The gold futures price has torn through the $3,000 ceiling, hitting $3,001.30 in April futures and cementing a 20% climb in just a few months. This record-breaking run was driven by the geopolitical chaos of U.S. President Donald Trump’s economy and the challenges investors are facing in adapting.

And, of course, gold’s biggest cheerleader, American stockbroker Peter Schiff, celebrated the record price on X.

We’re sure Schiff is thinking: “Oh, you thought your little funny internet money would be worth 50x the value of real tangible, usable gold? Nope. That’s right. Now say my name.”

So where is gold heading next and will it outperform BTC?

Gold Futures Price Smashes $3,000 Per Ounce

Gold hit $3,000 like a battering ram, fueled by a $57.90 jump (+1.97%) in a single day. The February PPI report added to the momentum, showing a 3.2% increase in wholesale prices year-over-year, signaling a cooling economy and fanning speculation about Fed rate cuts. “This flight to gold signals deep unease,” said Robert Yawger of Mizuho Financial Group.

Gold pulls in cash like a black hole as markets buckle under pressure. The trifecta of climbing tariffs, geopolitical turmoil, and skittish investors is driving flows into futures, ETFs, and bullion. Equities are out, stability is in.

While stocks and Bitcoin are down again today, gold is up $40, hitting another record high. Gold is now just $25 shy of hitting $3,000. Instead of wasting time figuring out how to add to its Bitcoin reserve, why doesn’t the U.S. government just add to its existing gold reserve?

— Peter Schiff (@PeterSchiff) March 13, 2025

A softer Consumer Price Index adds to the frenzy, hinting that the economy might be cooling faster than expected. Lower inflation bolsters the chances of a dovish Fed, setting the stage for gold to extend its run as the go-to hedge.

A Look at Bullish Predictions

The gold rush is crossing borders and breaking barriers. Retail traders and jewelers, especially in India, are fueling the frenzy. The Multi Commodity Exchange reported a $7 billion daily turnover in February from gold options alone, representing 26% of the total trading volume.

Gold analysts are hedging their bets that gold’s current boom has legs, projecting an upward trajectory well into 2025:

- Macquarie Bank raised its Q3 2025 gold price forecast to a peak of $3,150, potentially touching $3,500 under certain inflation-adjusted scenarios.

- BNP Paribas anticipates gold climbing above $3,100/oz in the second quarter, citing tariff threats and evolving international relationships as catalysts.

The Road Ahead

Gold bugs like Peter Schiff’s analysis stem from the long-term ramifications of monetarist meddling in the economy. The distortions it creates will cause long-term issues arising, such as the need to create inflation.

The problem with PM pundits is that the narrative they are talking about has a much longer timeline than they really allude to. So, if you go all-in on PMs in 2008, you missed many gains from the same inflation you needed to protect yourself from. This is why it’s important to remember that Schiff believes in gold and has long given up on the idea that it’ll go to ZERO.

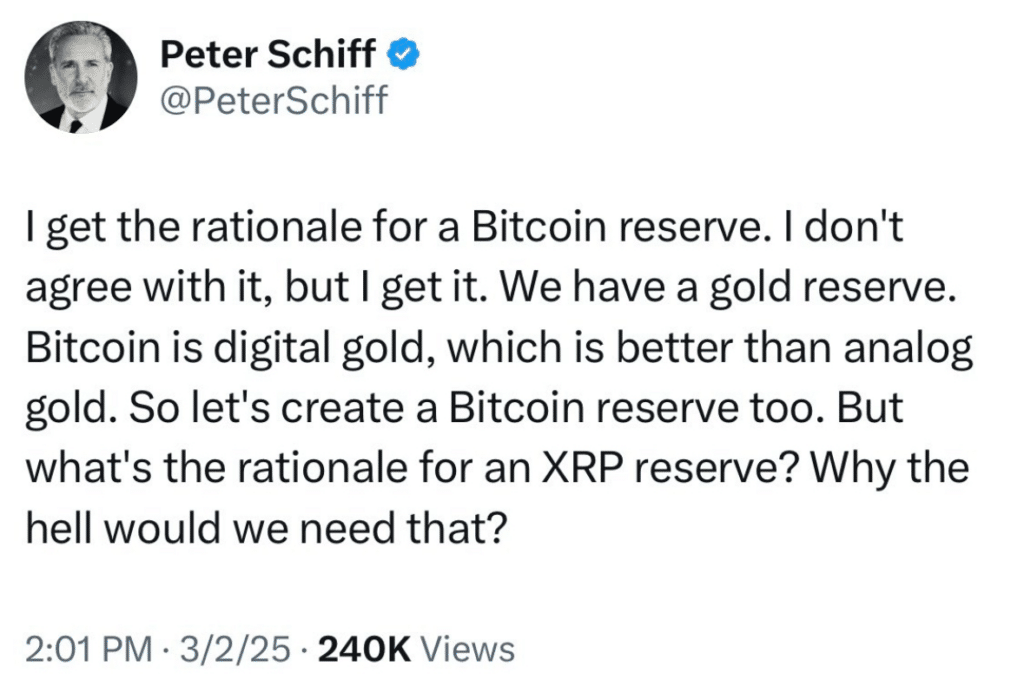

So, a friendly reminder that even Peter Schiff admits Bitcoin is “digital gold,” and adding that to your stack has been a smart move for the last 15 years.

He’s also a cringe-boomer, but we like him. His podcast teaches you a lot about economics. Plus, he says the next big opportunity will be gold mining stocks, which are going to gigapump this year.

” If you are thinking about buying precious metals, I think silver is the better buy, Schiff posted on Twitter. “But the best buy is gold and silver mining stocks. They are still trading below where they were before Trump was elected. The best way to buy the miners is $EPGIX.”

EXPLORE: XRP Price Jumps 11% After SEC Crypto Unit Tease XRP ETF Progress

Join The 99Bitcoins News Discord Here For The Latest Market Updates

Key Takeaways

- The gold futures price has torn through the $3,000 ceiling, hitting $3,001.30 in April futures.

- A friendly reminder that even Peter Schiff admits Bitcoin is “digital gold,” and adding that to your stack has been a smart move for the last 15 years.

The post Gold Futures Price Just Hit All-Time High: What Does Gold Mean For BTC Price? appeared first on 99Bitcoins.