Image source: Getty Images

So you’d like to turn some of your spare cash into passive income? Great – the stock market can be a great place to look and one of the best strategies involves investing a set amount each month.

Geopolitics and macroeconomics make it hard to tell exactly what future returns will be. But over the long term, the cash returned to shareholders by businesses has been ahead of other assets.

Investing in the stock market

Whether it’s the UK, the US, or anywhere else, the stock market can be a volatile place. Share prices can go down – and this can be stressful – but things do tend to work out eventually.

Over the last decade, for example, the average return from the FTSE 100 has been around 7.5% a year. That’s far better than what you could have earned in cash, but it hasn’t all been plain sailing.

A lot of businesses made no money and share prices fell sharply during Covid-19. But despite stocks doing worse than cash during this time, they’re still ahead over the last 10 years.

This isn’t an accident. While there might be times when stocks underperform and you’d rather be in cash, the best businesses find ways to do better than what they can get from a savings account.

How much can you make?

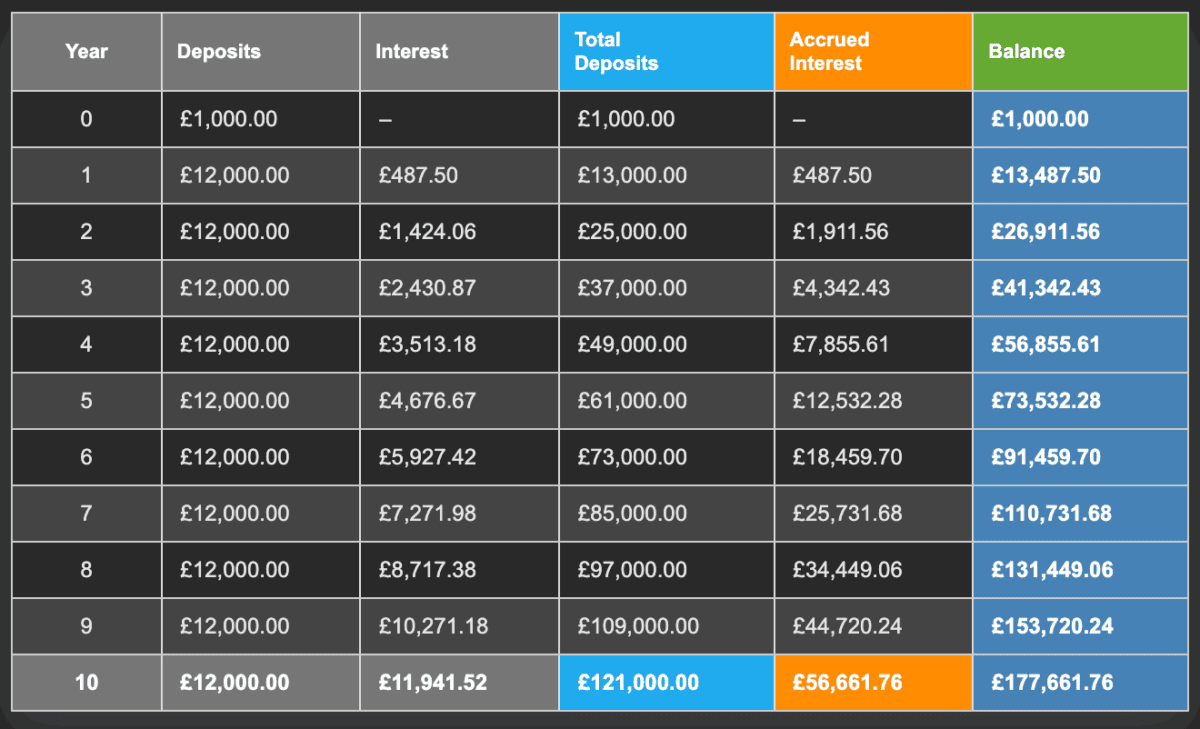

This is just an illustration, but investing £1,000 a month with a 7.5% return in dividends generates £487.50 in the first year. And doing it for 10 years means £4,875 a year at the end of a decade (as long as the dividend isn’t cut).

That’s not bad, but it isn’t the end of the story. That’s not bad, but it isn’t the end of the story. By staying invested and using dividends to automatically buy more shares whenever they’re paid, the long-term returns of a portfolio can dramatically increase.

Source: The Calculator Site

Different FTSE 100 companies have different approaches – some retain and reinvest their profits and others return them to shareholders as dividends.

With companies that retain their profits internally, you can still generate passive income. Remember, share price rises will add to the ultimate returns and selling part of the investment if it grows over time can also contribute to passive income.

Investing ideas

One stock that investors should take a look at is Rightmove (LSE:RMV). The UK’s largest online property platform has an outstanding record of generating huge profits with not much cash.

The firm’s property, plant, and equipment has a value of around £8m on its balance sheet. It turns this into operating income of £270m a year – and this number has been going up.

The dividend yield is only 1.5%, but the firm has a bigger focus on share buybacks. And given the company’s growth, I don’t think this by itself should put investors off.

Rightmove’s biggest strength – the network of buyers and sellers on its platform – doesn’t cost much to maintain. That allows it to return a lot of the cash it generates to investors through dividends and share repurchases that could drive the share price higher.

Risks and rewards

The stock market can be a volatile place and Rightmove is no exception. If the UK housing market falters – especially as a result of weak mortgage demand – this could threaten earnings growth.

Investors always need to be attentive to potential risks, but I fully expect shares to be a better long-term choice than cash. Especially ones in growing businesses with low costs.