Crypto analyst Steph has highlighted a high liquidity level that could spark a significant surge for the XRP price. This comes as the altcoin struggles to reclaim the psychological $3 level, which could lead to a further rally to new highs.

Liquidity Level That Could Spark An XRP Price Surge

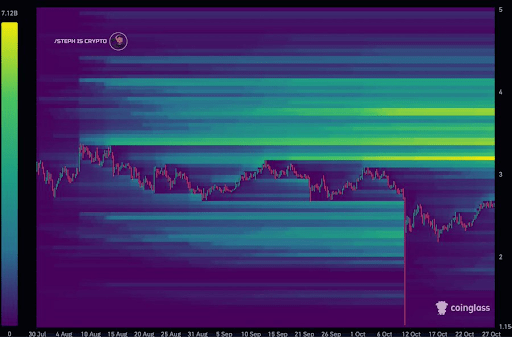

In an X post, Steph revealed that the liquidity around $3.2 is expanding for the XRP price and that the market is charging toward the highest cluster. He explained that there are many buy and sell orders around this level, with market makers often looking to capture liquidity at price levels with significant liquidity clusters like this one.

Related Reading

As such, the XRP price could rally to $3.2 at some point, reclaiming the $3 level in the process. However, the crypto market is currently on a downtrend, which makes this rally less unlikely for now. XRP has struggled to break out of its current range since the $19 billion liquidation event on October 10.

Crypto analyst CasiTrades had recently predicted that the XRP price could still drop to as low as $1.4 before it records a bullish reversal. She claimed that this will set the stage for the next Wave 3 impulse that could send XRP toward $6.50 or $10. Meanwhile, for the projected XRP crash to be invalidated, the analyst stated that the altcoin needs to break and hold above $2.82.

However, Steph revealed that the XRP price has formed a double bottom, which he predicts would lead to a reversal above $3. The analyst is also confident that XRP will reach a new all-time high (ATH), predicting a rally to $4.50 as he highlighted a compression on the chart.

Why Current Price Action Is Still Bullish

Crypto analyst Egrag Crypto revealed that the XRP price is making higher highs and that the RSI is also making higher highs, which he noted means strong bullish momentum and that buyers are still in control while the trend is healthy. He added that there is no bearish divergence, so momentum is confirming the price move.

Related Reading

Egrag Crypto further remarked that when the XRP price and RSI rise together, the uptrend is real and supported by strength. He suggested that XRP holders should only be worried when the price makes higher highs but the RSI makes lower highs. He explained that this is when a bearish divergence could occur, indicating weakening momentum. Meanwhile, the analyst also mentioned that a close above between $2.65 and $2.70 with confirmation is key.

At the time of writing, the XRP price is trading at around $2.5, down over 3% in the last 24 hours, according to data from CoinMarketCap.

Featured image from Freepik, chart from Tradingview.com