Image source: Getty Images

The Stocks and Shares ISA allows Britons to contribute up to £20,000 each year into a tax-free investment portfolio. In terms of wealth creation in the UK, there’s nothing quite like it.

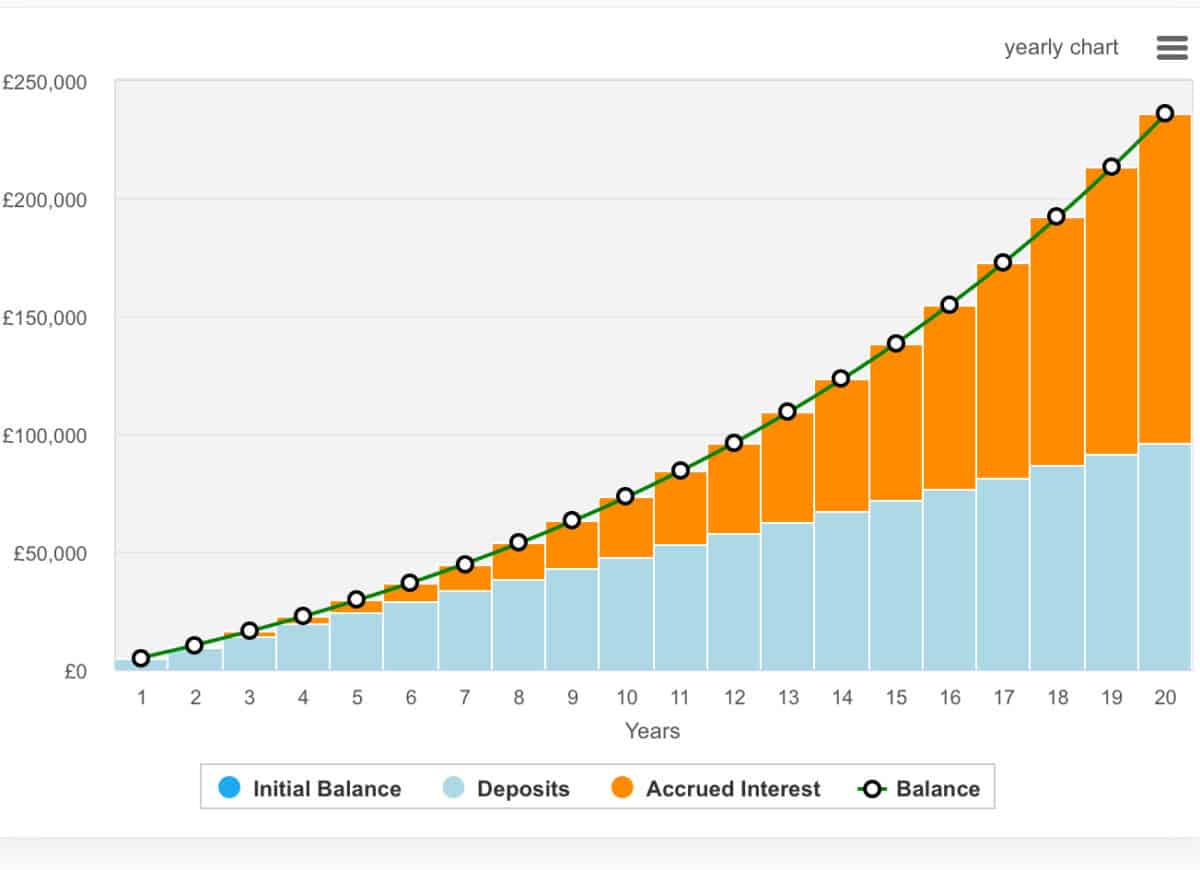

To generate £1,000 in passive income each month (£12,000 per year) from a Stocks and Shares ISA, an investor would need a portfolio of around £240,000 yielding 5% annually.

That’s a substantial sum, but the beauty of compounding means it doesn’t have to be built overnight.

For instance, investing £400 a month into a diversified ISA returning an average of 8% per year could grow to roughly £235,000 after 20 years.

Each year, the returns themselves start earning returns — that’s compounding in action. Early contributions have decades to grow, while later ones benefit from an ever-larger base.

The key is consistency and time in the market, not timing it. Even modest, regular investments can snowball into a meaningful passive income stream, particularly when sheltered from tax within an ISA.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

Where to invest?

Ok, so we’ve explored how this could be achieved in theory, but the next part is know what to do to get there. After opening a Stocks and Shares ISA with a brokerage, investors need to choose which stocks to buy with their hard-earned cash.

The options — depending on the brokerage — are typically vast. There’s everything from funds and trusts to stocks and bonds.

Funds and investment trusts pool money from many investors to buy a diversified mix of assets, managed by professionals aiming to generate steady returns.

They’re often seen as an easier way to spread risk without picking individual shares. Stocks, on the other hand, represent ownership in specific companies — higher risk, but with the potential for higher long-term gains.

Bonds are essentially loans to governments or corporations that pay fixed interest, offering stability and predictable income.

Personally, as a more experienced investor, my portfolio is geared towards a wide range of stocks. A data-driven approach helps me achieve returns that are typically far in excess those of an index-tracking fund.

A current favourite

My only investment in the month of October has been the London Stock Exchange Group (LSE:LSEG). According to analyst consensus, the London Stock Exchange Group is currently viewed as the most undervalued company on the FTSE 100.

Forecasts suggest a 42% discount to fair value. However, such estimates must be treated with caution as analyst coverage can vary in quality. So, why is it so undervalued?

The London Stock Exchange Group has a wide economic moat and high margin operations, especially in data and analytics. It also offers double-digit earnings growth while trading at a little over 20 times forward earnings.

However, no stock is perfect. Risks remain. Competition in data and analytics is fierce, and the transition away from legacy products could dent recurring revenues.

Still, for long-term investors, these risks may be balanced by the firm’s diversified, high-margin operations. I certainly believe it’s a stock worth considering.