Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

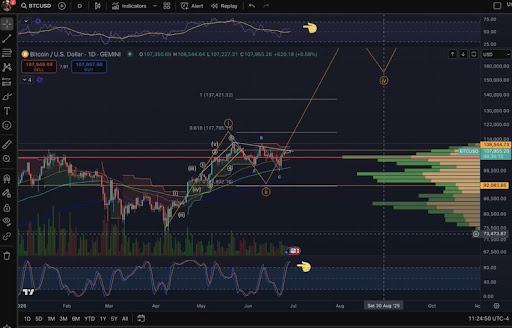

A crypto analyst has forecasted a powerful Wave 3 Bitcoin price rally that could take it toward new all-time highs between $160,000 and $200,000. Notably, this surge is expected to come with rising Bitcoin Dominance (BTC.D) and a delayed altcoin season, particularly if BTC can make a clean break above the $108,500 resistance level.

Bitcoin Price Breakout To Spark Next Bull Run

The Bitcoin price is currently hovering below a critical resistance level at $108,500, and according to a crypto analyst known as ‘BigMike7335’ on the X social media platform, a clean breakout and flip of this level into support could ignite an explosive Wave 3 bull run. Based on Elliott Wave Theory and Fibonacci Extension analysis, a successful move above this threshold could open the door to a bullish price surge with potential targets set in the $160,000 to $200,000 range.

Related Reading

The analyst’s chart shows that Bitcoin has already completed its Wave 1 of a five-wave impulse move, followed by an ABC corrective Wave 2. The market is also currently consolidating, and Bitcoin’s bullish momentum appears to be rebuilding. These positive developments are supported by a rising Stochastic Relative Strength Index (RSI) from the oversold region and a neutral-to-bullish RSI, both of which point toward upward price action.

Notably, the 0.618 and 1.0 Fibonacci Extensions around $117,795 and $137,421, respectively, are highlighted as interim resistance zones where price momentum could temporarily slow before continuing upward. A clean breakout above $108,500 could also place Bitcoin above a heavy volume node visible in the volume profile within the chart, suggesting less overhead resistance and a stronger potential for a price rally.

Furthermore, the analysis implies that during this powerful Wave 3 phase, Bitcoin Dominance will likely climb toward 70%. This increase in BTC.D would mean capital is concentrating in the leading cryptocurrency, which historically results in altcoins underperforming. As a result, the expected altcoin season for this cycle may be postponed, following the completion or cooling of Wave 3.

Analyst Predicts $375,000 Bitcoin Bull Run Peak

Crypto analyst TechDave has just sounded the alarm on what he calls the Bitcoin “launch signal”, a rare trigger that has only appeared four times in history and each time marked the start of major bull market rallies. This signal previously appeared in October 2012, July 2016, and July 2020—all preceding major upward moves that ended in new cycle peaks.

Related Reading

Currently, the same signal is emerging this July, aligning with the previous cycle structures and reinforcing the expectation of a breakout phase. Notably, the formation has led to exponential gains, with each bull market run typically peaking months later. Following this historical pattern, TechDave now predicts a fresh cycle top for Bitcoin at $375,000.

Featured image from Getty Images, chart from Tradingview.com