Want more housing market stories from Lance Lambert’s ResiClub in your inbox? Subscribe to the ResiClub newsletter.

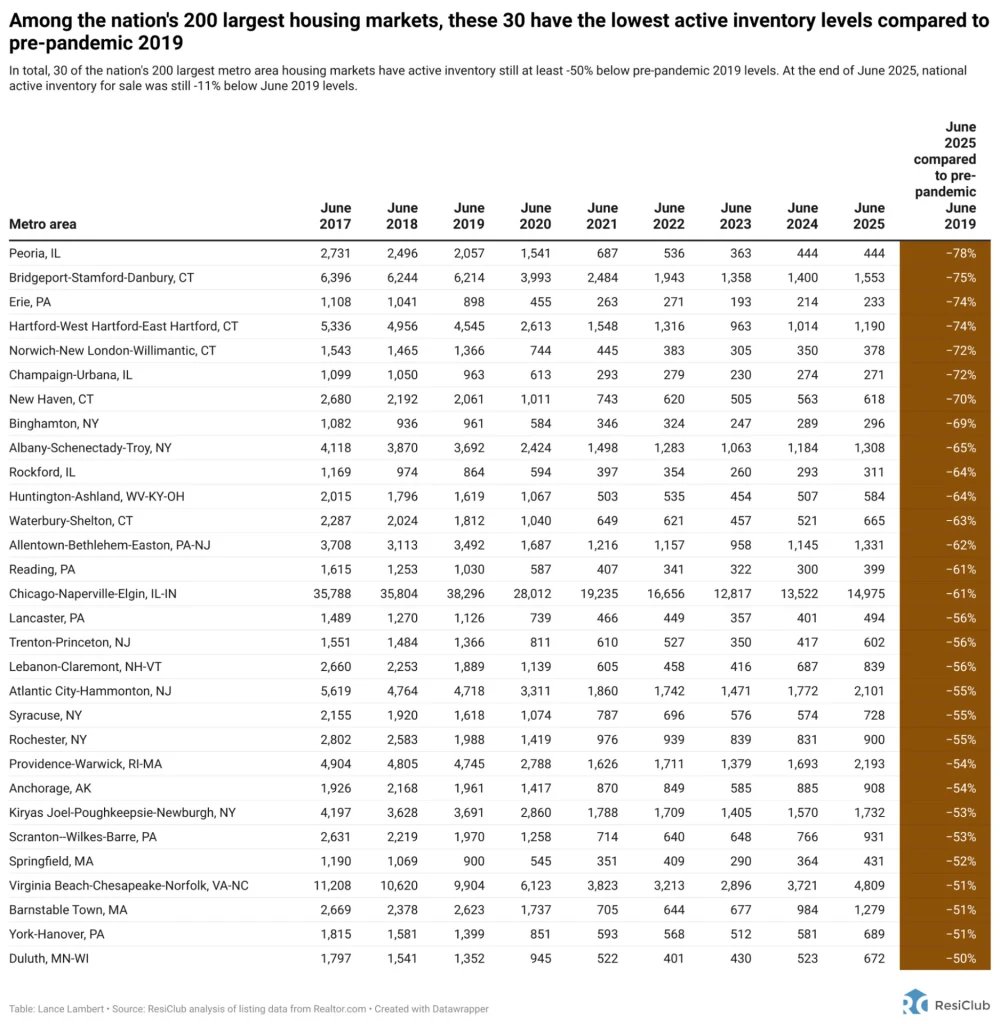

National active housing inventory for sale at the end of June this year was up 29% compared with June 2024. That’s just 12% below pre-pandemic levels in June 2019. However, while the national housing market has softened and inventory has surpassed 2019 pre-pandemic levels in some pockets of the Sun Belt, many housing markets remain far tighter than the national average.

Generally speaking, housing markets where inventory (i.e., active listings) has returned to pre-pandemic levels have experienced softer/weaker home price growth (or outright declines) over the past 36 months. Conversely, housing markets where inventory remains far below pre-pandemic levels have, generally speaking, experienced more resilient home price growth over the past 36 months.

Pulling from ResiClub’s monthly inventory tracker, we identified the tightest major housing markets heading into the spring 2025 season, where active inventory is still the furthest below pre-pandemic 2019 levels. These markets are where home sellers have maintained more power compared with most sellers nationwide.

Many of those tight markets are in the Northeast, in particular, in states like New Jersey and Connecticut.

Unlike the Sun Belt, many markets in the Northeast and Midwest were less reliant on pandemic-era migration and have fewer new home construction projects in progress. With lower exposure to the negative demand shock caused by the slowdown in pandemic-era migration—and fewer homebuilders in these regions offering affordability adjustments once rates spiked—active inventory in many Northeast and Midwest housing markets has remained relatively tight, maintaining a seller’s advantage heading into spring 2025.

!function(){“use strict”;window.addEventListener(“message”,function(a){if(void 0!==a.data[“datawrapper-height”]){var e=document.querySelectorAll(“iframe”);for(var t in a.data[“datawrapper-height”])for(var r,i=0;r=e[i];i++)if(r.contentWindow===a.source){var d=a.data[“datawrapper-height”][t]+”px”;r.style.height=d}}})}();

That all said, this cohort is slowly losing members. Back in May, 32 of the nation’s 200 largest metro-area housing markets still had at least 50% less-active inventory than in June 2019. In April, there were 37 markets. In March, there were 42 markets.