Want more housing market stories from Lance Lambert’s ResiClub in your inbox? Subscribe to the ResiClub newsletter.

Most of America’s largest homebuilders have publicly stated that the peak 2025 housing market saw softer-than-expected conditions, particularly in many parts of the Sun Belt.

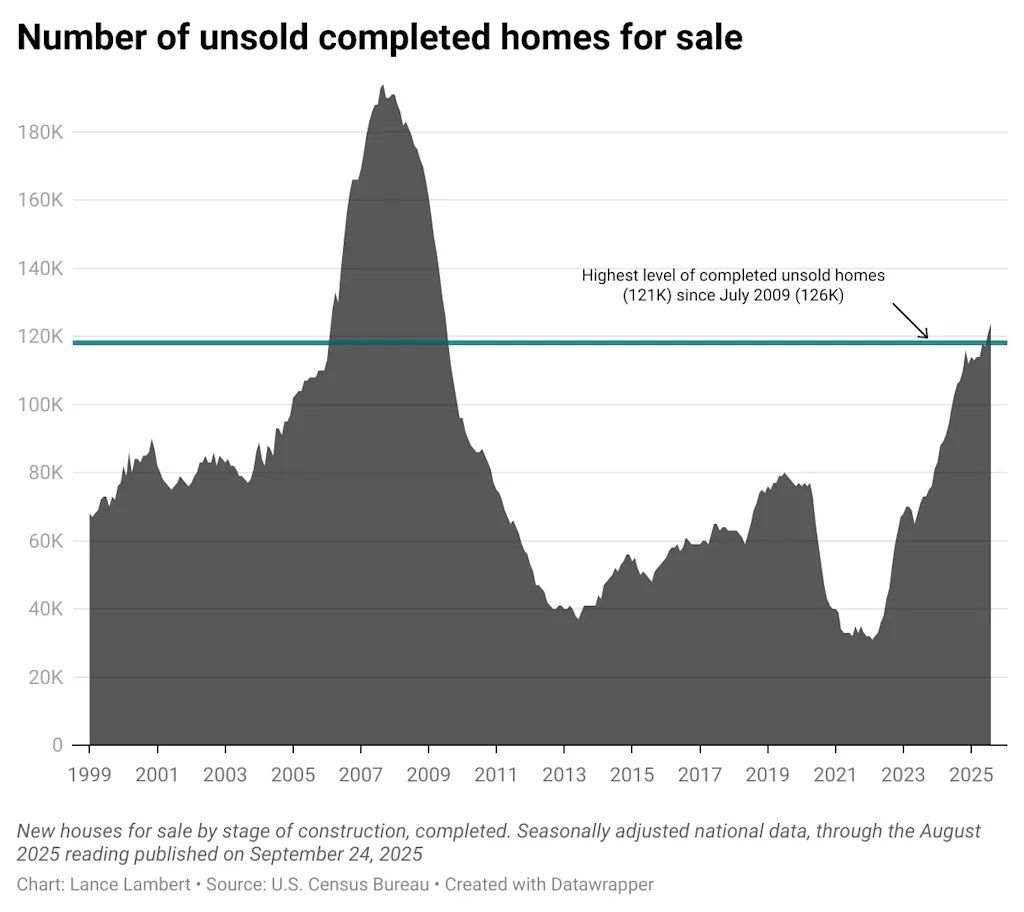

This softer housing market environment caused unsold inventory to tick up. Indeed, since the pandemic housing boom fizzled out, the number of unsold completed U.S. new single-family homes has been rising:

- August 2016 —> 61,000

- August 2017 —> 63,000

- August 2018 —> 69,000

- August 2019 —> 79,000

- August 2020 —> 52,000

- August 2021 —> 34,000

- August 2022 —> 45,000

- August 2023 —> 72,000

- August 2024 —> 105,000

- August 2025 —> 124,000

The August figure (124,000 unsold completed new homes) published last week is the highest level since July 2009 (126,000).

Let’s take a closer look at the data to better understand what this could mean.

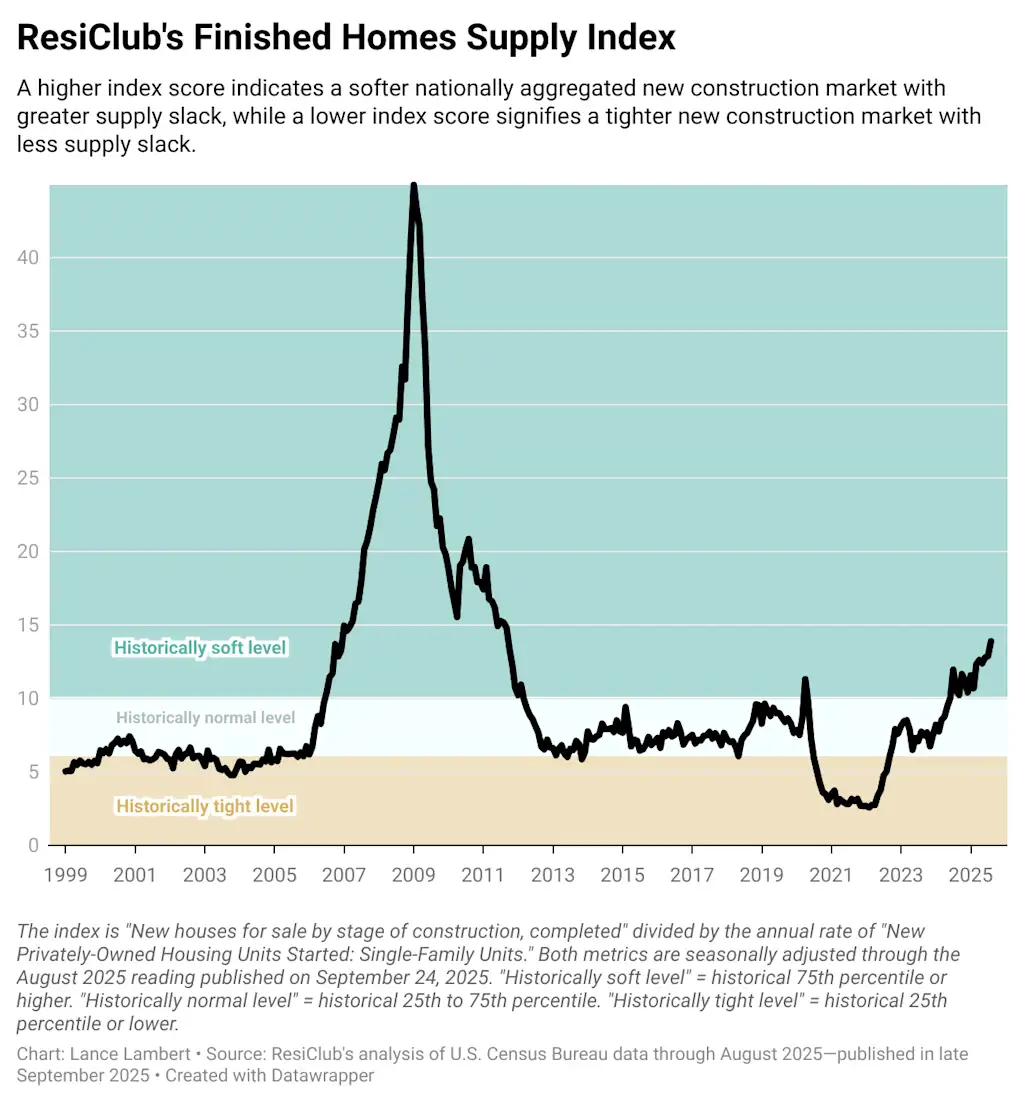

To put the number of unsold completed new single-family homes into historic context, we have ResiClub’s Finished Homes Supply Index.

The index is one simple calculation: the number of unsold completed U.S. new single-family homes divided by the annualized rate of U.S. single-family housing starts. A higher index score indicates a softer national new-construction market with greater supply slack, while a lower index score signifies a tighter new-construction market with less supply slack.

If you look at unsold completed single-family new builds as a share of single-family housing starts (see chart below), it still shows we’ve gained slack (and have more now than in pre-pandemic 2019); however, this slack, nationally speaking, isn’t anything close to the 2007-2008 weakening.

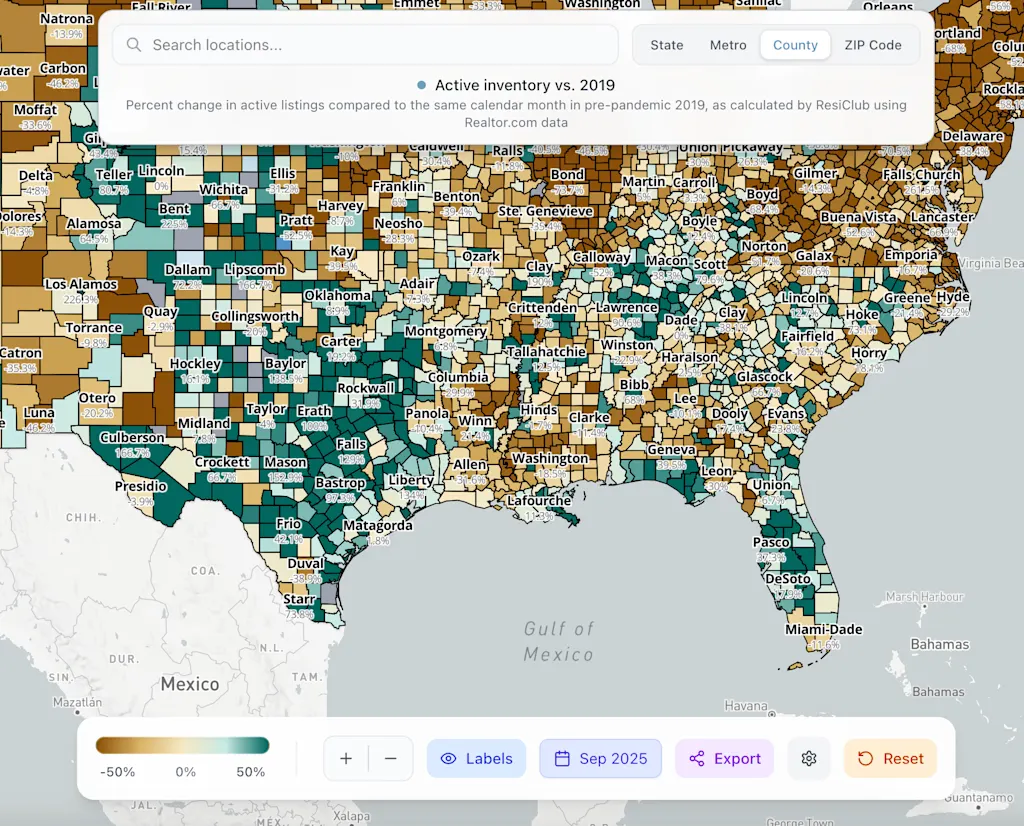

While the U.S. Census Bureau doesn’t give us a great market-by-market breakdown on these unsold new builds, we have a good idea where they are, based on total active inventory homes for sale (including existing). Much of it is likely in the Mountain West and Sun Belt, particularly around the Gulf area.

Indeed, some builders are experiencing pricing pressure, particularly in pockets of Florida and Texas, where resale inventory is well above pre-pandemic 2019 levels. See the screenshot from the ResiClub Terminal below.

To offer larger incentives and move some of these homes, many major homebuilders in the Sun Belt are compressing their margins.

While homebuilder margins have compressed from the highs of the pandemic housing boom, some look alright compared with pre-pandemic 2019 levels. However, if resale inventory and unsold completed new-build inventory continue to rise next year—and further margin compression becomes necessary—we could reach a point where both single-family permit activity and housing starts activity pull back more. We’ll keep a close eye on it.

Big picture: There’s greater slack in the new construction market now than a few years ago, giving buyers and investors some leverage in certain markets to negotiate better deals with homebuilders.