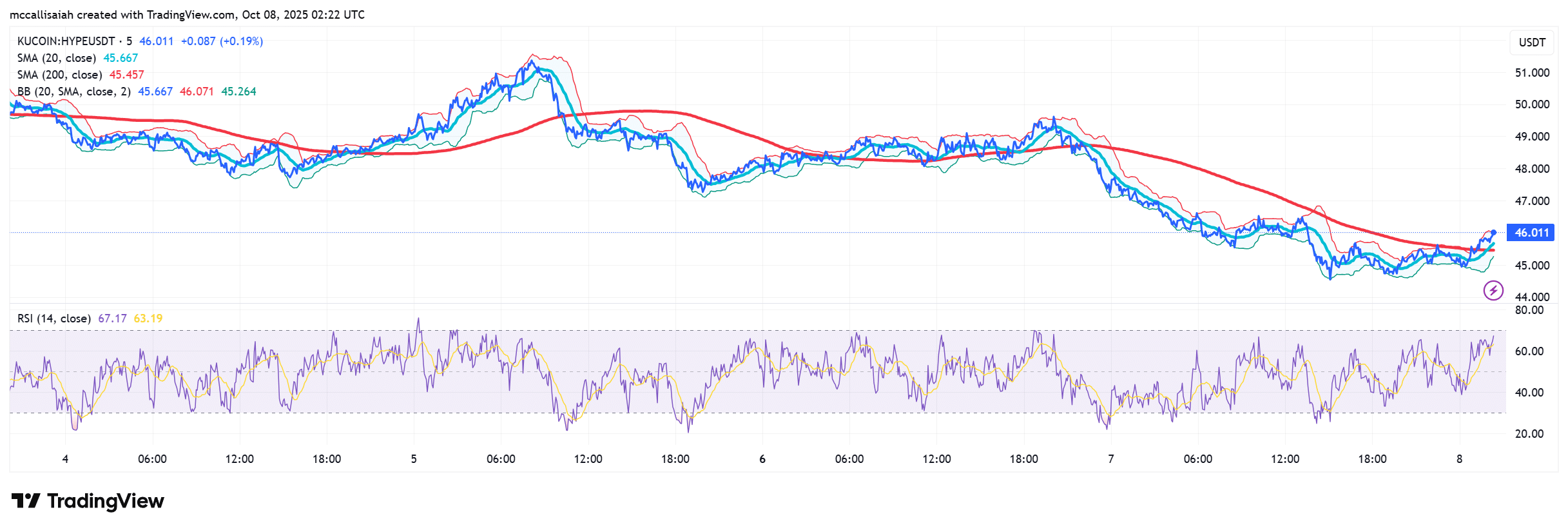

Hyperliquid token (HYPE) slipped for a fifth straight session Tuesday, falling about 6% intraday to the $45–$46 and finally rebounding slightly today.

HYPE has a lot going for it: low fees on both perps and spot. Also no KYC cause it’s a dex

The move adds to a week of steady bleeding, but on-chain and technical indicators hint the selloff could be running out of steam. Here’s what’s next for Hyperliquid:

Hyperliquid Token: Tight Range Signals Next Move, Rounding Bottom or Fakeout?

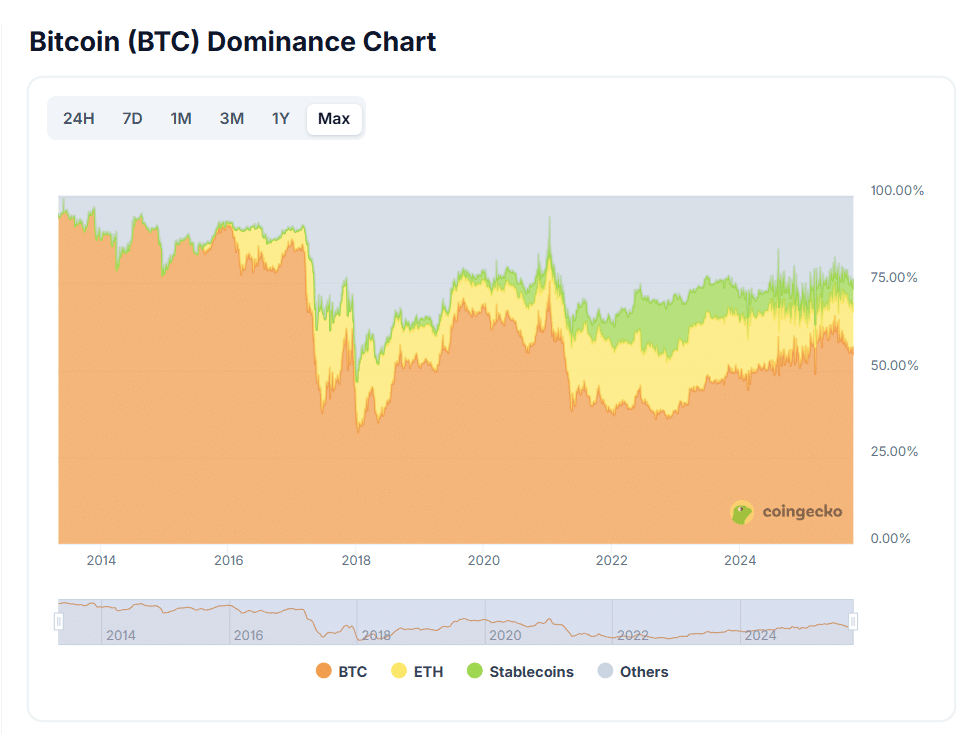

Two more weeks. That’s when people think altcoin season is finally going to break out… maybe in two more weeks we’ll be saying that phrase again. Who knows! But as it stands, resistance remains tight for Hyperliquid at $46.50–$47, where every intraday rally has stalled.

Here are some other important technicals:

- Bollinger Bands are narrowing, a setup that often precedes a breakout

- The moving averages are lining up too.

- The 20-day and 200-day SMAs just crossed near $45.5 in a mini golden cross

On the chart, HYPE is forming what appears to be a rounding bottom. A confirmed breakout could target $47.50–$48. RSI sits at 67, which is not overheated yet. Close but not there yet. Volume hasn’t spiked, which hints at quiet accumulation before a decisive move.

DISCOVER: Next 1000X Crypto: 10+ Crypto Tokens That Can Hit 1000x in 2025

Hyperliquid Derivatives Turn Bearish as Spot Stays Resilient

According to Coinglass, the long-to-short ratio for HYPE has dropped to 0.80, its weakest in over a month, showing that futures traders are leaning short into the dip. Momentum indicators also lean cautious, with the RSI below 50 and MACD flashing a bearish cross.

Even so, spot markets continue to hold the line. Price action has repeatedly found footing in the mid-$40s, similar to past consolidation zones that preceded sharp breakouts.

$SUI flips Hyperliquid in daily DEX volume pic.twitter.com/gHoGbCHNNL

— ToreroRomero (@Torero_Romero) October 8, 2025

On the downside, the next key support lies between $39–$40. A clean break there would risk a deeper correction. Conversely, reclaiming $51–$52 would likely trigger a squeeze higher toward $55–$60.

DISCOVER: 20+ Next Crypto to Explode in 2025

Final Thoughts on HYPE: Where Do We Go From Here?

DeFi Llama data shows Hyperliquid pulling in about $5M a day in protocol revenue, which is a steady flow even as rival perp DEXs dangle incentives. Around 660,000 HYPE (≈$30M) is staked, tightening supply and supporting a potential rebound.

The key range sits between $44 and $49. A close above $49 flips momentum bullish toward $52–$55, while losing $46–$47 risks another drop to $44 or even $40. With funding rates flat and open interest cooling, the setup mirrors past mid-cycle pullbacks that often end with a sharp recovery.

EXPLORE: Singapore Denies Do Kwon’s $14M Refund Demand For ‘Stolen’ Penthouse

Join The 99Bitcoins News Discord Here For The Latest Market Updates

Key Takeaways

- Hyperliquid token (HYPE) slipped for a fifth straight session Tuesday, falling about 6% intraday to the $45–$46.

- DeFi Llama data shows Hyperliquid pulling in about $5 Mn a day in protocol revenue.

The post Hyperliquid Token (HYPE) Tests Key Support as Traders Eye Potential $100 Rebound appeared first on 99Bitcoins.