Image source: Getty Images

Aviva (LSE: AV.) shares have been on a tear lately, and are now trading at levels not seen in over 15 years. When I first bought the stock five years ago, I certainly did not envisage such an explosive price move.

Like many other investors, my primary reason for buying Aviva was for its passive income-generating potential. With this in mind, just how much could £20,000 invested in the stock be worth in 15 years’ time?

Realistic scenario

Most investors assume dividend compounding happens automatically, but that is a simplification. If I invest a lump sum in a stock and then model future portfolio size based off the headline dividend yield, I am not accurately reflecting reality. Remember, compounding shares, not cash, drives long-term outperformance.

A more accurate approach is to model the actual dividend per share (DPS) itself, allowing it to grow at its own rate.

Let us do this with Aviva shares. In 2025, total DPS is expected to be 38.1p. The company is guiding for mid-single digit growth in the cash cost of the dividend thereafter. I will assume a 5% yearly increase.

I foresee the company continuing to grow in the future, off the back of rising profits. But I will apply a very conservative 2% annual share price growth.

Compounding wins

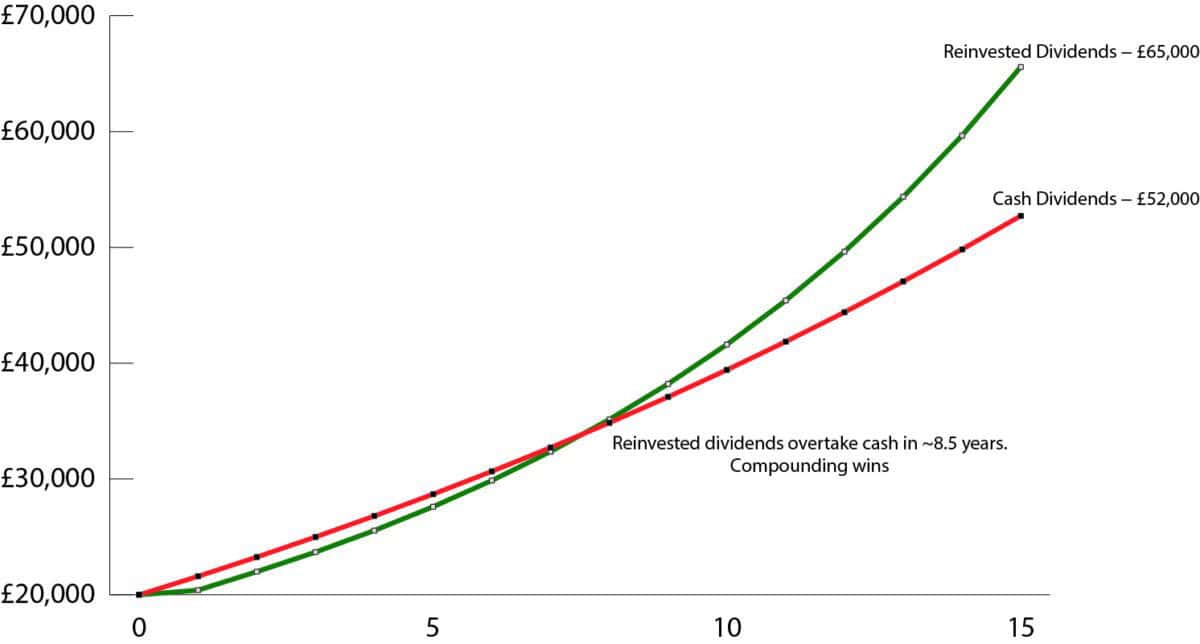

The following chart models these growth assumptions, based on a £20,000 lump sum investment. In the initial years, withdrawing dividends as cash takes an early lead.

Chart generated by author

But once it hits the knee of the curve, reinvesting dividends accelerates away. The effect of buying additional income-producing units year after year creates a compounding engine. This is the case even when a share price only rises modestly.

Future growth

Of course, I need to provide evidence to back up my belief that Aviva can sustain dividend increases into the future.

A core element of the insurer’s strategy is to shift its earnings mix towards capital light. Just a few years ago, the portfolio was evenly split. Today, two-thirds is weighted toward capital-light businesses. The acquisition of Direct Line will eventually see it rise above 70%.

The benefits of such a strategy are clear. Enhanced growth using less capital is a long-term win for shareholders.

Risks

The company has gone on an acquisition-binge over the last few years. Outside of the headline-grabbing Direct Line buy-out, it has acquired Probitas, a Lloyd’s managing agent. It also purchased Succession Wealth. And recently it entered a new distribution partnership with Nationwide Building Society.

Strategic growth investments have resulted in rising costs in its general insurance business. On its own that is not a red flag. However, after trending upwards for many years, house and motor insurance premiums are now starting to decline.

The risk here is that if revenues fall but the business fails to deliver expected cost synergies from its investments, then profit margins could get squeezed.

Of course, all stocks carry with them risks, which is why if an investor is looking to an invest a large lump sum into the stock market, the most prudent strategy would be to diversify across a number of different sectors.

Bottom line

The recent surge in the share price has pushed Aviva’s forward dividend yield down to 5.6%. But as I have demonstrated, the power of continuously reinvesting one’s dividends can potentially lead to outsized returns.

The company has a diversified business model, which includes wealth, pensions, and bulk purchase annuities. These markets are growing. For investors looking for passive income, it is certainly a stock worth considering.