Image source: Getty Images

Next week, I’ll be reminded once more why I hold Persimmon (LSE:PSN) shares. That’s because, on 19 June, the stock will go ex-dividend. Those with a position before this date will be entitled to receive the housebuilder’s final 2024 payout on 11 July.

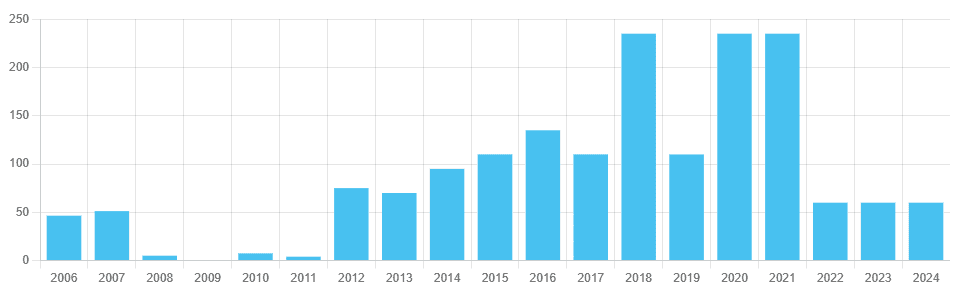

Added to the interim amount of 20p, it means the total dividend for the year will be 60p, giving a current (13 June) yield of 4.3%. Although above the FTSE 100 average of 3.5%, it’s low by historical standards.

Like all those exposed to the property market, the housebuilder’s had a tough few years. The pandemic forced building sites to close and the post-Covid rise in interest rates choked off demand for new properties. In 2025, it’s expecting to build 11,000-11,500 units. The 2020-2024 average was 12,716.

Understandably, to preserve cash, Persimmon cut its dividend. It’s been maintained at 60p for the past three years.

Looking ahead

But as the table below shows, analysts are expecting the position to improve through until 2027.

| Year | Dividend per share | Dividend growth | Dividend yield |

|---|---|---|---|

| 2025 | 62.01p | 3.4% | 4.4% |

| 2026 | 67.17p | 8.3% | 4.8% |

| 2027 | 73.19p | 9.0% | 5.2% |

The ‘experts’ are predicting modest growth this year but a more impressive increase thereafter. The prediction is for a dividend of 73.19p by 2027. That would be a 22% improvement on the 2024 payout. But it’s a long way short of previous highs. In 2018, 2020 and 2021, the group returned 235p a share.

However, I think the housebuilder will be more generous than this. From 2020-2024, its diluted earnings per share was 885.8p. And it paid dividends of 720p, meaning it returned 81% of profit to shareholders.

The analysts are forecasting a less generous dividend than this. Their predictions are for payout ratios of 66% (2025), 60.7% (2026) and 56.5% (2027).

If these were increased to 81%, the 2027 payout would be 104.9p — a 75% improvement on the 2024 dividend — and the stock’s yield would be 7.5%.

A word of caution

Of course, when it comes to payouts, there are never any guarantees.

And these forecasts may prove to be inaccurate. I think the green shoots of a recovery are starting to show in the housing market but a sustained pick-up isn’t certain.

Interest rates may stay higher for longer and the UK economy remains fragile. The government’s emphasis on planning reforms will help in the medium term but the disposable incomes of buyers will be the biggest determinant of Persimmon’s earnings in the short run.

But optimism surrounding the sector has driven the group’s share price higher over the past few weeks. Since 9 April, it’s risen nearly 30%.

My view

However, whatever level of profit it makes over the next three years, I’m confident it will return more to shareholders than analysts are expecting.

That’s because the company has no debt on its balance sheet. Also, as it owns over 83,000 plots of land, there’s no need to find lots of additional cash (over and above normal levels of capital expenditure) to buy more sites.

While I think it might be a while before the company pays a dividend of 235p a share again, I’m reasonably confident that it will increase its payout this year. And if the housing market recovers as I expect, it should be in a position to raise it significantly thereafter. That’s why, on balance, I think it’s a stock that investors could consider right now.