Image source: Getty Images

Many investors opt for a Self-Invested Personal Pension (SIPP) because it offers significantly greater control over how their retirement savings are managed. Unlike traditional pension schemes, which typically limit individuals to a narrow range of pre-selected funds, a SIPP allows for a much broader selection of investment options — including individual shares, investment trusts, ETFs, commercial property, and more.

This flexibility can be particularly appealing to those who are confident in making their own investment decisions or who work with a financial adviser to build a tailored strategy. Importantly, a SIPP also provides transparency. It allows investors to see exactly where their money is going and how each component of the portfolio is performing. For many, this visibility translates into greater confidence. It can also mean a stronger sense of ownership over their long-term financial future.

Starting young

I opened my daughter’s ISA when she was less than six months old. While the maximum contributions are relatively small, they’re still topped up by the government, and give her the very best chance of compounding her way to an early retirement. And that’s important for me, because I do worry about the future, the job’s market, and the world I’m bringing her into.

The real advantage lies in time. Starting early gives each pound the chance to grow again and again, quietly accumulating over the years. Even modest annual returns, when stretched over nearly two decades, can turn small deposits into something surprisingly substantial. And because gains within the ISA are tax-free, every bit of growth stays working for her. It’s not about guessing markets or picking winners — it’s just letting time and consistency do the heavy lifting. The earlier it starts, the harder compounding works.

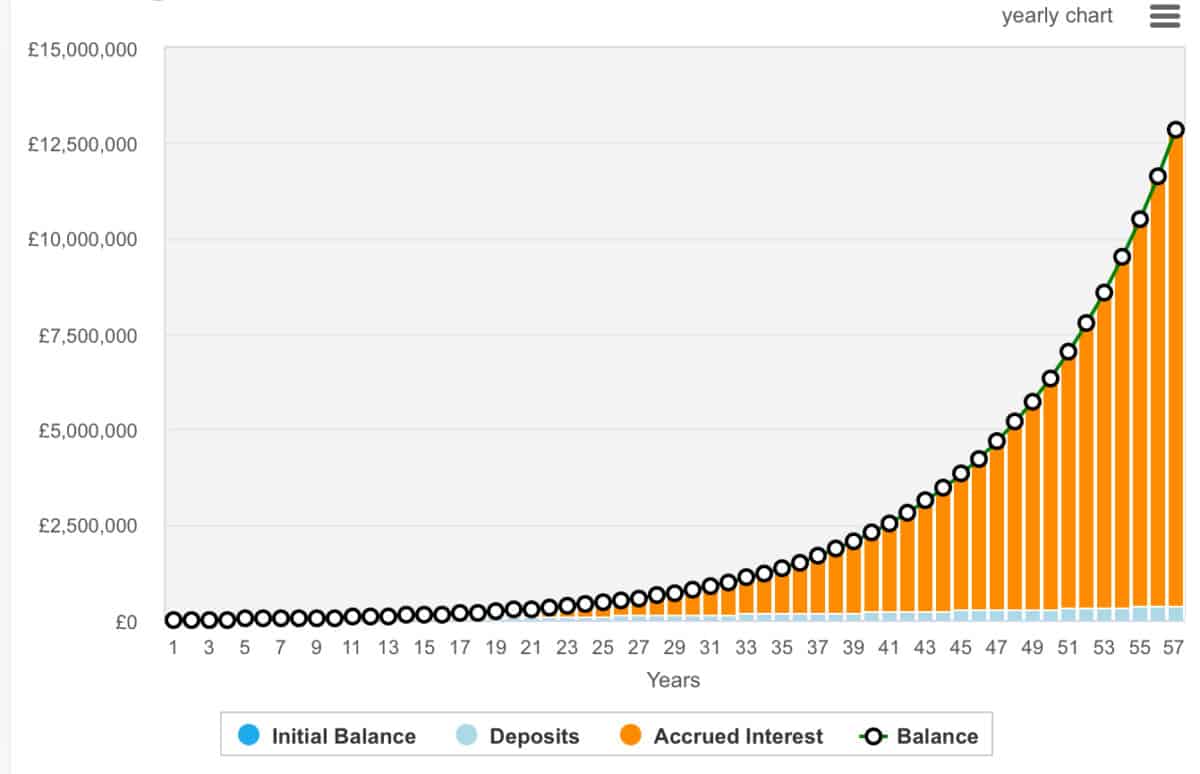

Here’s a very simple chart to show how it can grow. I’ve started with £300 of monthly contributions — which is the current limit including the state contribution — and added a 2% increase to that contribution. This means that in 50 years, the contribution will be around £800 a month. I’ve also assumed a 10% annualised return. That’s a strong return over the long run, but I’m backing myself here.

Where to invest?

Scottish Mortgage Investment Trust (LSE:SMT) has long held a place in many UK investors’ portfolios — and for good reason. Managed by Baillie Gifford, the trust has built a reputation for bold, long-term investing in transformational growth companies around the world.

Its portfolio includes both public and private firms, including Nvidia and SpaceX. These investments often focusing on disruptive technologies, healthcare innovation, and emerging markets. Investors are drawn to its global vision and willingness to back conviction bets early. Names like Tesla, Moderna, and ASML have all featured prominently.

However, with that ambition comes risk. One key factor is gearing — the use of debt to potentially amplify returns. While this can enhance gains in a rising market, it can also deepen losses during downturns. The trust’s growth focus also means performance can lag in more defensive or value-driven environments.

However, for those investors comfortable with volatility and thinking long term, though, Scottish Mortgage remains an ever-appealing option. It’s one I continually top up on.