Image source: Getty Images

With the Persimmon (LSE:PSN) share price falling 25% since April 2020, the stock’s now (4 April) yielding an impressive 4.9%. This puts it comfortably in the top quarter of FTSE 100 dividend payers.

And if the analysts are correct, the payout should improve over the next couple of years. For 2024, the housebuilder returned 60p a share. Looking ahead, those crunching the numbers are forecasting 60.84p (2025) and 66.12p (2026). This means the forward yield could be as high as 5.4%.

However, I’m hoping future payouts will be higher than this. From 2020 to 2024, Persimmon paid out 81.2% of earnings. If this ratio is maintained, based on the average of the brokers’ earnings forecasts, the dividend would be 77.80p (2025) and 92.17p (2026). This would push the forward yield up to 7.6%.

Of course, dividends are never guaranteed.

At the moment, the company’s returning less of its profit to shareholders than it did previously. For 2024, the ratio is 65%. And I understand the company’s caution. The recent housing market downturn means the industry has been treading carefully. But the company’s most recent update suggests things could be on the turn.

Green shoots?

In 2024, it built 10,664 homes. That’s a 7.5% improvement on 2023. And its earnings per share (EPS) increased by 11.8%.

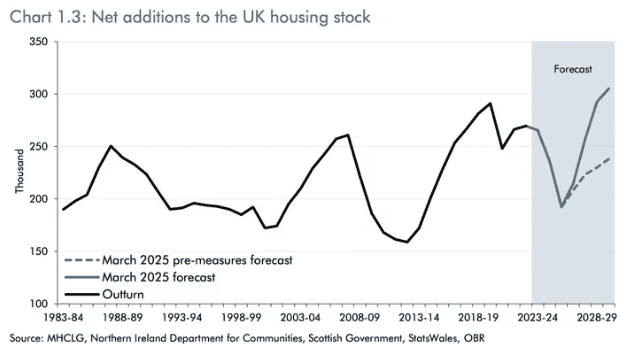

For 2025, it’s targeting 11,000-11,500 completions. The industry has welcomed government desire to boost construction, including its major overhaul of the planning system. The Office for Budget Responsibility (OBR) is predicting a large increase in the number of homes built during this Parliament.

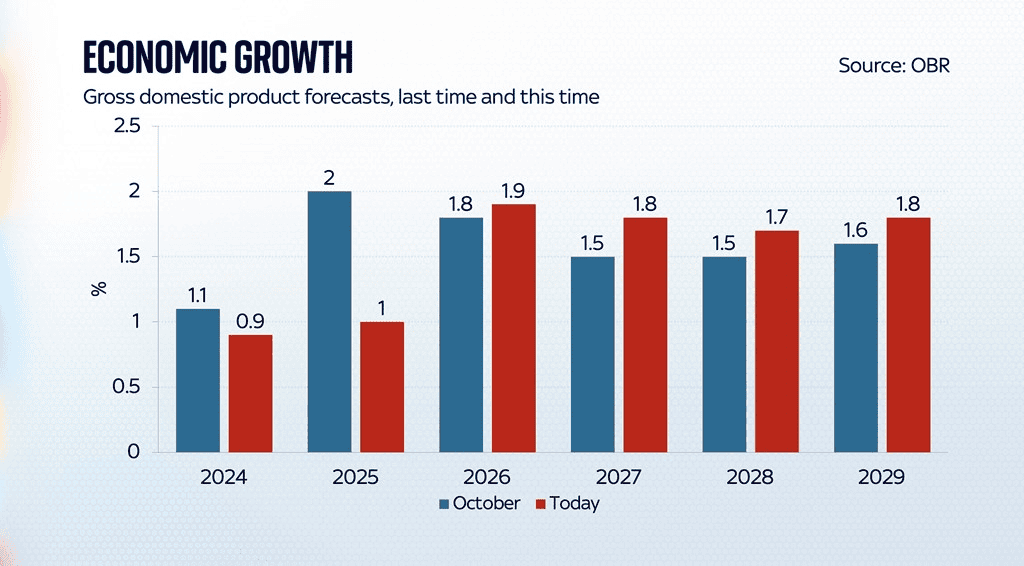

As announced during the Chancellor’s spring statement on 26 March, it’s also upgraded its UK growth forecast from 2026 through until 2029. If these estimates prove to be accurate, this should help secure the anticipated recovery in the housing market that’s likely to benefit from expected reductions in borrowing costs.

Still some challenges

But we’re not there yet. As a result of current global uncertainty, the OBR recently halved its growth forecast for 2025. And the ‘Trump tariffs’ could make things worse.

Also, inflation has eroded profit margins in the construction sector. In 2022, Persimmon recorded a profit before tax per completion of £68,086. For 2024, this was 46% lower at £37,050.

I doubt we are going to see a return to pre-Covid margins any time soon.

Broker opinion

However, with no debt on its balance sheet, a private sales order book of £1.15bn and a business that’s likely to escape the worst of the tariffs, I think the stock has strong growth prospects.

And I’m not alone in thinking the company has plenty of potential. Of the 18 analysts covering the stock, 13 say it’s a Buy. They also have an average one-year price target of £15.41 a share – 27% higher than it is today — with a range of £12.60-£23.

I first bought the company’s shares before the pandemic. This means I’m nursing a large loss. However, since then to help soften the blow, I’ve banked some healthy dividends. And that’s why I invested. I saw it as an excellent dividend share.

But I think the recent pullback in the share price means investors looking for a growth share could consider adding Persimmon to their portfolios. And the dividend’s not bad either.