Image source: Getty Images

Earning £10,000 of passive income per month requires a large pot of money. And ideally, it would all be in a Stocks and Shares ISA as both the capital gains and income would be entirely free from tax.

In fact, my calculations suggest that, in order to potentially earn £120,000 annually, an investor would need £2.4m in an ISA. Clearly, that’s a large chunk of money, and with a maximum annual contribution of £20,000, it would take some time to achieve.

But is it achievable? Potentially. It just takes time, consistency, and a strong investment strategy.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

Doing the maths

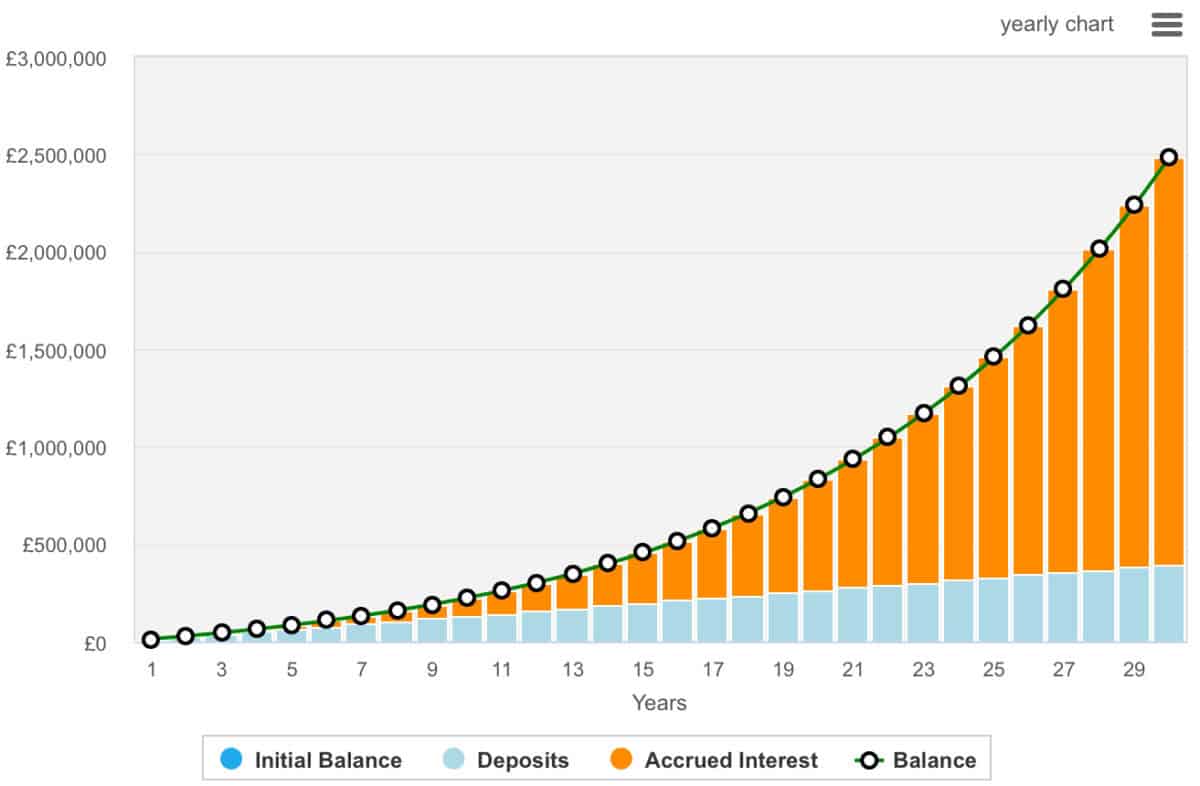

There are lots of ways to reach the same outcome. However, here’s one way of running the maths. Let’s assume monthly contributions of £1,100, or £13,200 annually over 30 years, and a 10% annualised return. At the end of the period, an investor would have a little more than £2.4m. Of course, not everyone can achieve a 10% annualised return over the long run. Although, many investors have done so simply by investing in index tracking funds.

However, it’s important to remember that many novice investors lose money. They may throw money after bad trying to get rich quick… many of us have been there. Instead, investors are better off take a diversified approach, perhaps opting to put the majority of their money towards index funds and reinvesting their dividends. This steady approach will leverage compounding and hopefully avoid costly losses.

Where does Bitcoin come in?

Well, I’ve typically avoided Bitcoin, and I can’t hold it within an ISA anyway. However, I can invest in companies that deal with Bitcoin or mine Bitcoin, like MARA Holdings (NASDAQ:MARA).

So, what’s so great about MARA Holdings? Honestly, it’s not a stock I love, but I appreciate it may be of interest to investors who are bullish on Bitcoin. It’s one of the largest Bitcoin miners globally, holding around 46k BTC as of February, valued at approximately $3.9bn.

The company mines Bitcoin and strategically purchases additional coins, with its reserves growing significantly over the past year. For instance, in 2024, MARA mined 9,457 BTC and acquired 22,065 BTC at an average price of $87,205.

MARA has also diversified its operations by lending 7,377 BTC (16% of its reserves) to third parties, generating modest single-digit yields. This lending strategy aims to offset operational costs while maintaining its Bitcoin holdings. MARA also operates a network of data centres powered by renewable energy, including a wind farm in Texas and multiple facilities in Ohio.

Despite its impressive long-term growth — up 2,463% over five years — the stock is volatile. In fact, it’s down 60% over three months. That’s perhaps unsurprising as Bitcoin is now cheaper than its average procurement price above. Moreover, investors should note that it’s becoming hard to mine Bitcoin, and long-term investors should be wary of regulatory changes. Mara also uses debt to fund Bitcoin investments.

It’s not a stock that I’m looking to add to my portfolio in the near term. However, I’m going to keep watching.