Image source: Getty Images

Unlike a SIPP, any contributions into a Stocks and Shares ISA do not attract the potential for top-up payments by the government. However, all gains made through such a vehicle are completely free of tax, regardless of the size of the final pot. That makes them an extremely attractive proposition for those looking for a second income in retirement.

Estimating potential returns

Building a pot large enough to withdraw £30,000 a year at retirement is no mean feat. Reaching that target will depend on many different factors. These include an individual’s investing time horizon and the annual yield earned on one’s portfolio.

Nevertheless, if we take as a base case that the drawdown phase will last for 25 years, notionally, the size of the portfolio would need to be £750,000 at retirement.

An individual can contribute up to £20,000 into an ISA each year. But given that only about 8% of ISA holders put aside this amount, then we need to be a little bit more realistic in building our contribution model.

Crunching the numbers

Let us assume that an individual has a 25-year investing time horizon and that they will increase their contributions as laid out in the table below.

| Tiered years | Yearly ISA contribution |

| 1-5 | £5,000 |

| 6-10 | £10,000 |

| 11-15 | £15,000 |

| 16-25 | £20,000 |

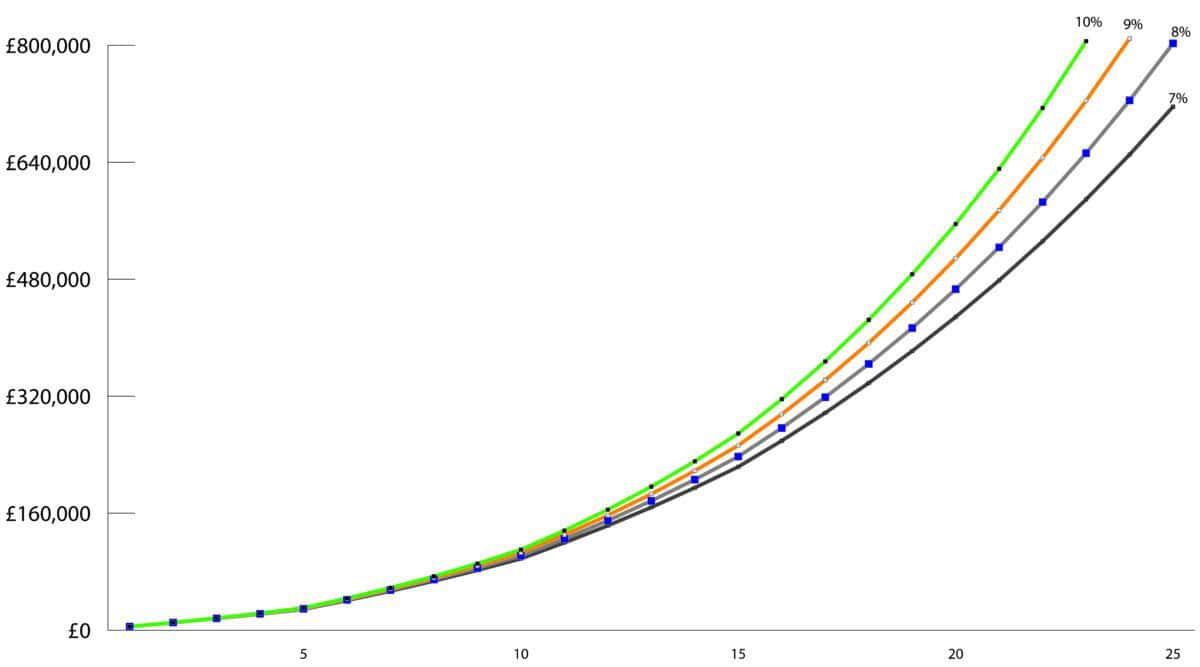

The following chart highlights how much such a stepped-contribution would be worth, based on various annual returns.

Chart created by author

Importantly, you can see that small changes in investment performance become magnified over a long time frame. This is because of the all-important factor of compounding gains. A 7% gain never reaches the required amount within 25 years, while a 10% annual returns gets to £750,000 within 22 years.

Diversified portfolio

Constructing a portfolio capable of achieving high single-digit annual returns year after year will not be easy. My preferred method is to choose a mix of growth stocks, which also pay a modest dividend, together with high-yielding stocks.

In the former category, I really like specialist chemicals producer Croda (LSE: CRDA). The dividend yield currently stands at 4.2%, but this is a company with bags of growth potential.

One major growth area is in the manufacture of ceramides. Across the beauty industry, ceramides have become the number one talked about active ingredient. A form of lipid, they keep skin hydrated, supple, and firm.

To date, Croda has been unsuccessful in commercialising the opportunity presented by this revolutionary active ingredient. It has now put in place a new strategy that will hopefully turn this around.

Dividend play

For an out-and-out dividend payer, Legal & General (LSE: LGEN) remains one of my firm favourites. A dividend yield of 9.2%, makes it one of the highest payers in the FTSE 100.

This is a company with a long-track record of increasing its payout. Indeed, it has not cut the dividend since the global financial crisis. Since 2015, total shareholder returns have amounted to 83%.

Recently, its share price has come under pressure over growing competition concerns in the pension risk transfer (PRT) market. However, I remain optimistic that its leading value proposition in this arena will continue to resonate with clients, thereby ensuring that dividends keep flowing well in to the future.