altcoins. Others remain cautious, pointing to weakening momentum, global instability, and a failure to sustain support as early warning signs of a potential breakdown below the $2,500–$2,550 area.

Adding to the analysis, Cheds shared a technical perspective showing that Ethereum’s weekly chart is printing yet another small-bodied candle with an upper shadow. This structure is consistent with what he sees as a “pre-tower top” setup — a pattern that often precedes heightened volatility or a reversal. It highlights the market’s current hesitation and the ongoing battle between buyers and sellers.

Macroeconomic conditions are not helping either. Rising US Treasury yields continue to pressure risk assets, while ongoing geopolitical turmoil—especially the escalating conflict between Israel and Iran—adds another layer of volatility and fear across financial markets.