Image source: Getty Images

Generating a small amount of passive income is fairly easy with a well-balanced portfolio of dividend stocks. However, reaching a point where one can live entirely off the income may take a bit more effort.

For those outside of London, the National Living Wage (NLW) is £12.60 per hour. Based on a standard 35-hour work week, that amounts to about £2,000 a month, or £24k annually.

How much would it take to achieve that much passive income?

Let’s take a look.

Reducing outgoings

The first thing to do when formulating an income strategy is to explore cost reduction options. With a Stocks and Shares ISA, UK residents can eliminate one of the biggest costs: tax.

This smart self-directed account allows up to £20k to be invested per year with no tax charged on the capital gains. Brilliant!

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

Building the investment

The average dividend yield on the FTSE 100 is 3.5% but income-focused portfolios can achieve as much as 7%. With £343,000 invested, a 7% portfolio would return £24k a year in dividends.

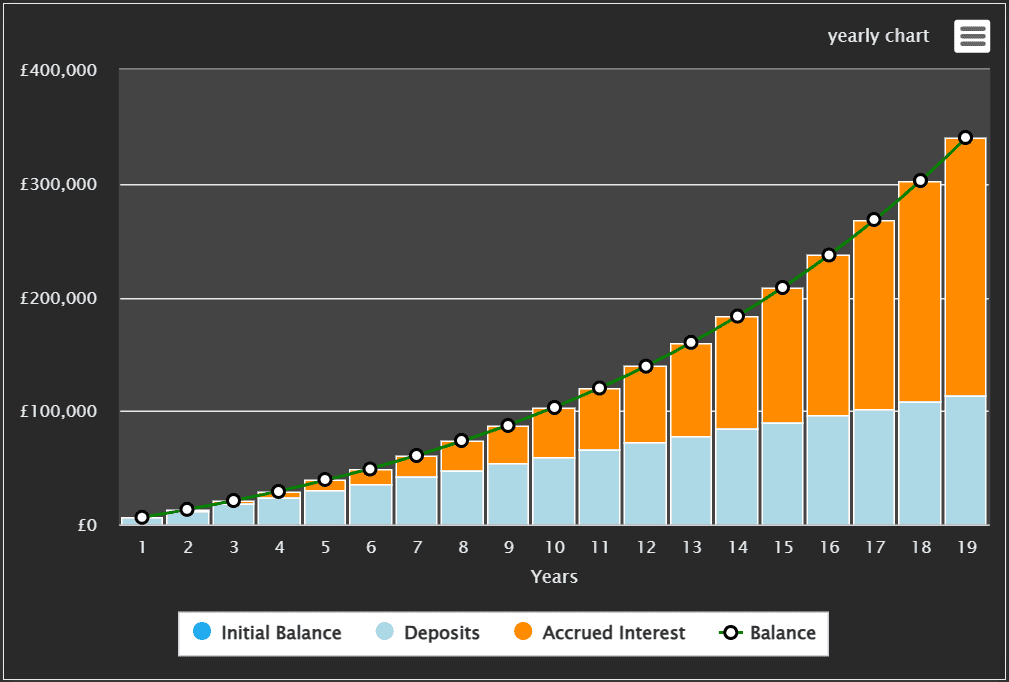

That’s no small chunk of cash. It would take over 56 years of saving £500 a month! Luckily, compounding gains could speed things up. In a portfolio achieving the market average 10% return, it could take only 19 years.

Hitting that high yield

In the investment world, passive income almost always comes in the form of dividends. How much in dividends depends on how high a portfolio’s average yield is. Fortunately, the UK stock market is a heavenly treasure trove of high-yield dividend stocks.

Let’s crack open our two main indexes and see what gems they’re hiding.

On top of the FTSE 100, we have Phoenix Group, with a 10.4% yield; M&G, with a 9.3% yield; and Legal & General, with 8.5%.

Over on the smaller-cap FTSE 250 index, the top three are renewable energy-related businesses with yields upwards of 12%. I’m a fan of renewables but when it comes to reliable passive income, I think large established companies are the way to go.

On the Footsie, the largest company paying meaningful dividends is HSBC (LSE: HSBA), with a 5.8% yield. With a £156.8bn market cap, it’s second only to AstraZeneca and recently passed Shell.

AstraZeneca is another great stock but the 2% yield doesn’t make it great for income. Shell’s 4.2% yield is decent but lately its performance has been underwhelming.

A global banking powerhouse

HSBC is a popular option among dividend investors. With a global presence spread across the US, Europe, and Asia, it’s shielded from a slump in any single region. This adds to its reliable income-focused credentials.

Over the years, it has maintained a consistently high yield and strong earnings, giving it more than sufficient coverage for payments.

Despite this, it has made some large dividend cuts in the past during economic downturns. If another pandemic or financial crisis occurs, it might enact more cuts, limiting returns.

Fortunately, it tends to recover quickly and usually enjoys steady price growth. The stock is up 43% in the past year and 90% in the past five years, equating to annualised returns of 13.7% per year.

HSBC is just one example of a great dividend stock to consider for passive income.