Everything seems to be going great for cryptocurrencies—regulations are evolving, political developments are shaping a clearer path, institutional funds are investing, and ETFs are gaining traction. Yet, despite all this progress, many people still don’t

use crypto for payments. Is it just a niche interest, or is there a significant industry built around cryptocurrency transactions? Who is using it, and how does it work? Why are over 30 Crypto PSPs thriving despite low adoption, and what value do they add?

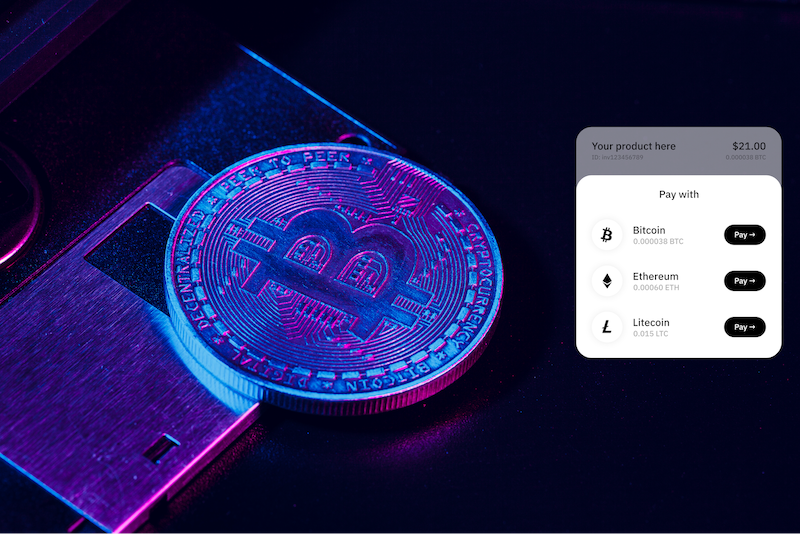

Let’s explore the different types of crypto payments and the use cases where they shine.

The Rise of Crypto Payments

Cryptocurrency payments have emerged as an alternative to traditional financial transactions, offering a new way to exchange value without the constraints of fiat currencies. Unlike conventional payments, which rely on banks and payment processors, crypto

transactions leverage blockchain technology. Digital currencies like Bitcoin and Ethereum and stablecoins like USDC and Tether can be used without any third party between the payer and the payee, but in many cases, a Crypto Payment Service Provider (PSP) acts

as an intermediary, ensuring smooth conversions and offering a variety of added value services. This setup allows businesses to accept crypto payments while still settling in fiat, often without even handling cryptocurrencies directly. So, let’s see what kinds

of cryptocurrency payments exist and what characterizes them.

- Direct Crypto Transfers: The Simplest Form: For those new to the space, the simplest way to understand crypto payments is by looking at a direct transfer of digital assets from one wallet to another. This approach is common among individuals

and on cryptocurrency exchanges, where users are required to deposit funds into platform-specific wallet addresses. However, this method is often too rudimentary for businesses that require structured invoicing, accounting, and regulatory compliance. - Crypto PSPs: A Bridge Between Crypto and Traditional Finance: That’s where crypto PSPs come in. By acting as an intermediary, these providers offer merchants tools that bridge the gap between crypto and traditional finance, converting incoming

payments into fiat while integrating additional features such as fraud prevention, tax reporting, and seamless reconciliation. - Crypto-Linked Credit Cards: Spending Crypto Like Cash: Another method of using crypto for payments comes in the form of crypto-linked credit cards. These cards allow users to spend their cryptocurrency holdings in a way that feels identical

to using a traditional debit or credit card. The underlying process is simple: when a transaction occurs, the card issuer automatically converts the cryptocurrency into fiat before settling with the merchant. This setup means that even businesses with no interest

in handling crypto can still indirectly receive payments from crypto holders. - Web3 and Decentralized Payments: The rise of Web3 has also introduced a new paradigm for crypto payments, particularly within decentralized applications (dApps) and blockchain-based ecosystems. In this environment, transactions are often

embedded within smart contracts, enabling automated financial interactions without intermediaries. However, for mainstream adoption, on-ramp and off-ramp solutions have been developed, making it easier for users to deposit and withdraw funds using traditional

currencies. These solutions also incorporate key compliance measures like Know Your Customer (KYC) and Anti-Money Laundering (AML) checks, ensuring regulatory alignment.

Use Cases for Crypto Payments

From an industry perspective, cryptocurrency payments serve a wide array of use cases. Some businesses target crypto holders directly, particularly those selling high-value goods like luxury watches or real estate, where buyers appreciate the speed and finality

of blockchain transactions.

In cross-border trade, crypto provides a streamlined alternative to traditional banking channels, cutting through inefficiencies and high transaction costs.

Additionally, in regions with weak local currencies, stablecoins present a way to bypass inflation and currency instability, offering both merchants and customers a more predictable financial tool.

Beyond these cases, crypto payments also play a crucial role in industries deemed high-risk by traditional financial institutions. Gaming, adult entertainment, and even some sectors of e-commerce often struggle to secure reliable banking partnerships due

to stringent regulations and chargeback concerns. With crypto, these businesses can accept payments without fear of arbitrary restrictions, giving them financial autonomy.

Similarly, in parts of the world where banking infrastructure is limited or inaccessible, cryptocurrencies enable financial inclusion, allowing unbanked populations to participate in the global economy without needing a traditional bank account.

The Role of Crypto PSPs in Overcoming Barriers

Despite its advantages, cryptocurrency payments face significant challenges, including price volatility, complex tax regulations, and a lack of widespread merchant acceptance. Many businesses are hesitant to adopt crypto due to concerns about fluctuating

asset values and accounting complexities. However, Crypto Payment Service Providers (PSPs) have stepped in to bridge these gaps. By offering real-time conversion to stable fiat currencies, they eliminate the risk of price volatility. Additionally, PSPs provide

automated tax reporting, fraud prevention tools, and compliance solutions that help businesses navigate regulatory requirements with ease. As more PSPs integrate with traditional financial infrastructure and gain regulatory clarity, the adoption of crypto

payments is expected to grow. In the future, seamless integration with mainstream payment systems, improved scalability, and greater institutional involvement could drive crypto payments closer to widespread acceptance.

The Future of Crypto Payments

Ultimately, the decision to accept cryptocurrency payments depends on the specific needs of a business. In cases where traditional payment systems create friction—whether due to high fees, slow settlement times, or access restrictions—crypto payments provide

a compelling alternative. While challenges remain, the evolution of crypto PSPs and integration tools continues to make cryptocurrency payments more accessible, practical, and valuable for both merchants and consumers. Whether for expanding market reach, lowering

transaction costs, or providing financial inclusion, crypto payments are carving out an increasingly important role in the global economy. If you are a business still unsure about whether to accept cryptocurrencies, how to implement them, and what the processes

and benefits of a crypto PSP are, a quick and effective way to gain the necessary knowledge is by enrolling in the eLearning course

Cryptocurrency Payments for Businesses from reMonetary. This course covers all of these topics, including the different processes

constituting the service of a crypto PSP, the conversion process and settlement options, the role of exchanges, a comprehensive overview of the transaction cycle, and the business model and cost structure of a crypto PSP. By the end, you will possess a solid

understanding of the crypto PSP business, enabling you to make critical decisions for your organization.